When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

February 3, 2023

Fiat Lux

Featured Trade:

(QUEEN MARY II JULY 13 SEMINAR AT SEA)

(SOME BASIC TRICKS FOR TRADING OPTIONS)

CLICK HERE to download today's position sheet.

Come join me in the grand appointments of the Cunard Line’s flagship, the elegant and spacious Queen Mary II, on an eastbound transatlantic cruise.

Cunard’s Black Friday sales are on, so you can participate in my Seminar at Sea at a nice discount. Reductions in prices, deposit amounts, and free onboard spending credits are offered by clicking here.

The ship departs New York at 12:00 AM on July 7, 2023 and arrives at Southampton on July 14. The Cunard cruise number is M319. There I will be conducting the Mad Hedge Fund Trader’s Strategy Update, a three-hour discussion on the global financial markets.

I mention this now because Cunard usually offers great sale prices during Thanksgiving week.

I’ll be giving you my up-to-date view on stocks, bonds, currencies, commodities, precious metals, energy, and real estate. I’ll highlight the best long and short opportunities. And to keep you in suspense, I’ll be tossing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $399 for the seminar only.

Attendees will be responsible for booking their own cabins through Cunard. They offer everything from an inside stateroom from $1,279 per person to $26,780 per person for Q1 deluxe two-bedroom apartment with its own gym.

Just visit their website (click here) or call them directly at 800-528-6273 to make your own arrangements.

The weather this time of year can range from balmy to tempestuous, depending on our luck. A brisk walk three times around the boat deck adds up to a mile. To follow the markets, full internet access will be available for a fee.

Every dinner during the voyage will be black tie, so you might want to stop at Saks Fifth Avenue in Manhattan to get fitted for a second and third tux. Don’t forget to bring your Dramamine and sea legs, although the 151,400-tonne 1,132-foot long $900 million ship is so big, I doubt you’ll need them.

The event will be held at a luxurious penthouse suite, the details of which will be emailed to you just prior to departure. To instill in us all a proper sense of humility, I will conduct the seminar as we sail over the wreck of the Titanic. The ship will give a blast of its horn three times as a salute as we pass the site.

At the moment, Cunard’s Covid protocols require a negative PCR test 48 hours before boarding. Please bring your Covid card.

Customers are required to book their own cabins and return flights from England. Again, the Cunard cruise number is M319.

To book the Cunard portion of the cruise, please click here.

To purchase tickets for this seminar alone, please click here.

I look forward to meeting you, and thank you for supporting my research.

Mad Hedge Biotech and Healthcare Letter

February 2, 2023

Fiat Lux

Featured Trade:

(A STRONG CONTENDER AGAINST THE ENDLESS VOLATILITY)

(BMY)

Despite substantial advances, cancer remains the second-leading cause of death in the United States. In 2022 alone, it was estimated that over 1.9 million new instances of cancer would be diagnosed in the United States alone. More than 600,000 deaths from cancer are anticipated in 2023.

There’s also a massive financial expense that’s continuously growing. Last 2018, the country's top 15 kinds of cancer cost more than $156 billion. By 2030, the spending for cancer-related treatments is projected to soar to a whopping $246 billion.

However, every problem brings with it an opportunity. In the case of cancer treatments, there is a huge opportunity. While several small companies are working on cancer therapies, many investors feel uneasy with the high risk and volatility of these early-stage biotechnology stocks. This is where well-established players come in.

Among the biotechnology names associated with cancer, one of the standouts is Bristol Myers Squibb (BMY). The company currently markets five treatments, each generating sales of a minimum of $1 billion yearly.

BMY’s best-selling drug is blood cancer treatment Revlimid. Unfortunately, Revlimid sales are falling because of the emergence of generic competition.

Meanwhile, cancer immunotherapy Opdivo continues to be on track with its goal to surpass Revlimid in BMY’s lineup. By 2026, this product is projected to reach peak sales of $11.75 billion. This is roughly 50% more than its current sales record.

Aside from these blockbusters, BMY has several rising stars. One of them is Opdualag, an immunotherapy that’s a combination of Opdivo and a LAG-3 inhibitor called relatlimab. This new drug has the potential to hit peak sales of over $4 billion. The other blood cancer drugs, specifically Breyanzi and Abeam, also have the potential to reach blockbuster status in the following years.

BMY has placed itself in a prime position for success in early 2023 thanks to years of careful planning in anticipation of the patent expirations of its blockbusters.

With about $40 billion in operating cash flow, BMY has created the third most extensive Phase 2 trial base. These efforts ensure investors would be happy with short-term results as the company has released nine new treatments in the past three years. This trend is expected to continue until the end of the decade.

For the subsequent years, investors can expect more approvals, eventually becoming new revenue streams and cash flow generators. Looking at the candidates in its pipeline, BMY is estimated to generate $25 billion in additional revenues from these new treatments by 2030.

Then the candidates in earlier-stage trials would replace the newly approved treatments in the queue. This continuous cycle represents the power of a solid and robust pipeline.

Suppose you’re still uncertain about the dependability of BMY. In that case, it’s good to remember that even the Oracle of Omaha believes in this stock.

While healthcare names do not typically make up a considerable share of the portfolio of Berkshire, BMY has made the cut. Warren Buffett’s penchant for consistent and reliable stocks underscored BMY’s solid performance amid the pandemic.

Moreover, BMY raked in a lot of money, enjoying a free cash flow in the past 12 months that totaled more than $12.7 billion. This marks the company’s third consecutive year of delivering free cash flow of at least $10 billion.

Having substantial cash is a crucial, especially for a company that frequently gets involved in acquisitions. In 2022, BMY bought oncology firm Turning Point Therapeutics for $4.1 billion, which dwarfs in comparison to its $74 billion acquisition of Celgene in 2019.

In addition to all these, BMY pays a 3.1% dividend yield. For long-term shareholders, these factors make the stock an excellent investment.

Overall, BMY is a great addition to your healthcare portfolio. Apart from being a frontrunner in the highly lucrative cancer market, this stock has a proven track record that outshone the rest of its peers amid the volatility and uncertainties in the previous years.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

February 2, 2023

Fiat Lux

Featured Trade:

(TESTIMONIAL)

(HOW THE COST OF ENERGY IS GOING TO ZERO),

(SPWR), (TSLA),

CLICK HERE to download today's position sheet.

A key part of my argument for a new Golden Age to take place during the coming Roaring Twenties is that the price of energy is going to zero.

It may not actually make it to zero. I’ll settle for a 90%-95% decline, which is good enough for me.

Take a look at the charts below.

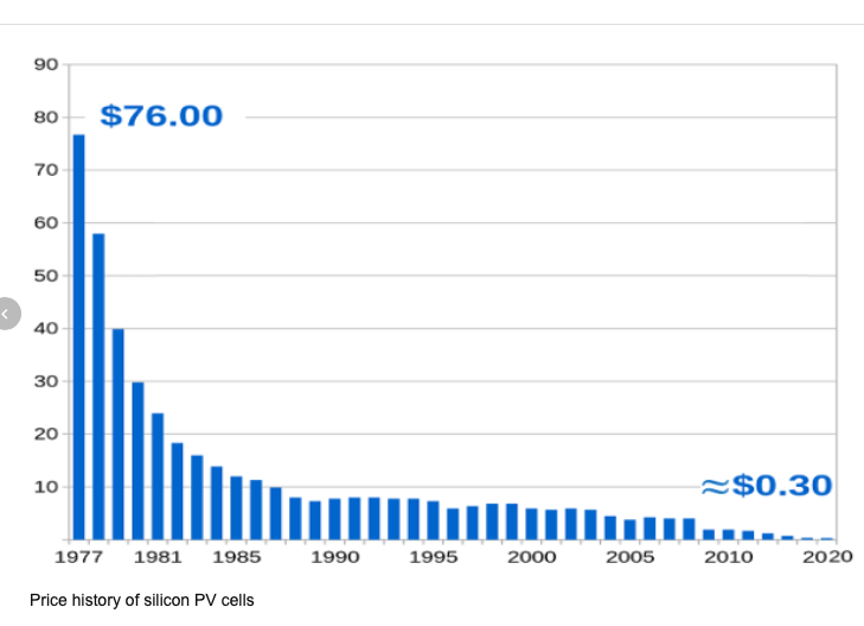

The first one shows how the price of a watt of solar-generated electricity has plunged by 99.60% since 1977, from $76.67 to $0.30.

Just in the past six years, retail prices for completed solar panels dropped by a staggering 80%.

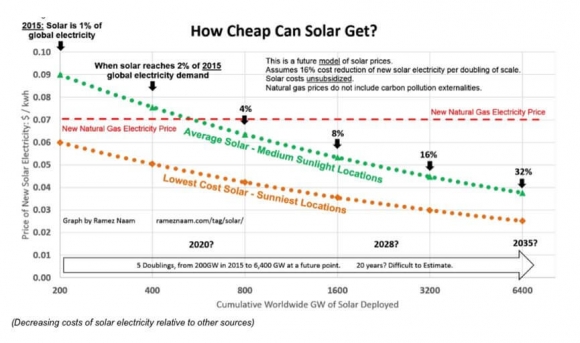

That is cheaper than electricity supplies generated by new natural gas plants, which now cost 7 cents per kWh.

