(AMZN), (NVDA), (GOOG), (MSFT), (AAPL), (CRM), (ORCL), (IBM), (TSLA)

In 1956, Elvis Presley's "Heartbreak Hotel" topped the charts, teenagers swooned, and parents worried about the decay of civilization.

That same year, a group of scientists at Dartmouth College coined the term "artificial intelligence," boldly predicting human-level machine intelligence within a generation.

Seven decades later, I'm debating with Google’s Gemini about whether a hot dog qualifies as a sandwich. (For the record, Gemini’s argument about structural integrity and bread-to-filling ratios was disturbingly convincing.)

I've analyzed markets for decades, but what's happening now makes those early dot-com days look positively quaint.

Amazon (AMZN) just dropped $4 billion into a startup called Anthropic bringing their total investment to $8 billion.

But Amazon isn't just throwing cash around for fun. They're rolling out custom-designed chips called Trainium and Inferentia to power Anthropic's AI systems through AWS.

Essentially, this move is a direct challenge to Nvidia's (NVDA) GPU dominance in the AI space.

Anthropic, founded in 2021 by OpenAI defectors, has rocketed from startup to major player with stunning speed.

In 2023, Google (GOOG) spotted their potential early and invested $500 million. Now with Amazon's backing, they've got serious muscle.

Considering the massive potential of the AI space, it’s not surprising that the tech giants are picking sides.

Amazon, Anthropic, and Alphabet form one power group, combining Amazon's cloud infrastructure, Anthropic's AI expertise, and Google's massive data resources.

Microsoft (MSFT) and OpenAI make up another, leveraging their Azure cloud platform and GPT technology to dominate enterprise AI solutions.

Apple's (AAPL) pulled off an exclusive deal to bring ChatGPT to iPhones - because apparently, Siri needed some company. This move signals that AI will be the next major battleground in consumer tech.

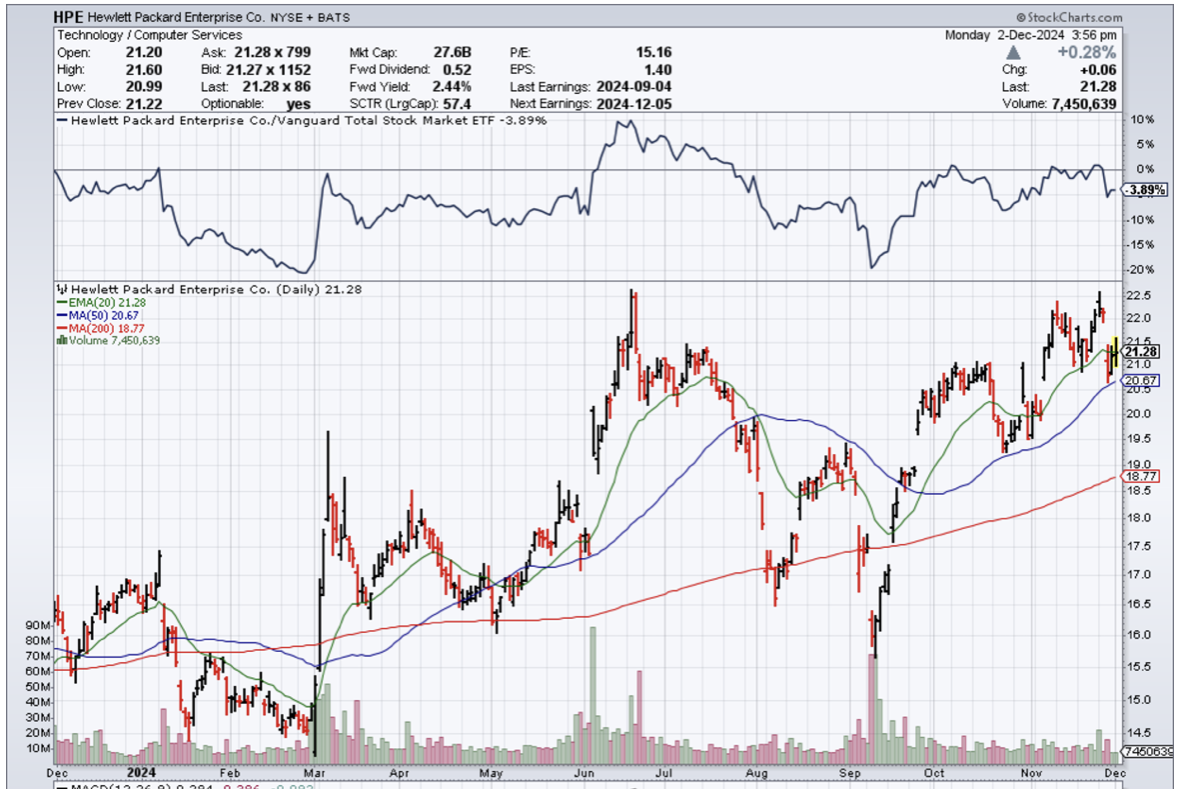

The November numbers reflect these strategic moves.

Amazon's roughly at $206, buoyed by investors betting on their AI infrastructure play. Microsoft commands $423, their OpenAI partnership driving cloud revenue growth. Alphabet sits at approximately $171, their diverse AI portfolio attracting long-term investors.

Nvidia, despite Amazon's chip rebellion, holds steady at $135 – proof that the AI boom needs more than just one chip supplier.

And the ripple effects are transforming every sector.

IBM's (IBM) Watson has evolved from winning Jeopardy! to analyzing medical data, opening up a $500 billion healthcare AI market.

Oracle (ORCL) finally made databases interesting – words I never thought I'd type. They’re leveraging AI to automate complex data operations, capturing enterprise clients from traditional providers.

Salesforce (CRM) embedded AI so deeply in their platform that their software predicts customer needs before customers even have them. I tested this claim. It knew I wanted to upgrade before I did. Unnerving.

Tesla's (TSLA) AI is teaching cars to distinguish between fire hydrants and pedestrians.

As someone who's had close encounters with both, I appreciate the effort. Though I'm still waiting for AI that can successfully negotiate with traffic cops.

So, how do you get a piece of the action? Consider keeping a close eye on industry leaders like Amazon and Microsoft for their cloud AI dominance, Alphabet for its research prowess, and Nvidia for AI hardware leadership.

And don't overlook IBM, Oracle, and Salesforce for enterprise AI applications. Adding these names to your watchlist could position you well as the AI revolution unfolds.

Needless to say, the stakes here are unprecedented. My first tech investment was in a company making faster floppy disk drives.

Now, I'm watching firms develop artificial minds that outthink teams of PhDs. The money flowing into AI makes those early internet investments look like spare change in a couch. And the pace is only accelerating.

The AI movement isn't approaching – it's here, changing our world faster than rock and roll transformed music.

We've got front-row seats to the biggest show since the internet. As Elvis would say, "It's now or never" for AI investing. Just make sure you don't end up at Heartbreak Hotel.