When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

(SKEPTICAL INVESTORS MAY SEE THE MARKETS TREND HIGHER)

September 5, 2025

Hello everyone

What’s next for the markets?

More upside ahead?

One hundred days have passed since the S&P500 reached its post “liberation day” closing low.

So, how would you describe the gains since then: incredible, astounding, amazing, eye-watering, irrational, annoying. I could go on, but you get the picture.

The index is up 29% inside that time frame. Since 1950, there have been just four instances in which the S&P500 has seen a larger return over a 100-day rolling period, according to several investment bank analysts.

It is no surprise to anyone to find the tech sector in the lead during this time. Over the past 100 days, the S&P500 tech sector has rallied more than 48% as investors have bought into the AI trade. Communication services and consumer discretionary stocks are also up more than 30% during the same period.

Spurring this recovery along is the expectation of Federal Reserve rate cuts, and some progress – albeit turbulent – on the global trade front.

Challenges are staring at the markets, but thus far, the market has overcome or bypassed every obstacle in its way.

Carson Group’s Ryan Detrick, as well as Tom Lee, from Fundstrat, investment banks, UBS, & Goldman Sachs (GS) and Jeremy Seigal all argue the market can move higher.

Detrick notes that the S&P500 averages 8.1% gain six months after a strong 100-day performance. One year out, that average increase expands to 12.9%.

AMAZON (AMZN)

The stock surged strongly on Thursday – around 3% - making it one of the S&P 500’s best-performing stocks of the day.

Over the past month, the stock has rebounded around 10%. Several catalysts are responsible for this:

# Its relationship with the rapidly growing Anthropic – an artificial intelligence startup backed by the e-commerce giant.

# expansion of its same-day grocery delivery offerings.

# newly minted deal for its satellite internet business.

Barclays sees a deep gold mine in Amazon’s deep-rooted relationship with Anthropic. The start-up trains its flagship generative AI Claude models primarily on Amazon Web Services, using Amazon’s Trainium and Inferentia chips for training and inference, respectively.

Some analysts believe Amazon could see significant upside in the fourth quarter. Anthropic could be pre-training its Claude 5 model by then, which would contribute to AWS growth.

I expect many of you made some good money (or are making good profits, if you are still holding these) on the AMZN options I recommended in early June, when the stock was sitting at $205.71.

AMZN 2015/225 with Oct. 17 expiry

and

AMZN 210/220 with Oct 17 expiry

I was even more aggressive in my personal account and took out a 220/230 option spread trade.

Took profits. On to the next trade.

THE TRAJECTORY OF GOLD

Gold at $4,000/ounce could be a reality by 2026.

Uncertainty and macro events are driving gold prices:

Trump’s actions are threatening Fed independence, and as Goldman analysts note, this could result in higher inflation, lower stock and long-dated bond prices, not to mention an erosion of the U.S. dollar’s status as the global reserve currency.

Gold futures gained 4.9% from Trump’s nomination of Stephen Miran on August 7 to fill a vacancy on the Federal Reserve Board. And the shiny metal gained 5.8% after Trump threatened to fire Fed Governor Lisa Cook on August 22 through to Tuesday.

Trump has made it clear that he wants to consolidate a majority on the Fed board so he can lower interest rates.

MY CORNER

Wallaby with joey in my front yard.

And a lone kookaburra sitting on a fence post.

Cheers

Jacquie

Global Market Comments

September 5, 2025

Fiat Lux

Featured Trade:

(APPLE LONG-TERM LEAPS),

(AAPL)

