When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

March 22, 2023

Fiat Lux

Featured Trade:

(THE MAD HEDGE TRADERS & INVESTORS SUMMIT VIDEOS ARE UP!)

(THE BARBELL PLAY WITH BERKSHIRE HATHAWAY),

(BRKA), (BRKA), (BAC), (KO), (AXP), (VZ), (BK) (USB), (TLT), (AAPL), (MRK), (ABBV), (CVX), (GM), (PCC), (BNSF)

CLICK HERE to download today's position sheet.

Mad Hedge Biotech and Healthcare Letter

March 21, 2023

Fiat Lux

Featured Trade:

(A BUMP IN THE ROAD)

(SRPT), (BIIB), (VRTEX), (RHHBY)

Little Orphan Annie had already predicted it: “The sun will come out tomorrow.” While it is disheartening that we’re still in a bear market, stocks will bounce back eventually.

It looks like Wall Street overreacted once again following the change in leadership in the Food and Drug Administration earlier this month. Dr. Billy Dunn, the public face of the highly controversial accelerated approval granted to Biogen’s (BIIB) Alzheimer’s disease drug and the standard bearer of the organization’s push for more flexibility on drug approvals, retired.

Biotech investors have expressed anxiety over the possibility of facing more stringent rules in the drug approval process. The fear is that Dunn’s departure would signify a step toward a more conservative handling of applications.

While the FDA assured the public that the approval process would likely remain the same, some notable decisions are proving otherwise.

One of them involves Sarepta Therapeutics (SRPT).

Sarepta Therapeutics is a biopharmaceutical company that focuses on developing and commercializing RNA-targeted therapies for rare neuromuscular diseases. Founded in 1980, this Cambridge-based company’s most notable drug is Exondys 51 (eteplirsen), used to treat Duchenne muscular dystrophy (DMD), a rare genetic disorder affecting muscle function.

Exondys 51 is designed to skip over a faulty section of the dystrophin gene, which helps to produce a functional protein that can slow the progression of the disease. Sarepta is also developing RNA-targeted therapies for rare diseases, such as limb-girdle muscular dystrophy and myotonic dystrophy. Since then, the company has earned additional approvals for Vyondys 53 and Amondys 45.

Basically, Sarepta is to DMD as Vertex Pharmaceuticals (VRTX) is to cystic fibrosis—both have virtual monopolies in their target markets.

Recently, though, Sarepta stock has started to fall. This came after the FDA announced its plan to seek additional input from a panel of independent experts regarding the company’s new DMD gene-therapy candidate: SRP-9001.

The move came as a surprise since Sarepta disclosed only a week or so ago that the FDA had no intention to convene an advisory board to evaluate the candidate. However, since SRP-9001 is one of the first-ever gene therapies biologics license applications built on a surrogate perspective, meaning it’s an alternative to clinical results, the FDA felt the need to add a layer of review.

Still, the fall in Sarepta’s share prices appeared to be yet another overreaction. Besides, the move was not triggered by any issue with the candidate or data from the trials. It was simply a precautionary measure. Despite the slight detour, Sarepta remains optimistic that it will receive the go signal for SRP-9001 by May 2023.

Prior to this, Sarepta shares have been beating the market since 2023 started and have recorded more than double increases in the last five years. Although the company does not enjoy the same name recall as several of its peers, Sarepta’s platform of promising and innovative treatments has delivered critical wins in the past, especially in the DMD market.

On top of its DMD-centered products, Sarepta has over 40 clinical programs. That’s impressive for a biotech with an $11 billion market capitalization.

More importantly, the latest catalyst for Sarepta, SRP-9001, is projected to become another blockbuster. This Roche-partnered (RHHBY) treatment is estimated to generate more than $4 billion in peak sales.

Notably, this particular DMD indication has been shown to exhibit an extremely high barrier to entry, with practically all experimental treatments falling apart in clinical trials. Needless to say, SRP-9001 would have an exceedingly high commercial ceiling plus a built-in competitive moat.

Investors can expect remarkable progress from Sarepta as a company and its programs in the next five years. Given the company’s track record and history, it won’t be farfetched for it to come up with more blockbusters soon.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Fed Action Dominates the Week

March 18th, 2023

Hello everyone,

How have you dealt with the volatility in the market over the past week?

Have you been frozen to the spot, did you sell bank shares, did you buy the big banks as John told you to, or did you turn everything off and put headphones on to just zone out?

Poor management doomed Silicon Valley Bank and created a new banking crisis.

Taxpayers nervously await the cost of the bailout.

Banks were not the only sector on sale. The Technology sector has been really good value of late as well. But some investors are just too distracted by the ongoing turmoil to see that there are plenty of quality buying opportunities.

Take Apple, for instance. There is the reaccelerating iPhone and Services growth, record gross margins, two new product launches, and the potential introduction of an iPhone subscription program. While the present macro backdrop looks rough, patient investors will be rewarded. Apple shares are up almost 20% since the start of the year.

