Below please find subscribers’ Q&A for the June 30 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Lake Tahoe, NV.

Q: How long will the tech rally last (QQQ)?

A: Short term we are overheated, but long term it’s still a buy. I think tech will lead for the next several years. Look for the next 10% correction, load the boat again with at-the-money LEAPS, and you’ll get almost as rich as I am, because I've been doing that for years.

Q: What is driving tech? Why is it suffering when interest rates rise, and they have such big cash balances?

A: I agree with you; that makes absolutely no sense for tech to fall when rates rise. Big tech actually makes more money when interest rates go up, because they’re all sitting on cash balances of up to $250 billion, as is the case with Apple (AAPL). The answer is that the modeling that stock analysts use is highly sensitive to interest rates and affects companies the most with the highest growth rates. That would be big tech which is averaging about 40% of growth right now. Industrials are less affected because they are slower growers, if at all. This is strictly a modeling question; I think long-term the market figures this out. And in fact, the recent price action has been immune to interest rate moves.

Q: Are you worried about the Tesla (TSLA) recall?

A: No. In fact, they did the recall like they do all the recalls; it happens overnight when you’re asleep. The software upgrade does it all and you end up with a new car in the morning with a lot more functionality. That just means you have to figure out how to use your new car about once a month. But that’s how they did it, and the fact is that Tesla is so much farther ahead in technology than all of their Chinese competitors, that Chinese electric companies will never grow outside of China, whereas Tesla takes over the world.

Q: What LEAP would you buy on Tesla?

A: I would buy the June 2023 $750/$800 vertical bull call spread for $18, and as long as Tesla shares are over $800 in two years, that will be worth $50 dollars giving you a return of 177% profit. If that’s not enough profit for you in two years, you are in the wrong business and should consider becoming a rock singer, drug dealer, or Bitcoin miner—one of these other really high return alleged professions.

Q: What’s happening with mergers and acquisitions? As a stock driver do you expect it to speed up or slow down?

A: Well I expect M&A to slow down because prices are so high. And notice that Warren Buffet has done virtually nothing in a year because in his world nothing really got cheap, even at last year’s lows. He’s been buying his own shares instead in (BRKB). But you still have backdoor M&A as I call it, and that’s share buybacks, which are returning with a vengeance. Last week, all the banks in financials were allowed to start their own buybacks for the first time in a year and four months, so that makes all of them buys. And I'm talking about JP Morgan (JPM), Bank of America (BAC), Citibank (C), Goldman Sachs (GS), and Morgan Stanley (MS) (where they’re also doubling dividends). Corporate buybacks I expect to top the previous record of $1.2 trillion, which we set right before the pandemic.

Q: I have a number of tech mutual funds with heavy weighting in (AMZN), (FB), (MSFT), (GOOG), and (NVDA) for my basic portfolio which I bought on your advice. Should I be cute and sell for the waiting 10% pullback or maintain a buy and hold?

A: The answer 99% of the time is just hold. We think tech goes up for ten more years. With mutual funds and ETFs you have no expiration dates like you do with options. And if you’re one of these guys that sits in front of a screen 24 hours a day with 30 years of experience, you can sell now and buy them back cheaper. But most people don’t have the training or discipline to pull that off. And the retail individuals who try this actually end up buying high and selling lower. I would say if you’re happy with your ETF tech funds, just keep them.

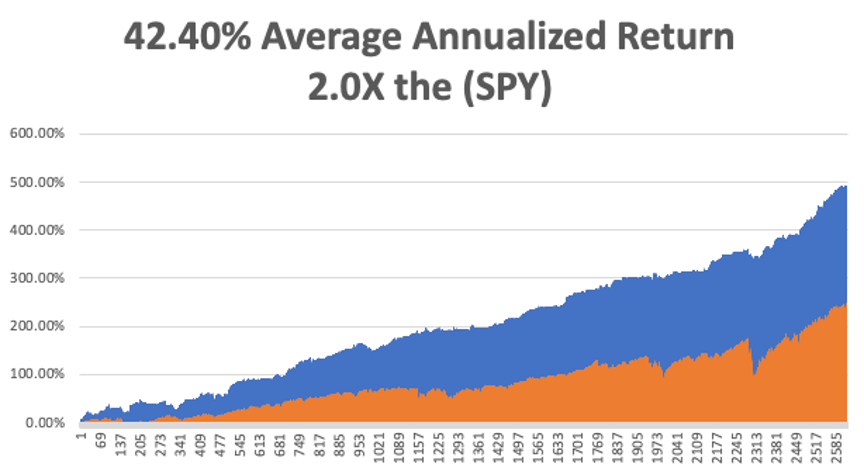

Q: I don’t trade options spreads—how much am I killing my returns? I’m having trouble with options trading.

