When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

TRADE ALERT: CLOSE SQQQ

Hello everyone,

As I expect the markets to go back up after a brief blip, I believe we should close the SQQQ ETF.

There is a firm expectation that the Fed will cut rates in June 2024, and this will drive the markets higher.

Additionally, as 10-year yields start to fall, this will also put a tailwind behind stocks.

Close SQQQ at best price.

Cheers,

Jacquie

Global Market Comments

February 1, 2024

Fiat Lux

Featured Trade:

(THE 16th YEAR ANNIVERSARY OF THE MAD HEDGE FUND TRADER)

The Diary of a Mad Hedge Fund Trader is now celebrating its 16th year of publication.

Last year, I religiously pumped out 3,000 words a day, writing or editing 24 newsletters a week of original, independent-minded, hard-hitting, and often wickedly funny research.

I spent my life as a war correspondent, Marine Corps combat pilot, Wall Street trader, and hedge fund manager, and if you can’t laugh after that, something is wrong with you.

I’ve been covering stocks, bonds, commodities, foreign exchange, energy, precious metals, real estate, and even agricultural products for 55 years.

You’ve been kept up on my travels around the world and listened in on my conversations with those who drive the financial markets.

The site now contains over 25 million words or 40 times the length of Tolstoy’s epic War and Peace.

Unfortunately, it feels like I have written on every possible topic at least 100 times over, if you sometimes think you’re getting repeats, you are, it’s just updated.

So, I am reaching out to you, the reader, to suggest new areas of research that I may have missed until now which you believe justify further investigation.

Please send any ideas directly to me at support@madhedgefundtrader.com/, and put “RESEARCH IDEA” in the subject line.

The great thing about running an online business is that I can evolve it to meet your needs on a daily basis.