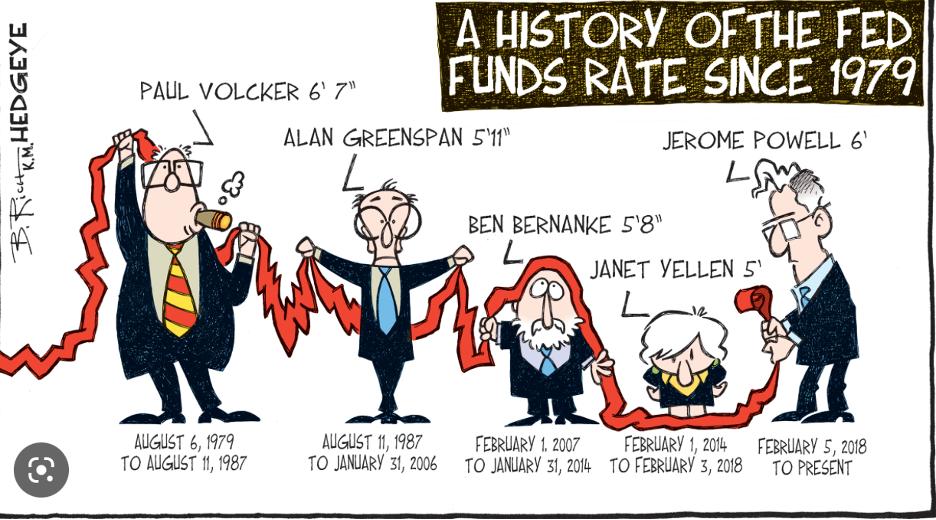

We have the Fed meeting on March 22. After the recent volatility, the Fed may stand still or raise only .25%. The comments after the announcement also tell an important story as to what we can expect going forward – dovish or hawkish.

Mr Trump is expected to be arrested on Tuesday as a New York grand jury investigates his connection with a hush-money payment to a porn star. If he is indicted, Trump, a 2024 Republican presidential candidate, would become the first former president ever to face criminal charges.

Bitcoin rallies 60% as investors rediscover its appeal as an alternative to the banking system.

Bitcoin’s outperformance amid a crisis in the traditional banking system had some wondering if the price rallied on a potential narrative shift. Though Bitcoin was initially designed to be digital cash and an alternative financial system, it spent much of last year trading like a speculative asset. Last week, it even fell with risk markets and bank stocks amid the uncertainty surrounding Silvergate Bank.

That shifted this past week however, following the closures of Silicon Valley Bank and Signature Bank, giving the appearance that investors were trading it on its core value proposition, the ability to “be your own bank.”

Investors will continue to monitor the banking crisis and the regulatory landscape in the week ahead. Bitcoin’s rally could remain in place if the Fed opts to end its tightening cycle and wait and see what happens next with banking turmoil. It seems that traders are pricing in rate cuts this summer already, so we will see what happens if the Fed opts to remain focused on inflation and deliver another quarter-point rise. A pause and Bitcoin could have the potential to make a run towards the $30,000 level.

Wishing you all a wonderful week.

Cheers,

Jacque

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

March 21, 2023

Fiat Lux

Featured Trade:

Trade Alert - (JPM) LEAPS – BUY

(JPM)

CLICK HERE to download today's position sheet.