A: Actually, over the long term, it’s the equity owners who make the most money. On an aggressive front month trading strategy in options, you’re only making 1% or 2% a month per position; whereas over time, the equities we’re picking are going up anywhere from 100% to 1,000% (295X for Tesla). I refer you to the Mad Hedge Hall of Fame list of ten baggers, of which we probably have over 30 now. The only people who would beat outright stock ownership are LEAPS players where you can regularly make 100% every 6 months if you have the right setup, the right timing, and so on. We’ve actually never lost money on LEAPS. Someone asked earlier whether I could tell you how to take profits on LEAPS, and the answer is no, you don’t have to do anything because they expire at max profit and you make a ton of money. So, LEAPS are the only area you’re missing out on. I recommend learning how to do LEAPS and I would be happy to teach you.

Q: When do you update your long-term portfolio?

A: Twice a year. I did it in January, so I guess I'm due for July.

Q: Is it time to buy LEAPS on Skyworks?

A: No, wait for a 10% correction. LEAPS are something you do at short term bottoms, not short-term tops; otherwise, it will cost you some money and you’ll miss the other 100% profit.

Q: I’m looking at ESG stocks (environmental, social & governance). Are they legit?

A: Yes, they attracted $2 trillion in asset allocations last year; however, a lot of them went ballistic discounting a Biden presidency, which happened, and they’re now up close to 400% year on year. I wouldn't chase them too much here, especially the ones that don’t have earnings yet. They became a mania at one point. So, I would wait for some decent pullback to get involved in any of the ESG plays.

Q: When will you deploy your cash?

A: I’m kind of waiting for my own market timing index to get back into the 20s, if we can get that; and we might sometime in July. But if we don’t, I’ll have to go back into the market in August, because then you’re front running very positive seasonals from October onwards, and August is usually our biggest month of the year.

Q: Is Amazon a good spot to load up on some more LEAPS, or should we wait?

A: The time to do this was when I sent out the LEAPS recommendation three weeks ago. Since then, we gave gained 25%. I would wait; don’t chase marginal trades ever, especially when you’re up 60% on the year—I would wait for a pullback, and I would run what you already own. Buy the pullbacks elsewhere, like in banks, financials, industrials, US steel (X), Freeport McMoRan (FCX), commodity plays, etc. Buy low, sell high; it’s a revolutionary new concept that I’ve invented.

Q: Why is oil (USO) at $74?

A: Global economic recovery. It’s a short-term move; eventually, we’re going back to zero in oil, but with the US growing at a 10% annual rate, the world's largest oil consumer, anything the US uses goes up. Any plays in oil will be short-term, and if you have things like NVIDIA going up 80% in two months, why the heck are you even looking in oil? Don’t make excuses to go into these really long-term downtrends—unless you work in the industry and I know a lot of you do.

Q: What is the NASDAQ (NASD) year-end target?

A: I’m looking at 18,000, or about 23% higher than here. That would give you a full-year return of about 39%.

Q: I'm a subscriber to Global Trading Dispatch, but don’t get trade alerts for LEAPS.

A: Well actually you do—three weeks ago I did send out a newsletter giving you 3 LEAPS in Amazon (AMZN), Microsoft (MSFT) and Apple (AAPL) and told you to buy all the LEAPS down there. Those are up anywhere from 10% to 30% since then. We do send those out occasionally to Global Trading Dispatch members just to show you what is doable. The way to get more constant LEAPS alerts is signing up for the Mad Hedge Concierge Service, which is by application only.

Q: Are you bullish on Bitcoin even though the Chinese government is against it?

A: Yes, but this is a pure technical play and I’m not really sure what I'm buying, so I'm only going to get in at my price which will be at $10,000 or $20,000. A big chunk of the mining industry literally moved over a weekend from China to the US or other unregulated domiciles like Kazakhstan. And how much confidence do you want to have on a monetary instrument based in Kazakhstan? Not much.

Q: What are the economic conditions that would trigger the expected 10% pullback?

A: There are none, because I expect the superheated growth in the economy to continue for two more years, and the only short-term pullbacks we’re getting are triggered by rises in interest rates. Interest rates will fluctuate, but just buy every dip and keep loading the boat on your equity longs and our favorite sectors and you will be glad that you heard of Mad Hedge Fund Trader.

Q: Is it worth looking at electric grid stocks?

A: Excellent question, and I promise to do more work on that. Yes, absolutely, because the grid has to triple in size in order to accommodate the move to a green economy and that means we have to build 200,000 miles of aluminum long-distance transmission lines. The copper going into a new car will jump from 20 pounds for the old internal combustion engines to 400 pounds. So that's why I say, Freeport McMoRan (FCX)—it’s not a question of if or when you get in; they are seeing a generational upgrade in demand for copper. Same is true for electric cars.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader