While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

April 12, 2016

Fiat Lux

Featured Trade:

(APRIL 13 GLOBAL STRATEGY WEBINAR),

(APRIL 25 CHICAGO GLOBAL STRATEGY LUNCHEON),

(A NOTE ON THE FRIDAY APRIL 15 OPTIONS EXPIRATION)

SPDR S&P 500 ETF (SPY)

SPDR Gold Shares (GLD)

Come join me for the Mad Hedge Fund Trader?s Global Strategy Luncheon, which I will be conducting in Chicago on Monday, April 25th.

A three course lunch will be followed by an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too.

Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $235.

I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a downtown Chicago venue on Monroe Street that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets,? please click here.

We have a couple of options positions that expire on Friday, April 15 and I just want to explain to the newbies how to best maximize their profits.

These include:

The S&P 500 SPDRs ETF (SPY) April 15, 2016 $182 puts

The? SPDR Gold Trust (GLD) April 15, 2016 $109-$112 vertical bull call spread

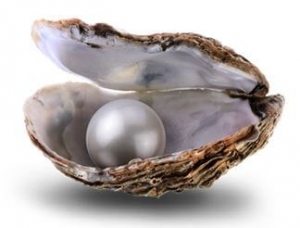

My bet that gold would rise, despite all market conditions, proved dead on accurate. This makes our third consecutive win with the barbarous relic. All we need now is another substantial dip so we can get back in, rolling our options up and out.

The S&P 500 (SPY) is another story. We originally purchased this as a hedge against our many deep-in-the-money (SPY) call spreads, all of which proved profitable. My plan was to take profits on the $182 puts on the next dip if the market, and bring in profits on both the long and the hedge.

However, the dip never came. What ensued was the strongest and sharpest move up in market history. The market didn?t take in a single breath. As a result, our (SPY) April 15, 2016 $182 are going to expire worthless, shaving some 4.87% off our 2016 performance.

That?s a hit and a half!

Netting it all out, we still managed a profit on our (SPY) longs. It took a once a century event to deprive us of our bragging rights.

Those once a century events are darn hard to call.

Provided that some 9/11 type event doesn?t occur by Friday, the (GLD) position should expire at its maximum profit point. In that case, your profits on this position will amount to 12.35% in 18 trading days.

Many of you have already emailed me asking what to do with these winning positions. The answer is very simple. You take your left hand, grab your right wrist, pull it behind your neck and pat yourself on the back for a job well done.

You don?t have to do anything.

Your broker (are they still called that?) will automatically use your long $109 call position to cover your short $112 call position in the April (GLD), cancelling out the total holding.

The profit will be credited to your account on Monday morning April 18, and the margin freed up.

If you don?t see the cash show up in your account on Monday, get on the blower immediately.

Although the expiration process is now supposed to be fully automated, occasionally mistakes do occur. Better to sort out any confusion before losses ensue.

I don?t usually run positions into expiration like this, preferring to take profits two weeks ahead of time, as the risk reward is no longer that favorable.

But we have a ton of cash right now, and I don?t see any other great entry points for the moment. Better to keep the cash working and duck the double commissions. This time being a pig paid off handsomely.

If you want to wimp out and close the position before the expiration, it may be expensive to do so.

Keep in mind that the liquidity in the options market disappears, and the spreads substantially widen, when a security has only hours, or minutes until expiration. This is known in the trade as the ?expiration risk.?

One way or the other, I?m sure you?ll do OK, as long as I am looking over your shoulder, as I will be.

This expiration will leave me with a very rare 90% cash position. I am going to hang back and wait for good entry points before jumping back in. It?s all about getting that ?Buy low, sell high? thing going.

I?m looking to cherry pick my new positions.

Take your winnings and go out and buy yourself a well earned beer. Or use it to pay your 2015 income tax bill due Monday, April 18.

Well done, and on to the next trade.

Looking for the Next Whopper

Looking for the Next Whopper

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

April 11, 2016

Fiat Lux

Featured Trade:

(APRIL 22 NEW YORK STRATEGY LUNCHEON),

(INTRODUCING THE MAD HEDGE FACEBOOK/TWITTER MARKET FEED),

(WHAT TO DO ABOUT APPLE),

(AAPL), (CHL)

Apple Inc. (AAPL)

China Mobile Limited (CHL)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.