“Banks have turned into gigantic gambling institutions. You never know what you own. I wouldn't touch them if you pointed a gun to my head,” said legendary hedge fund manager Bill Fleckenstein on Hedge Fund Radio.

Come join me for lunch at the Mad Hedge Fund Trader’s Global Strategy Luncheon, which I will be conducting off the coast of Antarctica on Friday, February 13, 2026. The meeting will take place on a Celebrity cruise that departs for Buenos Aires, Argentina on Saturday, January 31. I just checked, and there are still cabins available.

The cost of the luncheon will be $499.

An excellent meal will be followed by a wide-ranging discussion and an extended question-and-answer period.

I’ll be arriving early and leaving late in case anyone wants to have a one-on-one discussion or just sit around and chew the fat about the financial markets.

The lunch will be held during a 14-day cruise on the Celebrity Equinox, where I will be occupying the Owner’s Penthouse Suite. The precise location will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets for this luncheon, please click here.

Global Market Comments

January 20, 2026

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or A BLACK SWAN A DAY),

(GS), (MS), (GLD), (SLV), (IWM), (XLI), (CRWD), (AAPL)

“The economy without debt is like major league baseball without steroids,” said Jack Ablin, chief investment officer of BMO Private Bank.

Global Market Comments

January 16, 2026

Fiat Lux

Featured Trade:

(JANUARY 14 BIWEEKLY STRATEGY WEBINAR Q&A),

(CSCO), (GLD), (MSTR), (JPM), (FXA),

(BTC), (SOFI), (HOOD), (UUP)

The writing has been on the proverbial wall as central banks around the world struggled for years to contain inflation without destabilizing financial systems.

A steady stream of economic data over the past several years has highlighted how fragile the global financial balance became after the pandemic, with inflation emerging as one of the most persistent challenges.

Central banks were slow to tighten policy because moving too aggressively risked triggering recession, asset market stress, or outright financial accidents. For a long time, it was simply easier to keep policy loose than to risk being blamed for breaking the system.

That hesitation reshaped how investors viewed scarce assets.