Squeezing efficiencies out of our existing solar technology through improved software, production methods, chemistry, and design are nearly unlimited, and are expected to drive solar costs by half down to 3 cents per kWh by 2035.

And here is the great shortcoming of all these wonderful predictions. Technology NEVER stays the same.

My own SunPower (SPWR) panels with their Maxeon solar cell technology deliver an efficiency of 22.7%, the best on the market available 18 months ago. That means that convert 22.7% of the solar energy they receive into electricity.

SunPower is now producing 25.1% efficiency panels in the lab. Another research lab in Germany, Fraunhofer, is getting 44.7%.

And my friends at the Defense Department tell me they have functioning solar cells delivering 70% efficiencies. Whether they are economic and scalable is anyone’s guess.

(Warning: most cheap Chinese-made solar cells have only lowly 15% efficiencies, so don’t be tricked by any great “deals”).

And this is how most long-term predictions fall short.

Not only do they assume that technology doesn’t change, they fail to account for dramatic improvements in other related fields.

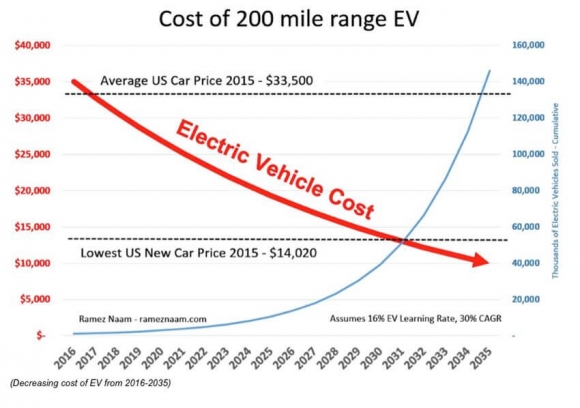

Electric car technology is a classic example. Battery costs are currently falling off a cliff.

When I bought the first Nissan Leaf offered for sale in California in 2010, the battery cost $833 per kilowatt. In 2012, I purchased a high-performance Tesla (TSLA) P85 Model S-1 at $353 per kilowatt. My last purchase in 2018 of a Tesla Model X P100D further dropped the cost to $150.

Efficiencies gained through the economies of scale from the Sparks, Nevada Gigafactory could take that down to under $100. From $833 down to $100, not bad.

However, that is not the end of the story.

The car industry will start to move towards carbon fiber in five years, which has five times the strength of steel at one-tenth the weight. The only issue now is mass production cost.

Some 67% of the weight of a Tesla S-1 is in the body, with the four motors at 13%, and the 1,200-pound lithium-ion battery at 20%.

What happens when the body weight falls by 90%? The battery weight, and cost decline by two-thirds. That cuts the effective cost of the battery to $66/kilowatt.

Add up all of this, and it is easy to see how energy costs can plunge by 90% or more. And it will happen must faster than you expect.

This has been the experience with memory costs, processor speeds, and hundreds of other technologies over the past half-century I have been following them.

I could go on and on.

This is why the State of California has mandated to get 50% of its energy from alternative sources by 2030. Some researchers believe an 80% target could be achieved. And it is doing this while closing its two remaining nuclear power plants.

To say that free energy would be a game-changer is a huge understatement.

The elimination of energy as a cost has enormous consequences for all companies. You can start with the energy-intensive ones in transportation, steel, and aluminum, and work your way down the list.

My bet is that you won’t recognize the car industry in 20 years. At a $66/kilowatt effective battery cost, it will make absolutely no sense to build internal combustion engines in new cars. Too bad Detroit is a decade behind in this technology.

Lose transportation, and you lose 50% of US oil consumption, or about 10 million barrels a day. Guess what that does to oil prices.

Goodbye Middle East and Russia.

The profitability and efficiency of the entire economy will take a great leap forward, much like we saw with the mass industrialization that was first made possible by electricity during the 1920s.

Share prices of all kinds will go ballistic.

Since energy costs will eventually fall effectively to zero, that wipes out the present business model of the entire electric power, coal, oil, and gas industries, about 10% of US GDP.

Their business models will be reduced to trying to sell something that is free, like air.

Dow 240,000 anyone?

For more about the economic rationale behind these predictions, please read my book, Stocks to Buy for the Coming Roaring Twenties.

Getting Ready for the 2020s

Enough Batteries to Operate Grid-Free Forever!

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.