When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

October 12, 2022

Fiat Lux

Featured Trade:

(I STILL HAVE AN OPENING FOR THE MAD HEDGE FUND TRADER CONCIERGE SERVICE)

I seem to have a recurring problem.

People make so much money from my concierge service that they retire early, and I never hear from them again.

September was particularly egregious because we went into the last crash with 100% cash and then nailed the bottom 100% fully invested.

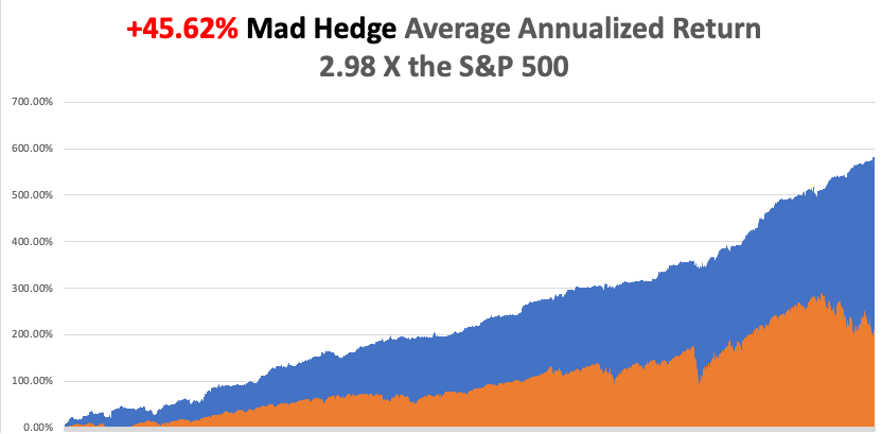

That trade brought my 2022 year-to-date performance to +72.93%, a new high. The Dow Average is down -22% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high +81.35%.

As a result, I still have one remaining Mad Hedge Concierge place open. I limit the service to only ten clients at any one time.

The goal is to provide high-net-worth individuals with the extra degree of assistance they may require in managing diversified portfolios. Tax, political, and economic issues will all be covered.

It is also the ideal service for the small and medium-sized hedge fund that lacks the resources to support their own in-house global strategist full time.

The service includes the following:

1) Emergency access to John Thomas 24/7 through his personal cell phone number so he can act as your investment 911.

2) A risk analysis of your own personal portfolio with the goal of focusing your investment in the highest return sectors for the long term.

3) A monthly phone call from John Thomas to update you on the current state of play in the global financial markets.

4) Personal meetings with John Thomas anywhere in the world once a year to continue our in-depth discussions, ever the pandemic ends.

5) Early releases of strategy letters and urgent trading information.

6) More detailed recommendations on LEAPS, or two-year call options on the best high-growth names.

7) Access to a dedicated Concierge website listing complete All LEAPS investment portfolios.

The cost for this highly personalized, bespoke service is $12,000 a year.

To best take advantage of my Mad Hedge Fund Trader Concierge Service, you should possess the following:

1) Be an existing subscriber of the Mad Hedge Fund Trader who is already well aware of our strengths and limitations.

2) Have a liquid net worth of over $250,000.

3) Possess a degree of knowledge and sophistication of financial markets. This is NOT for beginners.

To subscribe to Mad Hedge Fund Trader Concierge Service, please email Filomena at customer support at support@madhedgefundtrader.com. Please put “Concierge Candidate” in the subject line.

I look forward to hearing from you.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Dear Major Thomas,

Congratulations on your appointment.

I absolutely loved and was fascinated with the latest concierge information. I remember discussing this with you on the phone a month and a half ago and to watch it become reality and read what is happening is a level of involvement that normally I would not be party to.

Of course, it helps make BETTER commercial and personal decisions--- for which I am grateful and thankful.

It is so great that your expertise has been not just noticed and appreciated by the American government--- but that they are actually listening and acting–– Thank you from all of us

Rodney

Sydney, Australia

Mad Hedge Biotech and Healthcare Letter

October 11, 2022

Fiat Lux

Featured Trade:

(A GUARANTEED WIN IN HEALTHCARE)

(PFE)

The previous month was another difficult time for the markets, with the S&P 500 sliding 9%. Meanwhile, the index has already fallen 24% year to date, dragging several quality businesses along with it.