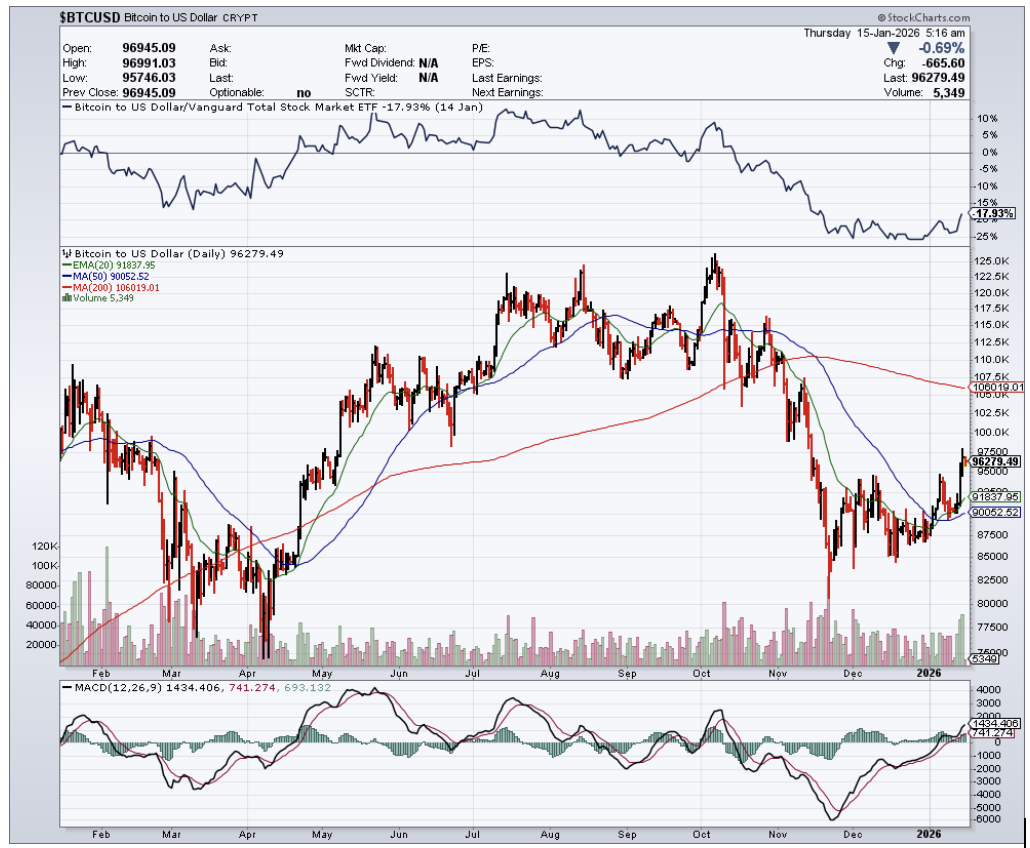

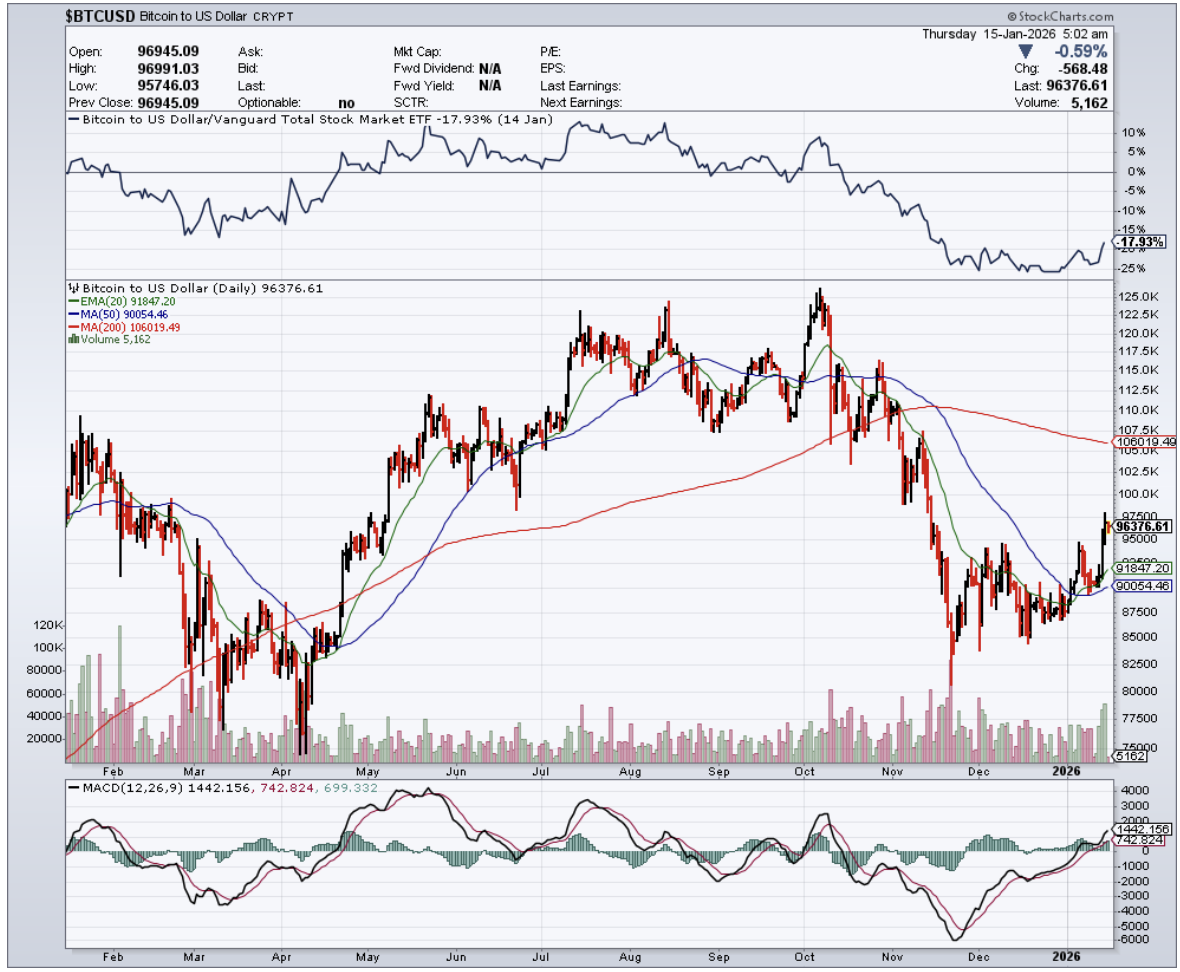

The appeal of Bitcoin has consistently strengthened during periods when inflation outpaced wages and purchasing power eroded. While Bitcoin is not mechanically linked to inflation data, its narrative as a hedge against monetary debasement gained traction as inflation surged across developed economies between 2021 and 2023.

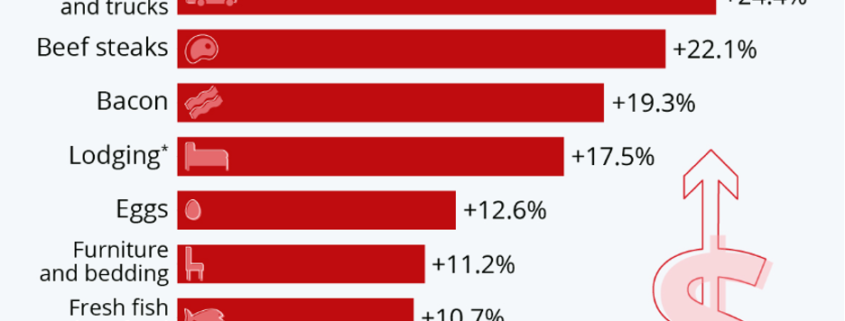

Canada was an early warning sign. Inflation surged to levels not seen in decades as supply chain disruptions, labor shortages, and rising energy costs collided. Prices for housing, transportation, and food rose sharply, forcing central banks to abandon the idea that inflation was merely transitory.

Similar dynamics played out across Europe and the United States.

Supply chains proved far more fragile than expected, and they did not normalize quickly. Worker shortages, geopolitical disruptions, and energy market volatility repeatedly pushed costs higher, even after headline inflation began to cool.

Governments were forced to step in at times simply to keep essential goods moving. Fuel shortages, transport bottlenecks, and labor constraints became recurring reminders that modern economies are more brittle than they appear.

Inflation acted as a quiet tax on consumers, businesses, and savers. Wage increases often failed to keep pace with rising prices, meaning higher nominal income did not translate into higher real purchasing power. For many households, raises were effectively absorbed by higher rent, food, energy, and insurance costs.

That erosion of purchasing power pushed more people to reconsider where they stored long-term value.

Rising interest in crypto during high inflation periods was not driven by optimism alone, but by frustration with traditional systems that appeared unable to preserve real wealth. For many investors, crypto represented an opt-out mechanism rather than a speculative gamble.

Supply shocks compounded the problem. Energy disruptions, extreme weather, and geopolitical tensions repeatedly slowed logistics and increased costs. Food prices were especially sensitive, with meat, eggs, and dining costs rising sharply during peak inflation periods, even as other categories stabilized later.

These pressures reinforced a broader narrative. When trust in institutions weakens and policy responses lag behind economic reality, alternative systems attract attention.

The rise in crypto adoption has reflected that shift in sentiment. It has been less about chasing rapid gains and more about hedging against policy uncertainty, currency debasement, and institutional fragility.

Crypto price cycles have remained volatile, but the underlying demand story has matured. Participation has broadened, infrastructure has improved, and access through regulated investment products has expanded globally.

The result is an asset class that responds not just to speculation, but to macroeconomic stress.

High inflation did not single-handedly drive crypto adoption, but it accelerated it. And as long as confidence in monetary policy remains imperfect, digital assets will continue to benefit from that uncertainty.

This article is not a joke. This is an article about a parody token that is now a real thing.

There are meme stocks, and there are meme tokens.

There is the argument out there that the flood of liquidity is giving these assets their time in the sun.

I am not saying these assets are great to buy and hold long-term, hardly not, but they do offer the volatility for traders to jump in and out of them for a nice profit.

Shiba Inu Coin (SHIB), a popular meme token based on another alternative coin, Dogecoin (DOGE), is a decentralized cryptocurrency created in August 2020 by an anonymous person or persons known as “Ryoshi.”

SHIB experienced its most explosive run during the 2021 meme-asset cycle and has since settled into a more mature, volatility-driven trading range.

While this dog-inspired cryptocurrency continues to see sharp rallies during periods of market enthusiasm, it remains well below its 2021 all-time high of approximately $0.000088.

Shiba Inu Coin now typically ranks around No. 34 by market capitalization, with a market value fluctuating between roughly $4.7 billion and $5.2 billion, still firmly placing it among the largest meme-based cryptocurrencies, but far from the very top of the market.

Before investing in any altcoins, it’s important to understand that these coins are a great deal riskier than something like Bitcoin (BTC).

It sounds funny just saying that but yes, there are different degrees of risk with different coins.

There has been a lot of hype surrounding the Fear of Missing Out (FOMO) movement, but I would say, only deploy capital in altcoins if you are willing to write off the entire investment.

And I’ll say this, it’s a speculative investment in general, so at least do a little due diligence before you take the plunge.

Shiba Inu Coin is an Ethereum-based ERC-20 token, which means it was developed on the Ethereum blockchain, rather than its own blockchain.

Ryoshi decided to launch SHIB on Ethereum (ETH) because it’s “already secure and well-established,” according to the SHIB white paper, or, as its community calls it, the “woof paper.”

I have gone on record saying that Ethereum will go higher than Bitcoin in the future because it’s that attractive platform that every DeFi developer wants to build on, and SHIB is just one iteration of that.

Developers also choose to roll out their projects using the ETH platform because it’s way cheaper than building a platform from scratch.

SHIB launched with a total supply of 1 quadrillion tokens, though a meaningful portion has since been burned, bringing the circulating supply down to roughly 589 trillion SHIB over time.

Ryoshi is on record saying he doesn’t have any SHIB, and nearly half of its initial supply was locked in a liquidity pool on the decentralized exchange Uniswap.

The rest was sent to Ethereum co-founder Vitalik Buterin.

According to SHIB’s white paper, Ryoshi sent tokens to Buterin with hopes that he’d keep the tokens.

However, Buterin did not.

He donated a significant amount to the India Covid Relief Fund and other charities, which goes to show that not all Covid Relief Funds are created equal.

This is not a joke, and some people might be laughing when they read what this coin is based on.

That is why altcoins may require additional caution due to their differences from something like Bitcoin, including their structure, supply, and utility.

SHIB supporters might point to a comprehensive ecosystem, which now includes smart contract functionality, NFTs, liquidity mining opportunities, and a dedicated Layer-2 network, Shibarium, aimed at lowering transaction costs and expanding real utility beyond pure community hype.

Another juicy piece of news saw rising support for a Change.org petition urging trading platform Robinhood to list SHIB on the broker’s platform.

That effort ultimately succeeded.

SHIB has been listed on Robinhood since 2022, improving accessibility and liquidity, though the listing did not translate into a sustained re-rating of the token’s price.

When asked by analysts, Robinhood CEO Vladimir Tenev had initially been noncommittal, but the listing was later approved as part of a broader expansion of the company’s crypto offerings.

That’s the thing about these altcoins — they can come out of nowhere, and even a “fake it till you make it,” SHIB created real wealth during its peak cycle for early participants.

Now the secret is out about SHIB, I would scale in slowly, but don’t bet the ranch on this speculative bet, and prepare for high volatility.

Once it rains, it pours.

South Korea’s public pension ecosystem has long been viewed as conservative, but that perception has been steadily eroding. One of the country’s largest institutional pools of capital, the Korean Teachers’ Credit Union (KTCU), has explored digital asset exposure as part of its broader effort to improve long term returns.

The fund considered gaining Bitcoin exposure through exchange-traded funds in early 2022, a move that would have been unthinkable for most public pensions just a few years earlier.

I am not going to touch on whether there is a moral high ground when it comes to investing employee retirement assets. The reality is that the fixed-income instruments pension funds traditionally rely on have struggled to deliver adequate returns in a prolonged low-yield environment.

The definition of insanity is repeating the same approach when it no longer works.

Faced with a shrinking menu of viable options, institutional allocators have been forced to expand their definition of alternative assets, and crypto has increasingly entered that conversation.

Pension fund managers have performance targets like everyone else and are ultimately judged on results.

This shift does not represent the old status quo for retirement capital, but it does reflect a broader change in how alternative investments are evaluated.

KTCU’s exploration of Bitcoin-linked exchange-traded products included funds associated with South Korean asset manager Mirae Asset Global Investments, which launched Bitcoin futures-based ETFs through its Canadian subsidiary Horizons ETFs in 2021.

Today, KTCU oversees more than $45 billion in assets under management, with a substantial portion allocated to alternative investments alongside domestic and international equities.

The mere consideration of crypto and blockchain exposure by pension funds has opened a new chapter in the digital asset market, one where the most conservative capital pools in the world no longer dismiss the asset class outright.

What once seemed bizarre has become increasingly rational when viewed through the lens of portfolio construction and risk management.

Despite lingering concerns about volatility, crypto has established itself as one of the most actively traded and institutionally monitored asset classes globally.

Regulatory clarity has improved over time, particularly following the approval of spot Bitcoin exchange-traded funds in major markets, including the United States, which significantly lowered the barrier to entry for large institutional investors in Bitcoin.

Traditional stewards of retirement capital have begun voting with their currency, and this trend has extended beyond Korea into other parts of Asia.

Family offices were early adopters of crypto funds, but pension plans and endowments have since followed, accelerating the professionalization of the digital asset ecosystem.

The market has grown more sophisticated and more institutional, driven by post pandemic monetary policy, inflation concerns, and the search for assets that behave differently from traditional markets.

Being risk-averse no longer automatically means avoiding cryptocurrency. Increasingly, it means understanding it.

Several high-profile pension-related moves have underscored this evolution.

The Houston Firefighters’ Relief and Retirement Fund confirmed allocations to Bitcoin and Ethereum, marking one of the earliest United States public pension entries into digital assets.

Canada’s Ontario Teachers’ Pension Plan Board participated in a major funding round for crypto exchange FTX. That investment was later written down following FTX’s collapse, reinforcing the importance of counterparty risk management rather than reversing institutional interest in digital assets more broadly.

This growing channel of institutional capital has reshaped the crypto market structure, providing deeper liquidity and a more resilient base of long-term participants.

With more buyers able to access the market through regulated products, crypto has moved further into the financial mainstream, even as volatility remains a defining feature of the asset class.

Global Market Comments

January 15, 2026

Fiat Lux

Featured Trade:

(NEW VIDEO UPDATE ON HOW TO EXECUTE A VERTICAL BULL CALL DEBIT SPREAD),

(AAPL), (GS)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.