Trade Alert - (AAPL) – BUY

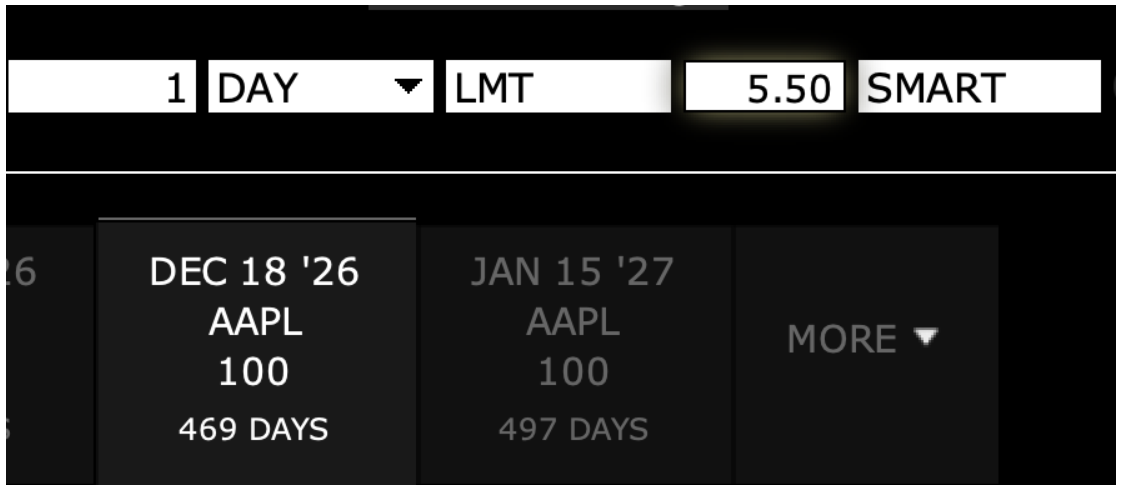

BUY the Apple (AAPL) December 2026 $230-$240 at-the-money vertical Bull Call spread LEAPS at $5.50 or best

Opening Trade

9-5-2025

expiration date: December 18, 2026

Number of Contracts = 1 contract

With Apple about to announce its next-generation iPhone 17 on Sunday, which is AI-enabled, this is a good time to dive into a long-term Apple LEAPS.

You hear a lot of incredible stories in Silicon Valley.

An electronic compact disc is coming that can deliver perfect sound and movies. Have you heard of the Internet? Compaq is offering a computer that will sit on your laptop! Do you have any idea how Google is going to make money? Steve Jobs is building a smartphone! Is he out of his mind? Elon Musk is building an electric car with a 250-mile range. Hey, I heard about this thing called “artificial intelligence.”

So I listened very carefully the other day when a friend of mine told me he had scored the real estate deal of the century.

His house had sat on the market like dead wood for a year and a half, priced at $4.0 million. It was a very nice 5,000 square foot Italian villa-type home with a huge garden and a fantastic 360-degree view.

Then out of the blue, a cash buyer said he wanted to rent the house for a year for the spectacular over-the-market rent of $20,000 a month, plus all utilities. Then, he offered to pay 10% over the asking price, or $4.4 million to buy the house outright, and would pay $400,000 in cash for the option to do so, payable immediately.

My friend, puzzled but ecstatic, asked why he was going about buying a home in this way. The buyer answered that he had some stock options from his company that he didn’t want to cash in for a year. His profession? He had a PhD in artificial intelligence.

That set the alarm bells off in my head.

I pulled out a paper map of the San Francisco Bay Area and drew a circle around the house within one hour driving time to reduce the number of potential candidates. Then I called a seasoned technical analyst and asked him which big California stock had a chart that was just about to break out to the upside. He didn’t hesitate.

Apple!

It all makes so much sense. Apple is one company behind in artificial intelligence that has the most money to do something about it. All they have to do is buy a ready-made AI company like Perplexity, and it will be out front. The shares will race to $260. I then calculated how high Apple shares would have to rise to justify the enormous premium for my friend’s house. I hit bang on $260.

I am therefore buying the Apple (AAPL) December 2026 $230-$240 at-the-money vertical Bull Call spread LEAPS at $5.50 or best

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

These LEAPS are illiquid, so you are going to have to play around with prices to get a position. Start at $5.00, then increase to $5.50, $5.60, $5.70, and so on. Don’t pay more than $7.00, or these will get expensive. It is easier to do this on days when the stock market is down.

This is a bet that Apple (APPL) will not fall below $240 by the December 18, 2026, option expiration in 15 months. Apple shares have to rise only 70 cents in 15 months to hit the upper strike in this LEAPS.

To learn more about the company, please click here to visit their website.

Notice that the day-to-day volatility of LEAPS prices is minuscule, less than 10%, since the time value is so great and you have a long position simultaneously offset by a short one.

This means that the day-to-day moves in your P&L will be small. It also means you can buy your position over the course of a month, just entering new orders every day. I know this can be tedious, but getting screwed by overpaying for a position is even more tedious.

Look at the math below, and you will see that a 70-cent rise in (AAPL) shares will generate an 82% profit with this position, such is the wonder of LEAPS. That gives you an implied leverage of 117:1. LEAPS stand for Long Term Equity Anticipation Securities.

(AAPL) doesn’t even have to get to a new all-time high of $260 to make the max profit in this position, which it will probably do in weeks, if not months. It only has to get back to $240, where it traded in March before the meltdown.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it.

Here are the specific trades you need to execute this position:

Buy 1 December 2026 (AAPL) $230 calls at………….………$38.00

Sell short 1 December 2026 (AAPL) $240 calls at…………$32.50

Net Cost:………………………….………..………….…...................$5.50

Potential Profit: $10.00 - $5.50 = $4.50

(1 X 100 X $4.50) = $450 or 82% in 15 months.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Debit Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.

Mad Hedge Biotech and Healthcare Letter

September 4, 2025

Fiat Lux

Featured Trade:

(SHEAR GENIUS)

(INCY), (NVS), (SNY), (MRK)

My barber Charlie has this uncanny ability to diagnose which of his clients are making money in the market just by watching how they tip.

Last Thursday, while he was working his magic on what's left of my hairline, he mentioned how his pharmaceutical rep clients have been tipping like oil sheiks lately.

"Something big is brewing in biotech," he said. That conversation got me thinking about Incyte Corporation (INCY).

You see, Charlie's pharmaceutical reps understand something most Wall Street analysts miss most of the time, and that’s the difference between flashy breakthrough drugs that grab headlines and the workhorses that generate consistent cash flow quarter after quarter.

Incyte falls squarely into that second category, except their "workhorse" just delivered Q2 2025 numbers that would make a racehorse jealous.

Digging deeper, I found where things get exciting, and why my neighbor's dermatologist probably drives a Porsche.

Incyte's Opzelura cream isn't just another skincare product - it's the first and only FDA-approved treatment for vitiligo in the United States. Think about that for a moment.

When you own the sole solution to a visible medical condition that affects millions, you've essentially discovered a legal monopoly that patients will pay for without batting an eye.

Revenue from this little tube of magic hit $164.5 million in Q2, climbing 38.6% quarter-over-quarter and 35.2% year-over-year.

But the real treasure lies in their emerging drug Niktimvo, which just posted sales of $36.2 million with a staggering 166% quarterly growth.

Meanwhile, the clinical data backing this drug shows 86% of patients with essential thrombocythemia achieving normalized blood counts.

For a condition affecting roughly 60,000 Americans, those efficacy rates suggest Incyte has another blockbuster hiding behind the boring medical terminology.

More impressively, the financial architecture of this company reads like a masterclass in pharmaceutical economics.

Their gross margin expanded to 55.9% while operating income margin hit 25.6%, a three-year high. On top of that, their total debt sits at just $42.4 million against EBITDA of $334.5 million.

That debt-to-EBITDA ratio of 0.04x is like having a mortgage payment of fifty bucks on a million-dollar mansion.

Now here's where Wall Street's myopia creates opportunity.

Everyone obsesses over Jakafi's patent cliff coming in 2028, treating it like some inevitable catastrophe. What they're missing is the patent protection story that extends well beyond that timeline.

Opzelura's patents don't expire until 2040, essentially giving Incyte a guaranteed revenue stream for the next 15 years.

The May settlement with Novartis (NVS) also cut their royalty payments in half, dropping cost of goods sold guidance to just 8-9% of revenues.

Every percentage point of margin expansion in a billion-dollar revenue company translates to serious money hitting shareholders' pockets.

The acquisition angle makes this story even more compelling.

Remember when Sanofi (SNY) swooped in and bought Blueprint Medicines for $9.5 billion in June?

Incyte trades at 13.8x forward earnings, roughly 24% below the sector median, with minimal debt, growing cash flows, and a diversified pipeline that includes povorcitinib and INCB123667.

They're essentially gift-wrapped for a strategic buyer. Those November 2024 rumors about Merck (MRK) sniffing around weren't idle gossip - they were reconnaissance missions.

What really seals this investment thesis is the momentum building behind their numbers.

Non-GAAP earnings per share hit $1.57, beating expectations by a nickel, while management raised Jakafi guidance from $2.95-3 billion to $3-3.05 billion for 2025.

The beauty of Incyte's transformation reminds me of watching a small-town hardware store evolve into a regional empire. They're systematically building a franchise that compounds value over time.

Trading at $84.61 with multiple growth catalysts, patent protection extending into the 2040s, and a strong balance sheet, this represents exactly the kind of overlooked opportunity that creates generational wealth.

My barber may think he's just cutting hair and making conversation, but his pharmaceutical rep theory just validated what decades of investing has taught me: find companies that solve real problems for real people, then hold on tight.

My next visit to Charlie's chair just might coincide with a very good mood and an even better tip.

Global Market Comments

September 4, 2025

Fiat Lux

Featured Trade:

(THIS WILL BE YOUR BEST PERFORMING ASSET FOR THE NEXT 30 YEARS),

(IYR), (PHM), (LEN), (DHI), (TLT), (HYG), (MUB), (SPY)

Lately, I have spent my free time trolling the worst slums of Oakland, CA.

No, I’m not trying to score a drug deal, hook up with some ladies of ill repute, or get myself killed.

I was looking for the best-performing investment for the next 30 years.

Yup, I was looking for new homes to buy.

As most of you know, I try to call all of my readers at least once a year and address their individual concerns.

Not only do I pick up some great information about regions, industries, businesses, and companies, but I also learn how to rapidly evolve the Diary of a Mad Hedge Fund Trader service to best suit my voracious, profit-seeking readers.

So when a gentleman asked me the other day to reveal to him the top-performing asset of the next 30 years, I didn’t hesitate: your home equity.

He was shocked.

I then went into the economics of the Oakland trade with him.

West Oakland was built as a working-class neighborhood in the late 1890s because it was a short hop on the ferry to San Francisco. Many structures still possess their original Victorian gingerbread designs and fittings.

Today, it is a 5-minute BART ride under the Bay to the San Francisco financial district.

A one three-bedroom, two-bath home I saw was purchased a year ago for $450,000, with a $50,000 down payment, and a 6.5% loan on the balance.

The investor quickly poured $50,000 into the property, with new paint, heating, hot water, windows, a kitchen, bathrooms, and flooring.

A year later, he listed it for sale at $650,000, and the agent said there was a bidding war on that would probably take the final price up to $700,000.

Excuse me, gentlemen, but that is a 400% return on a 50,000 investment in 12 months.

As Oakland rapidly gentrifies, the next buyer will probably see a doubling in the value of this home in the next five years.

Try doing that in the stock market.