The silver lining for long-term investors is that many of these beaten-down stocks won’t remain down for long. That means buying flailing quality stocks today, as risky as it may sound, could offer you an opportunity to lock in several high-yielding businesses at cheaper valuations.

In the biotechnology and healthcare world, one of the most promising buys so far is Pfizer (PFE).

This company’s stock price has fallen by 16% in the past six months as Pfizer’s COVID-19 vaccine profits are anticipated to decrease. However, there’s something that investors appear to be overlooking.

The sales of the COVID-19 vaccine, Paxlovid, may gradually decrease, but the fact remains that its bolstering Pfizer’s pipeline. While its bottom line will expectedly show signs of decline as concerns around the coronavirus subside, its revenue won’t disappear completely.

Paxlovid sales are estimated to reach roughly $12 billion in the second half of 2022.

After all, health officials are continuing to administer booster shots, and there’s really no concrete answer if and when that will eventually end.

Moreover, Paxlovid is one of only two preferred antiviral treatments for patients at high risk for severe COVID-19. Based on CDC data, 50% to 60% of the US population aged 12 and above will experience one or more symptoms for progressing to a more severe stage of the disease.

This, along with the additional approvals in other countries, has reaffirmed the $22 billion revenue guidance for Paxlovid this 2022.

Needless to say, injecting this much cash flow into a company—even a large-cap business—would move the needle and put it in a very healthy financial position.

Pfizer’s continued strength amid the chaotic year can be seen in its second-quarter financial report in 2022. In fact, Pfizer reported its highest quarterly sales ever in its history in this quarter.

The company recorded its revenues increased to $28 billion, up by 47% compared to the $19 billion it reported in the same period in 2021. Its net income climbed by an impressive 78% year over year from $5.6 billion in the same period in 2021 to $9.9 billion.

This increase is driven by the substantial contributions of its COVID-19 products, Paxlovid and Comirnaty.

Hence, Pfizer has all but guaranteed that it can stay profitable and deliver outstanding results despite the anticipated decline in Paxlovid sales.

On top of that, the low earnings multiple indicates that a lot of bearishness was already built into the stock. But, the market’s fears seem to do little to slow down Pfizer.

Pfizer has increased its budget for R&D from $2.2 billion in the second quarter of 2021 to $2.8 billion in the same period in 2022.

The company has been aggressive in its decision to acquire several businesses in 2021 and 2022, growing its presence and expanding its portfolio.

More importantly, these new additions have transformed Pfizer into a more diversified company. For example, the company closed on the deal buying ReViral, which is a clinical-stage organization that focuses on treatments for the respiratory syncytial virus (RSV). The addition of ReViral’s resources provides a more solid direction for Pfizer’s ongoing RSV trials.

Aside from that, there are several additional opportunities for this drugmaker.

Pfizer is known to be able to consistently deliver positive free cash flow, which means it's in excellent shape to pursue expansion and growth opportunities while still comfortably paying out a solid dividend. Over the last five years, Pfizer has boosted its dividend by 25%.

So far, the company’s dividend yield is at 3.7%, which is more than twice the S&P 500 average of 1.8%.

Overall, Pfizer is a solid business with an expanding portfolio, a growing pipeline, tons of cash, and an impressive yield. It’s almost impossible to go wrong with this business, particularly at its low valuation these days.

Mad Hedge Bitcoin Letter

October 11, 2022

Fiat Lux

Featured Trade:

(KOWTOWS TO THE INSTITUTIONS)

(BTC), (ETH), (COIN), (GOOGL)

