Back in 2008, I found myself in a private dining room at Copenhagen's Noma restaurant – then barely known outside culinary circles – seated next to a senior Novo Nordisk (NVO) executive who couldn't stop talking about their early-stage GLP-1 research.

"This will change diabetes treatment forever," he insisted between bites of moss and lichen. I nodded politely while thinking he'd had too much aquavit. Fast forward to today, and I've never been happier to have been dead wrong.

That same GLP-1 technology now powers Ozempic and Wegovy, creating a weight-loss revolution that's transformed both waistlines and balance sheets.

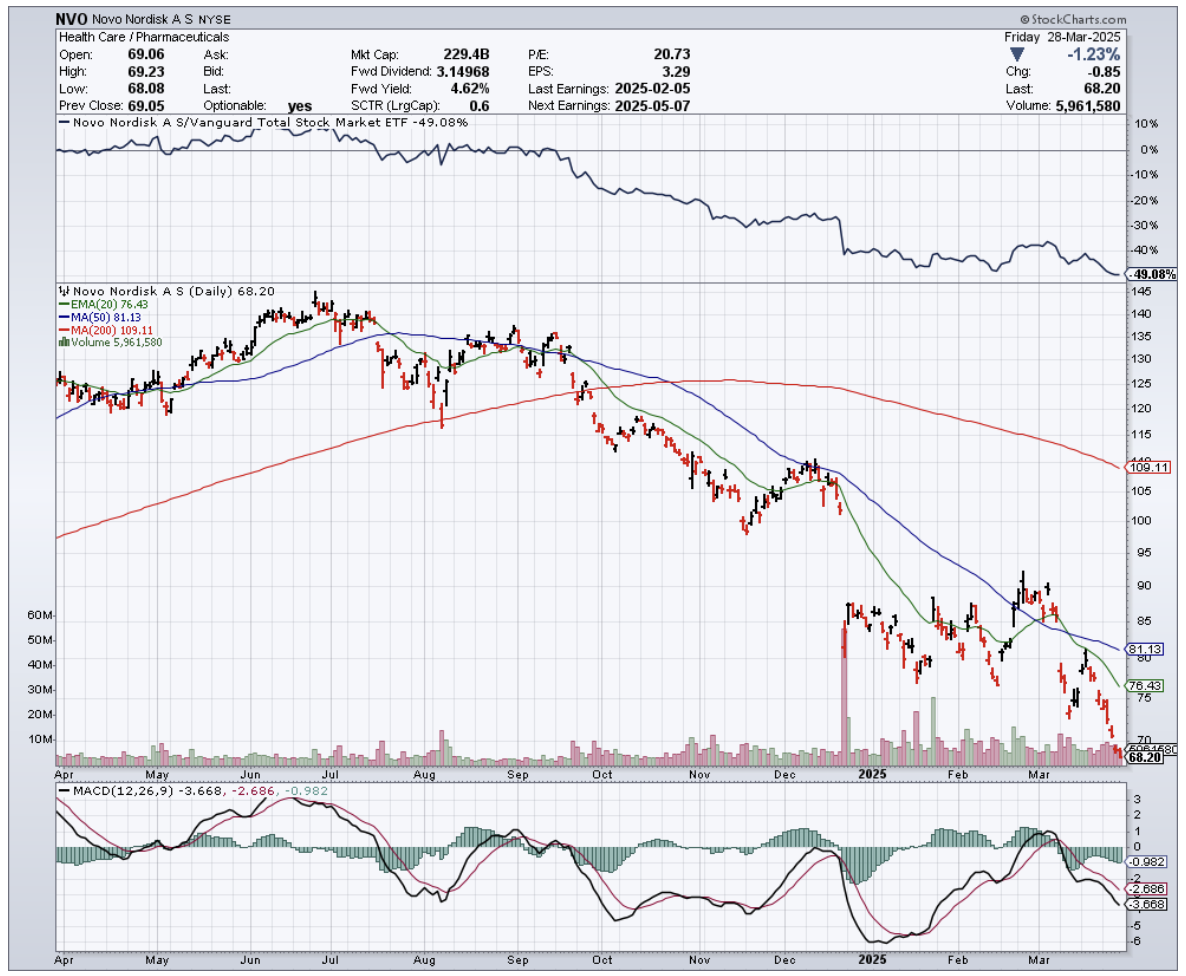

But here's what has me reaching for my trading account: Novo Nordisk's stock has somehow crashed 50% since last summer, creating what might be the buying opportunity of the decade in the pharmaceutical space.

