While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

September 11, 2020

Fiat Lux

Featured Trade:

(WHY SOLID-STATE BATTERIES ARE THE “NEXT BIG THING”)

(TSLA)

“Battery Day” is coming up soon on September 22.

This is Elon Musk’s equivalent to Apple’s developers' conference when he announces his latest products and technological advances with great fanfare. I have been to many of these.

However, this year, Elon may outdo himself, no mean feat, emboldened by last week’s meteoric $450 billion market capitalization for Tesla (TSLA).

Most expect Musk to announce his “Million Mile Battery”, doubling the lifetime of batteries installed in new Teslas. That would increase lifetime recharges from 2,000 to 4,000.

But Elon being Elon, he could also go a giant step forward in battery technology, taking a great leap forward to solid-state technology.

For the last 30 years, the cutting edge of battery design has been trapped in lithium-ion liquid or gel states. This originally Japanese technology took us from the first generation of smartphones in the 1990s to the 1,200-pound, 402-mile range behemoths of today.

Now it’s time to move on.

Solid-state batteries, made of oxide, sulfide, and phosphate ceramics, have existed in labs for decades and are currently used in pacemakers. But economic mass production has remained elusive.

That may be about to change.

Last week, Bill Gates-backed QuantumScape gained a listing on the New York Stock Exchange via a SPAC (special purpose acquisition corporation) with Kensington Capital Acquisition Corp. (KCAC). The deal valued the company at $3.3 billion, a high figure for a firm with no salable product.

QuantumScape is a decade-old San Jose, CA-based startup which has been pioneering solid-state battery technology. It obtained a $100 million investment from Volkswagen in 2018. QuantumScape’s goal is to supply the batteries for an all-electric VW Golf by 2025.

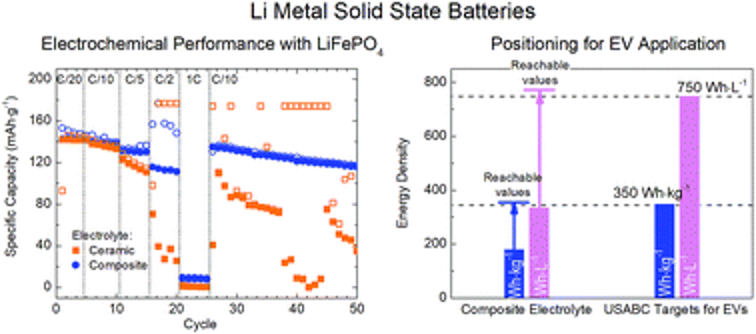

And here is the big deal about solid state. It offers energy densities 2.5 greater than existing lithium-ion batteries. It also presents far less risk of catching fire when punctured, as we have seen dramatically on TV a few times over the last couple of years.

With such technology, Tesla can cut battery sizes from 1,200 pounds to 500 pounds, chop $6,000 off the cost of production of each car, and further extend ranges because of less weight.

That would enable Tesla to enter the mass market with a $36,000 entry-level Tesla 3 or small SUV Model Y with minimal fuel cost and maintenance for the life of the car. This is how Tesla boosts production from this year’s 500,000 units to 5 million units annually by 2025. This is what the $500 share price was all about.

There are even more advanced battery technologies on the horizon. Samsung is working on graphene technology for its smart phones. The University of Chicago has developed a lithium dioxide battery seven times more powerful than those currently available. Silicon nanowire technology will become viable in three years that offers a further multiplication of ranges.

In the end, Elon Musk may surprise us all. In 2019, Tesla bought Maywell Technologies and their dry battery technology which can produce batteries at 16 times greater energy density at 20% less cost, giving a 20-fold improvement in battery performance.

That is a greater leap in energy densities than we have seen over the past decade when costs dropped by 80%.

As a long time Tesla owner, I can tell you that it has been a battle to keep up with Tesla’s technology. As soon as I bought a Model X two years ago with a 275-mile range, a new 351-mile range was announced. I did get a great deal on the car though and I’ll never drive another vehicle.

For a YouTube video of Bill Gates explaining his involvement in QuantumScape, please click here.

Today, I am going to suggest one more position. And it will be a short term hedge position with a bearish bias.

The stock is Qorvo, Inc. (QRVO).

QRVO is trading around $121 as I write this.

The idea will be similar to the recent CRUS alert we just closed out.

I am going to suggest a one half hedge position on the stock.

Here is the suggestion:

Buy to Open (1) October 16th - $125 Call @ $5.70

Buy to Open (2) October 16th - $120 Puts @ $6.50

Each position will cost $1,870.

Based on the nominal portfolio, I suggest you limit this trade to a 1 lot, which will cost $1,870 or 1.8% of the tracking portfolio.

This will result in you buying 2 of the $120 puts and 1 of the 125 calls.

Today, I would like to make a suggestion on a stock we have traded in the past.

The stock is Clovis Oncology, Inc. (CLVS). It appears that CLVS has turned the corner and is making a push higher.

I would like to suggest a weekly covered call on the stock and use next week's expiration, which is September 18th.

CLVS is trading around $5.86 as I write this.