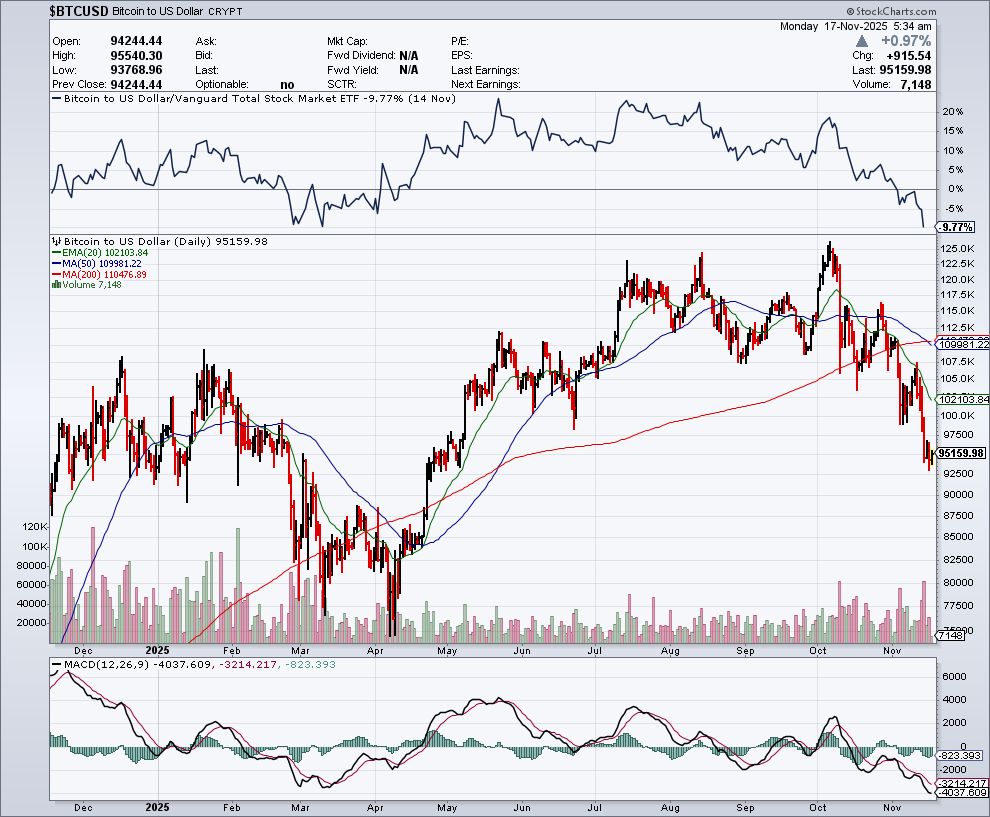

Google allowing crypto payments to its cloud services from Coinbase Global (COIN) doesn’t move the needle.

COIN is the crypto exchange platform that has run into a litany of problems recently, from falling trading volumes and regulatory fines to shifting strategic focus.

The news is a footnote to the carnage that is really happening front and center in the crypto market.

Funnily enough, why would a customer choose to pay for Google’s cloud services through Coinbase when fees are still meaningful and alternative rails (cards, bank transfers) dominate?

Crypto isn’t cheap, and it doesn’t pretend to be.