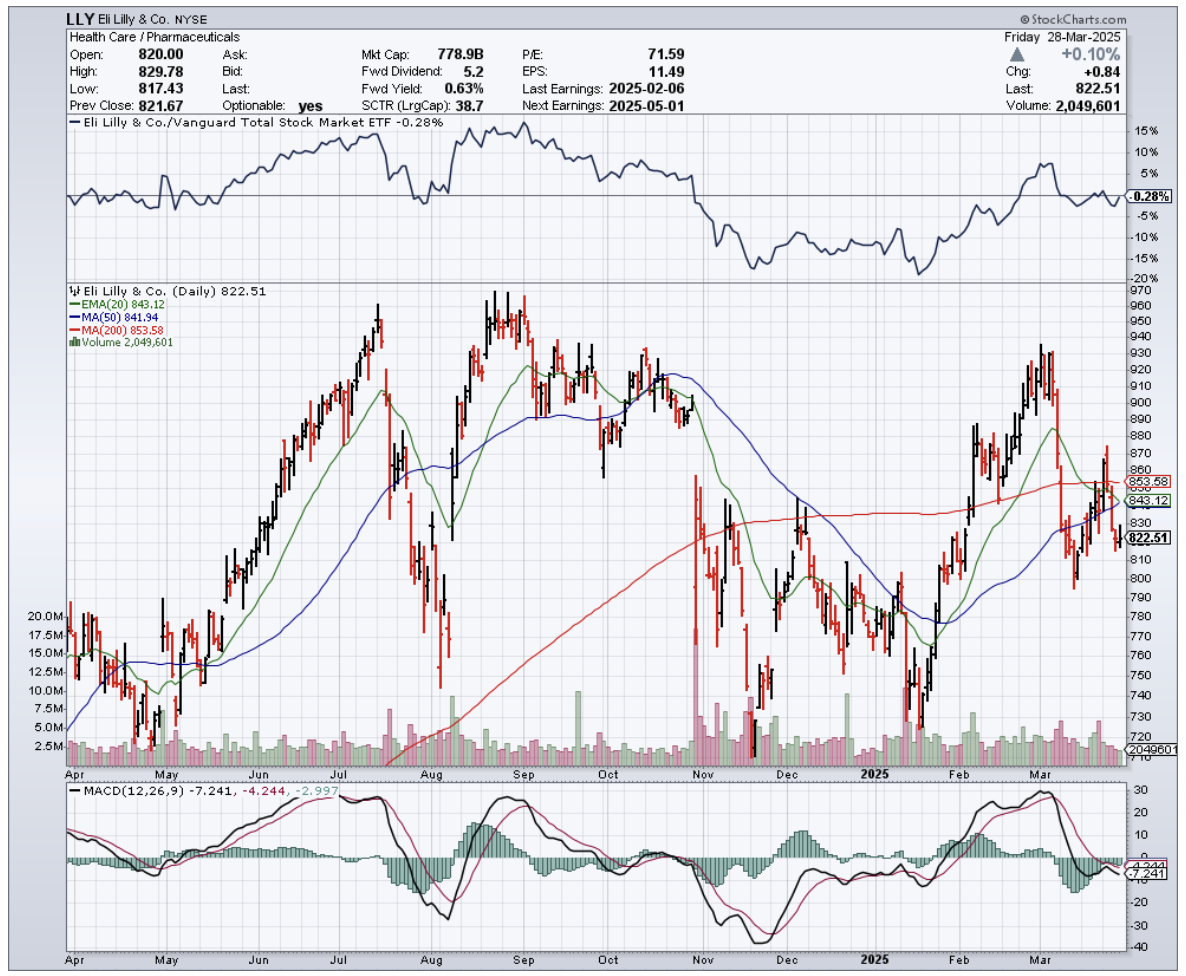

Meanwhile, their American rival Eli Lilly (LLY) has remained relatively stable despite identical market challenges. Let's dissect this peculiar divergence.

The facts paint a compelling picture: Novo Nordisk remains the undisputed global leader in the GLP-1 segment with a commanding 55.1% market share.

Their quarterly revenue hit $11.95 billion, up 25.13% year-over-year – not quite matching Lilly's impressive 44.7% growth, but still exceptional by any standard.

What's particularly striking is the valuation disconnect. Novo now trades at just 17.9x forward earnings compared to Lilly's 35.4x multiple. That gives Novo a PEG ratio of 0.97 – catnip for value investors hunting growth at a reasonable price.

The Danish giant's financial position remains rock-solid with lower net debt ($10.6B vs. Lilly's $31B) and a superior debt/EBITDA ratio. Their EBIT margin stands at an impressive 48.2% versus Lilly's 38.9%.

The precipitous stock decline stems from two primary concerns: recent clinical trial results for their next-generation Cagrisema showed 22.7% weight loss versus their 25% target, and potential U.S. tariffs could pressure margins on European-manufactured drugs. Both fears seem drastically overblown.

For context, Novo's monthly RSI has dropped below 40 – a rare technical signal that has occurred only three times this century (2002, 2009, and 2016), with each instance preceding returns exceeding 500% before the next correction.

Historical patterns aren't guaranteed, but they certainly make me sit up straighter in my trading chair.

The company isn't standing still either. They've committed $4.1 billion to expand U.S. manufacturing facilities, reducing tariff exposure.

They've also signed deals worth up to $3 billion with United Laboratories (ULIHF) and Lexicon Pharmaceuticals (LXRX) to bolster their weight-loss drug pipeline, ensuring they remain competitive with Lilly's offerings.

Last month at a healthcare conference in Boston, I cornered a veteran endocrinologist who's been prescribing these medications since their approval.

"The competition between Lilly and Novo is creating better outcomes for patients," she told me. "But from a prescription perspective, we still reach for Novo's products first in most cases."

That kind of clinical preference creates a moat that's difficult to quantify on balance sheets but enormously valuable over the long term.

While Eli Lilly deserves its premium valuation with a more diversified therapeutic portfolio spanning oncology, immunology, and neurology, Novo's singular focus on diabetes and obesity has created unparalleled expertise in categories representing massive long-term growth markets.

The obesity treatment market alone is projected to grow at 22% annually, with GLP-1 drugs leading the charge. Approximately 25% of the world's population will be obese by 2035, and Western markets like the U.S. and Europe (Novo's primary territories) will see the highest rates.

Both companies will thrive in this expanding market, but at current prices, Novo represents a superior investment opportunity. Analyst consensus targets suggest 57% upside potential for Novo versus 23% for Lilly.

I've initiated a position in Novo Nordisk at these levels while maintaining a smaller holding in Lilly for diversification. After all, in pharma investing, sometimes the most profitable opportunities emerge when the market overreacts to short-term concerns.

As for that Danish executive from 2008? He retired to a villa overlooking the Øresund Strait last year. I sent him a congratulatory gift basket filled with moss and lichen – a reminder of where billion-dollar ideas sometimes begin.