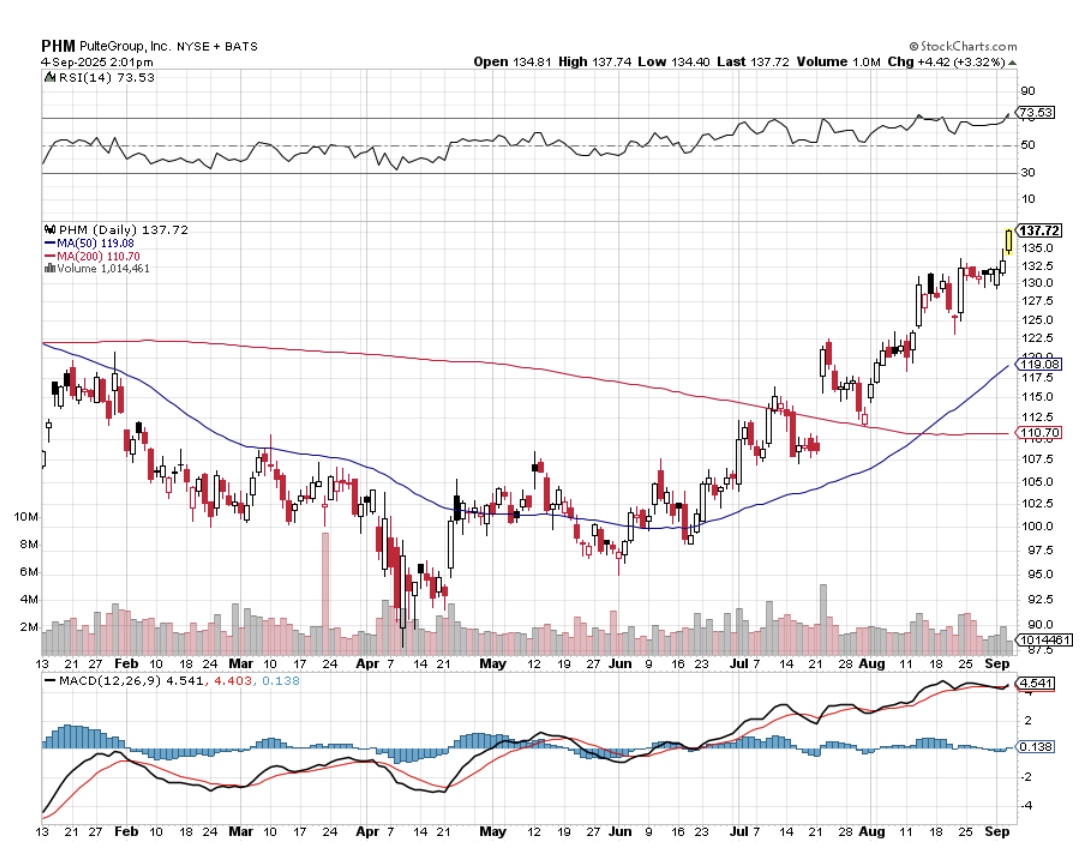

Needless to say, housing stocks like Lennar Homes (LEN), D.R. Horton (DHI), and Pulte Homes (PHM) need to be at the core of any long-term stock portfolio.

I then proceeded to list off to my amazed subscriber the many reasons why residential housing is just entering a Golden Age that will drive prices up tenfold, if not 100-fold, in the decades to come. After all, over the last 60 years, the value of my parents’ home in LA went up 100-fold and the equity 1,000-fold.

1) Demographics. The last decade started out as the hard decade for housing, when 80 million downsizing baby boomers unloaded their homes for greener pastures at retirement condos and assisted living facilities.

The 65 million Gen Xers who followed were not only far fewer in number, but earned much less, thanks to globalization and hyper-accelerating technology.

All of this conspired to bring us a real estate crash that bottomed out in 2011.

During the 2020s, the demographics math reverses.

That’s when 85 million millennials start chasing the homes owned by 65 million Gen Xers.

And as they age, this group will be earning a lot more disposable income, thanks to a labor shortage.

2) Population Growth

If you think it's crowded now, you haven’t seen anything yet.

Over the next 30 years, the US population is expected to soar from 335 million today to 450 million. California alone will rocket from 38 million to 50 million.

That means housing for 115 million new Americans will have to come from somewhere. It sets up a classic supply/demand squeeze.

That’s why megaprojects like the San Francisco to Los Angeles bullet train, which may seem wasteful and insane today, might be totally viable by the time they are finished.

3) They’re Not Building Them Anymore

Or at least not as much as they used to.

Total housing starts for 2024 were 1.55 million, a 3% decline from the 1.60 million total from 2023. Single-family starts in 2023 totaled 1.01 million, down 10.6% from the previous year. That means they are producing half of peak levels.

The home building industry has to more than triple production just to meet current demand.

Builders blame import taxes (tariffs) for materials like lumber (Canada) and drywall (Mexico), regulation, zoning, the availability of buildable land, lack of financing, and labor shortages.

The reality is that the companies that survived the 2008 crash are a much more conservative bunch than they used to be. They are looking for profits, not market share. They are targeting a specific return on capital for their business, probably 20% a year pretax.

It is no accident that new homebuilders like Lennar (LEN), Pulte Homes (PHM) and (DHI) make a fortune when building into rising prices and restricted supply. Their share prices have been on an absolute tear lately, and that is with a heartbreaking 6.5% mortgage rate.

This strategy is creating a structural shortage of 10 million new homes in this decade alone.