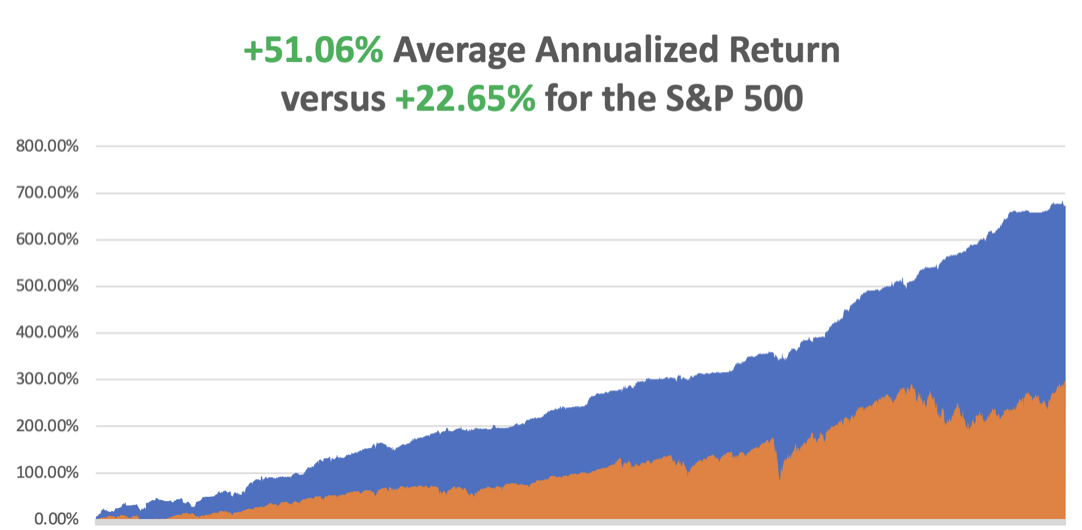

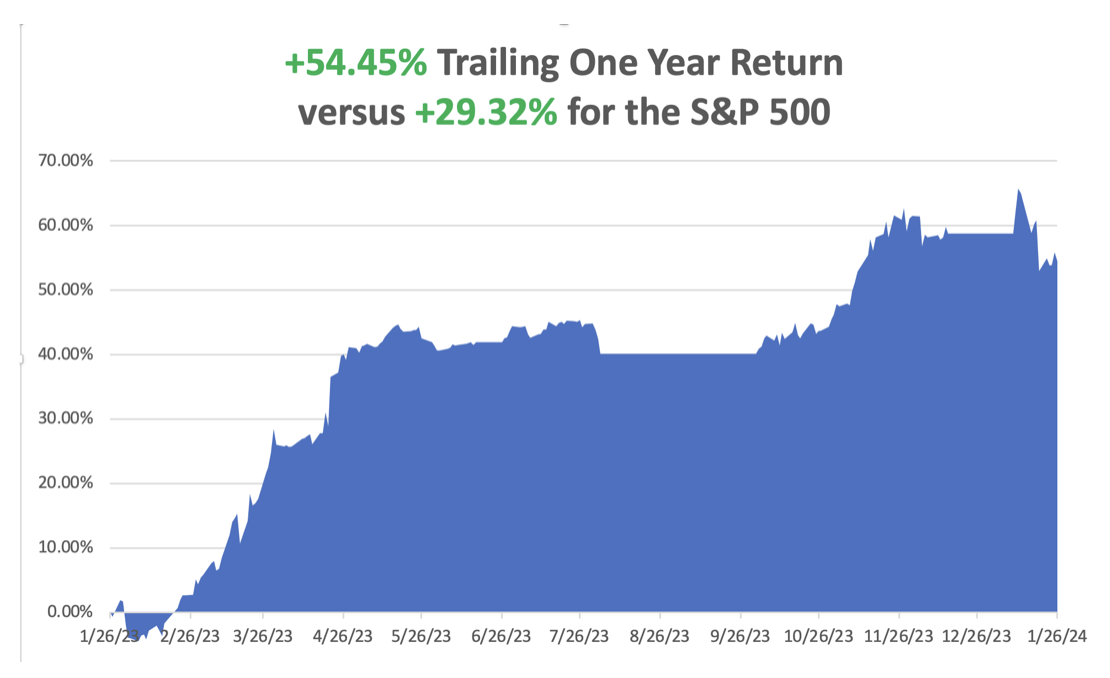

Many of the new products and services that I have introduced since 2008 have come at your suggestion. That has enabled me to improve the product’s quality, to your benefit. Notice how rapidly my trade alert performance is going up, now annualizing at +51% a year.

This originally started as a daily email to my hedge fund investors in 2008 giving them an update on fast market-moving events. That was at a time when the financial markets were in free fall, and the end of the world seemed near.

Here’s a good trading rule of thumb: Usually, the world doesn’t end. History doesn’t repeat itself, but it certainly rhymes.

The daily emails gave me the scalability that I so desperately needed. Today’s global mega enterprise grew from there. Today, the Diary of a Mad Hedge Fund Trader and its Global Trading Dispatch is read in over 140 countries by 30,000 followers. The Mad Hedge Technology Letter the Mad Hedge Biotech & Health Care Letter, Jacquie’s Post, and Mad Hedge AI also have substantial followings. And Mad Hedge Hot Tips is one of the most widely-read publications in the financial industry.

I’m weak in distribution in North Korea and Mali, in both cases due to the lack of electricity. But that may change.

One can only hope.

If you want to read my first pitiful attempt at a post, please click here for my February 1, 2008 post.

It urged readers to buy gold at $950 (it soared to $2,175), and buy the Euro at $1.50 (it went to $1.65).

Now you know why this letter has become so outrageously popular.

I always get asked how long will I keep doing this.

I am already collecting Social Security, so that deadline came and went. My old friend and early Mad Hedge subscriber, Warren Buffet is still working at 93, so that seems like a realistic goal.

Hiking ten miles a day with a 50-pound pack, my doctor tells me I should live forever. He says he spends all day trying to convince his other patients to be like me, and the only one who does it is me.

The harsh truth is that I don’t know how to NOT work. Never tried it, and never will.

This year I received a new reminder of my indestructibility. While observing a Ukrainian HIMARS missile attack on Crimea, a Russian missile landed 100 feet away from me. It was a dud and didn’t go off. If it exploded it would have killed us all. Later that day, a Russian bullet fired across the Dnieper River hit me in my right hip, caught by my body armor. If that isn’t a message from above, I don’t know what is.

The fact is that thousands of subscribers love me for what I do, pay for me to travel around the world first class to the most exotic destinations, eat in the best restaurants, fly the rarest historical aircraft, then say thank you. I even get presents (keep those pounds of fudge and bottles of bourbon coming!).

Given the absolute blast I have doing this job I would be Mad to actually retire.

Take a look at the testimonials I get only on an almost daily basis and you’ll see why this business is so hard to walk away from (click here)

In the end, you are going to have to pry my cold dead fingers off of this keyboard to get me to give up.

Fiat Lux (Let there be light).

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.