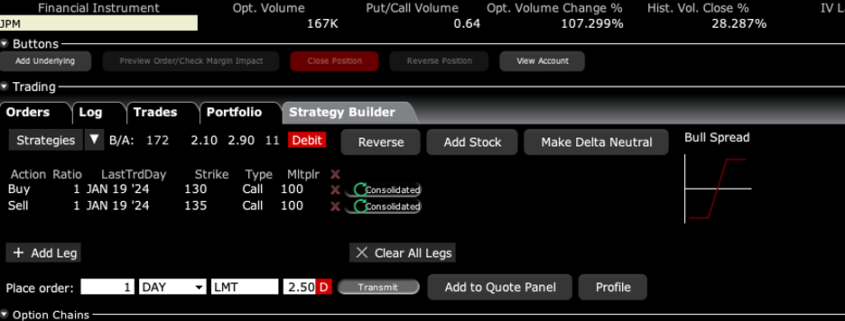

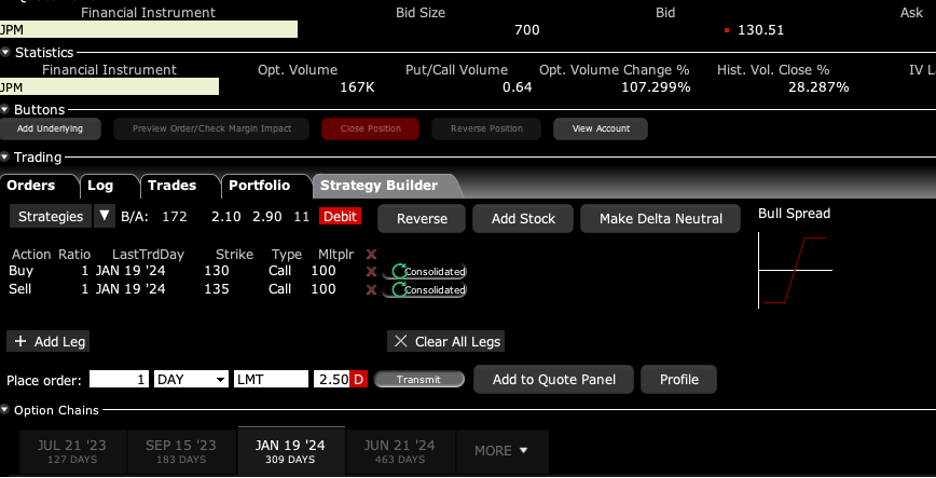

BUY the JP Morgan (JPM) January 2024 $130-$135 at-the-money vertical Bull Call spread LEAPS at $2.50 or best

Opening Trade

3-21-2023

expiration date: January 19, 2024

Number of Contracts = 1 contract

USE THE MATH BELOW TO ESTABLISH 9-MONTH OR ONE-YEAR LEAPS ON ANY LARGE BANK OR BROKERAGE HOUSE RIGHT NOW! GO AT-THE-MONEY.

The banking sector has been beaten like the proverbial red-headed stepchild this year. However, it should now be at the core of any long-term LEAPS portfolio.

The best time to pick up this position will be during a market meltdown day and the Volatility Index is over $30.

If you are looking for a lottery ticket, then here is a lottery ticket.

While the chance of winning a real lottery is something like a million to one, this one is more like 10:1 in your favor. And the payoff is 30:1. That is the probability that JP Morgan shares will rise over the next nine months.

(JPM) is the class act in the global banking sector, and CEO Jamie Diamond is the best CEO in the country. Not only that, with rocketing interest rates, we are just entering the golden age of the banking sector.

The regional banking crisis has pulled forward any recession and therefore the recovery. The Fed will certainly raise interest rates by 25 basis point because it is already in the mail. The banking crisis is an enormously deflation event and I expect inflation to be well below 4% by yearend.

After that, there will be no interest rate rises for a decade. The cuts will start in June and continue rapidly after that. That’s when the economic data catch up with the reality that is happening right now, which is hugely deflationary.

(NVDA) and (TSLA) already know this, which are rising sharply today.

And here is the sweet spot. Fears of a recession increasing loan default rates have knocked $20, or 14% off the $145 high in (JPM) shares this year. We are now only $30 above the 2020 pandemic low. When recession fears fade in 2023, interest rates will still remain historically high, and (JPM) profits and share price should rocket.

To learn more about the company, please visit their website at https://www.jpmorganchase.com

I am therefore buying the JP Morgan (JPM) January 2024 $130-$135 at-the-money vertical Bull Call spread LEAPS at $2.50 or best.

Scale in order every ten cents up to $3.00.

Don’t pay more than $3.00 or you’ll be chasing on a risk/reward basis.

Please note that these options are illiquid, and it may take some work to get in or out. Executing these trades is more an art than a science.

Let’s say the JP Morgan (JPM) January 2025 $130-$135 out-of-the-money vertical Bull Call spread LEAPS are showing a bid/offer spread of $2.00-$3.00, which is typical. Enter an order for one contract at $2.50, another for $2.60, another for $2.70 and so on. Eventually you will enter a price that gets filled immediately. That is the real price. Then enter an order for your full position at that real price.

Notice that the day-to-day volatility of LEAPS prices is miniscule since the time value is so great. This means that the day-to-day moves in your P&L will be small. It also means you can buy your position over the course of a month just entering new orders every day. I know this can be tedious but getting screwed by overpaying for a position is even more tedious.

Look at the math below and you will see that a 3.85% rise in (JPM) shares will generate a 100% profit with this position, such is the wonder of LEAPS. That gives you an implied leverage of 26:1 across the $130-$135 space.

(JPM) doesn’t even have to get to a new all-time high to make the max profit. It only has to get back to $135.00, $5.00 higher than it traded today.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it.

This is a bet that JP Morgan will not fall below $135 by the January 19, 2024 options expiration in 9 months.

Here are the specific trades you need to execute this position:

Buy 1 January 2024 (JPM) $130 calls at………….………$15.00

Sell short 1 January 2024 (JPM) $135 calls at…….……$12.50

Net Cost:………………………….………..…….........…….….....$2.50

Potential Profit: $5.00 - $2.50 = $2.50

(1 X 100 X $2.50) = $250 or 100% in 9 months.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Debit Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.