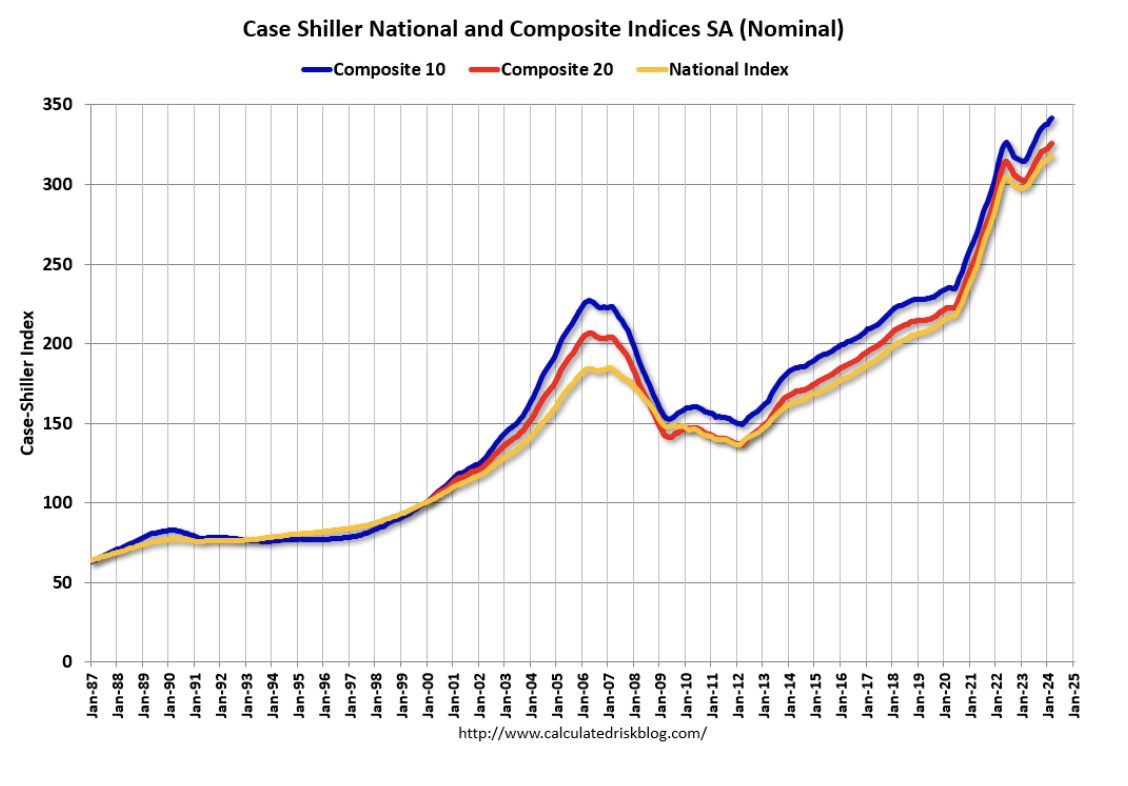

4) The Rear View Mirror

The Case Shiller CoreLogic National Home Price Index (see below) has started to fall after decades of increases. This will finally start to address affordability, one of the most daunting issues facing the market today.

Unless you have a new Internet start-up percolating in your garage, it is going to be very hard to beat your own home’s net return.

5) The Last Leverage Left

A typical down payment on a new home these days is 25%. That gives you leverage of 4:1. So in a market that is rising by 5.0% a year, your increase in home equity is really 20% a year.

Pay a higher interest rate, and down payments as low as 10% are possible, bringing your annual increase in home equity to an eye-popping 50%.

And if you qualify for an FHA loan up to $633,000, only a 3.5% deposit is required.

There are very few traders who can make this kind of return, even during the most spectacular runaway bull market. And to earn this money on your house, all you have to do is sleep in it at night.

6) The Tax Breaks are Great

The mortgage interest on loans up to $750,000 is deductible on your Form 1040, Schedule “A”, with a $40,000 limitation.

You can duck the capital gains entirely if the profit is less than $500,000, you’re married, and have lived in the house for 2 years or more.

Any gains above that are taxed at only a maximum 20% rate. These are the best tax breaks you can get anywhere without being a member of the 1%. Profits can also be deducted on the sale of a house if you buy another one at the equivalent value within 18 months.

7) There is No Overbuilding Anywhere

You know those forests of cranes that blighted the landscape in 2020? They are nowhere to be seen.

The other signs of excess speculation, liar’s loans, artificially high appraisals, and rapid flipping no longer exist. Much of this is now illegal, thanks to new regulations.

No bubble means no crash. Prices should just continue grinding upwards in a very boring, non-volatile way.

So the outlook is pretty rosy for individual homeownership for the foreseeable future.

Just don’t forget to sell by 2030 when the demographics reverse.

That's when the next round of trouble begins.

For Sale

“An S&P 500 index fund never beats the index. There’s fees, there’s friction costs, and other costs involved,” said Robert Reynolds, a manager at Putnam Investment Fund.

Global Market Comments

September 3, 2025

Fiat Lux

Featured Trade:

(TESTIMONIAL)

(HOW TO SPOT A MARKET TOP),

(SPY), (NFLX), (TSLA), (PLTR), (LEN), (TLT), (BAC), (MS), (GS)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.