Buy CLVS at the market and then execute the sale of this call.

Sell to Open (1) September 18th - $6.00 Call for every 100 shares you own.

You should be able to sell them for $.30 for every option.

If the calls are assigned next Friday, the return will be about 7.5% for a week and one half.

Based on the nominal portfolio, limit the buy in to 600 shares, which is 3.5% of the portfolio.

Mad Hedge Biotech & Healthcare Letter

September 10, 2020

Fiat Lux

Featured Trade:

(CAN CRISPR STOP THE SILENT KILLER?)

(CRSP), (VRTX), (EDIT), (NTLA)

Obesity has virtually tripled worldwide since 1975.

In 2019 alone, the World Health Organization classified 38 million children under 5 years old as overweight or obese.

More alarmingly, obesity has been dubbed as the “silent killer” because it is one of the leading factors that cause premature deaths.

In 2017, 4.7 million or 8% of global deaths were linked to this condition.

For context, the number of deaths caused by obesity is 4 times the fatality rate from road accidents and almost 5 times the number of those who died from HIV/AIDS.

Right now, 39% of adults across the globe are considered overweight and 13% are obese.

By 2030, nearly half the adult population of the United States is expected to be suffering from obesity.

Now, we might have the answer to this “silent killer:” CRISPR gene editing.

A recent Harvard study showed that CRISPR gene editing can be used to engineer cells to avoid weight gain and even potentially stop the onset of obesity-related diseases like diabetes.

The solution is straightforward.

The scientists will convert the body’s white fat, which is the “bad fat,” into brown fat or the "good fat.”

Brown fat is known as the healthy fat because it produces heat for the body by burning calories. Meanwhile, white fat tends to build up and leads to obesity.

Through CRISPR gene editing, the white fat is transformed into brown fat. This will then be burned by the body and used as an energy source, which can also result in weight loss.

So far, the technology proved to be successful in mice which were put on a high-fat diet.

What CRISPR targets is a gene for a protein called UCP1, which is distinctly found in brown fat.

The function of UCP1 is to turn chemical energy into heat.

Using the UCP1, the researchers created cells that closely resembled brown fat cells. These are called human brown-like cells or HUMBLE cells.

The manufactured HUMBLE cells are then transplanted into the mice with weakened immune systems. These mice were also fed with a high-fat diet.

Upon observation, they found that the modified cells actively helped in preventing the progression of obesity in mice and even showed improvements in the metabolic function of the animals.

Over the course of 12 weeks, the mice given white fat cells continued to gain weight while those transplanted with the HUMBLE cells showed weight loss. The latter also showed higher sensitivity to insulin, indicating that they could be protected against diabetes.

This is where it gets interesting because the technique can ultimately lead to cell therapies not only for obesity but also other metabolic disorders.

In the future, the process could evolve into something as convenient as removing a small amount of a patient’s white fat and having that engineered into brown-like fat and re-implanted to the same person’s body.

Apart from that, the HUMBLE cells also appear to send a chemical trigger to the existing brown fat stored in the mice’s own bodies, stimulating them to burn more energy.

This means that a simpler treatment method could be explored in which the experts could mimic the signal to activate the patient’s own brown fat. This will no longer require re-engineering the white fat and re-implanting it, making the entire treatment extremely straightforward.

The release of this study has profound implications to the total available market for CRISPR gene editing technology.

In the US alone, over 34 million are suffering from diabetes. The medical spending and loss of work wages linked to this is valued at roughly $327 billion annually.

If this technology proves to be effective in boosting a patient’s insulin sensitivity, then it could open an exponentially huge market.

Aside from diabetes, obesity is also considered a major risk factor in certain types of cancer, fatty liver and kidney disease, osteoarthritis, and even pregnancy problems.

This study is another example of how gene editing can be utilized to find treatments for untreatable conditions in the past years.

With this groundbreaking potential, it is no wonder investors are lining up to get their hands in biotechnology stocks in the gene editing sector.

The most widely known gene editing stock is CRISPR Therapeutics (CRSP).

With a market capitalization of $5.72 billion, this company is the only one in its field with actual treatments set for launch in the market soon.

One is a rare genetic disease treatment called CTX-001. Every year, about 60,000 people are born with this condition, causing anemia, lifelong pain, and early death. The other treatment is CTX-100, which is geared towards cancer patients.

Compared to its competitors like Editas Medicine (EDIT), which has a market capitalization of $1.82 billion, and Intellia Therapeutics (NTLA) with $1.03 billion, CRSP has a financial runway that can be reassuring to its investors.

CRSP also has minimal debt and a beneficial partnership with healthcare giant Vertex Pharmaceuticals (VRTX). This makes it one of the most attractive gene editing stocks out today.

Nonetheless, buying early stage companies, especially in the biotechnology sector, can be like oil wildcatting back in the 1930s. The key is to spread your bets broad enough to boost your chances of finding a gusher.

If this CRISPR gene editing technology works to treat obesity and even diabetes, then it could revolutionize the medical field.

While it’s still wise to exercise caution when investing in gene editing stocks, this technology undoubtedly embodies how the future of medicine looks like.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.