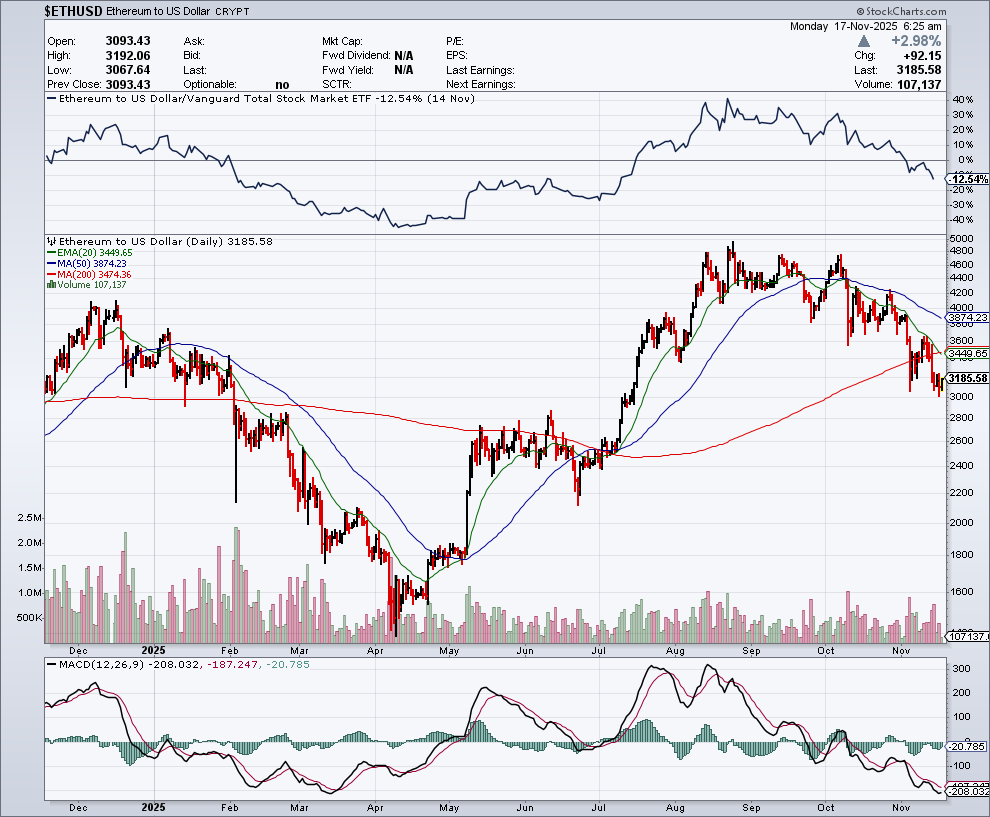

Ether (ETH) remains infamous for its “gas fees.” In 2021, they averaged around $63 for one transaction, which contributed to its lag behind other networks.

In 2025, the network has improved (via upgrades like Dencun and protocol optimizations), but fee-peaks still occur and many users have migrated to layer-2s or alternative chains.

Bank ACH transfers are free or very low cost, and so are most debit/credit card purchases.

Even though El Salvador claims to be a crypto-first economy, most everyday transactions continue to be completed in cash or U.S. dollars.

At least crypto will now be allowed to transact on Google’s platform (or at least participate via some rails), which is a victory in itself, but I don’t believe this will catch on like wildfire.

Crypto is up against a Sisyphean task.

The Google Cloud infrastructure service will initially accept cryptocurrency or crypto-adjacent payments from a limited set of customers; the roll-out is far from universal. Meanwhile, Google has pivoted toward broader payments infrastructure, agentic AI commerce and blockchain layers.

Over time, Google may allow more customers to make payments via crypto or stablecoins but the emphasis is no longer solely “pay with Bitcoin/Ether” but “use stablecoins or tokenized rails.”

Coinbase will (or already does) earn a percentage of transactions that go through whatever rail they enable but the margin of that business remains tiny relative to its overall operations.

It remains high risk to hold crypto on the balance sheet. Coinbase no longer flags a large impairment charge the way it did in 2022, but it continues to grapple with volatility and shrinking core trading revenue. In Q2 2025, Coinbase’s revenue fell to about $1.5 billion, with consumer spot trading volumes down ~45% year-over-year.

Therefore, I expect Google (or Google’s payment rail) to charge a fee or apply a conversion spread to turn crypto in and out of fiat - just as before - or to prefer stablecoin/fiat rails entirely.

From the outside, this really does look like a marketing gimmick.

Blockchain technologies, such as non-fungible tokens (NFTs), have moved out of the “wild hype” phase; for Google’s cloud division the bigger focus now is on tokenized assets, stablecoin infrastructure, AI-agent payments, and building developer tools around these.

Google has announced the Agent Payments Protocol (AP2), an open standard for AI-agent-led payments that supports stablecoins among other rails.

Previously, Google pushed for growth in major industries such as media and retail. This year, it started forming more teams around blockchain, payments infrastructure and “Web3” tooling but the narrative has shifted from “crypto payments” to “tokenized finance + AI commerce.”

However, I thought that crypto was going at its lone-wolf style hoping to create a parallel system to the fiat money system which it despises.

Apparently not.

Tying up with a mega-tech corporate firm sounds like they are giving up to me.

It seems as if the founding investors are ready to cash out and leave the die-hard crypto believers for a more stable income stream.

Annuity-like income stream is something many crypto firms lack and locating one is a hard sell.

Crypto was supposed to be “decentralized” but this appears to be a move that will offer Google the keys to Coinbase’s data while limiting them to lateral moves.

In short, this is a move that allows more centralization in the biggest crypto platform in the United States.

Growth was crypto’s calling card and that means parabolic growth possibilities are over.

Integrating with Google also means Google will have deep insight into how they can use Coinbase to profit from digital currencies - since Coinbase has agreed to onboard their data onto Google’s cloud infrastructure in some capacity.

Honestly, this is a bone-head strategic move for Coinbase, and my inclination would be to buy Google’s stock if one believes in crypto.

Desperation can trigger some unusual moves and we are seeing that in real time. But analyzing the bleak short-term prospects for crypto, this might be a move for survival rather than anything else.

“Every technological revolution takes about 50 years.” – Said Founder of Alibaba Jack Ma

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.