23andMe Gets Dumped

Tech is full of ideas swept into the dustbin of history, and 23andMe is just another blatant example of it.

Mr. Market decides the fate of these public companies and nobody else.

Remember they went public when there was more money than common sense.

Interest rates were low and half-baked tech ideas were getting funded left and right.

That was back when things like Hollywood used to be relevant.

Fast forward to today and 23andMe is done and dusted.

They filed for bankruptcy protection in the US to help sell itself.

Many of these mediocre tech companies are falling like dead flies as the thirst to prove profitable has really hit tech as small firms deal with the 1000-pound gorilla in the room.

The company has never flipped a profit.

They could solve the problem of extracting recurring revenue and many customers fled the company after doing their DNA test.

The San Francisco-based company said its chief executive and co-founder Anne Wojcicki was stepping down. She has been pushing for a buyout since April last year but was rebuffed by 23andMe’s board.

The company is still reeling from a huge data breach in 2023 that affected the data of nearly 7 million people, about half of its customers. Revenues have fallen as many of its 15 million customers scramble to delete their DNA data from the company’s archives.

This is a company that can solely exist with some level of trust, and that trust was extinguished in one fell swoops as hackers made out with everything important to the company.

At a time when other tech overlords are headed into the health business, the proverbial goalposts could never be narrower than they are today.

That is bad news for shareholders and bad news for the possibility of a quick turnaround.

Fighting for survival, 23andMe has cut the jobs of 200 people, amounting to 40% of its workforce, and stopped the development of all its therapies in November. Wojcicki’s ambition has been to turn the company into a drug developer.

The CEO will be replaced by its chief financial officer, Joe Selsavage, until a permanent replacement is found but she is staying on the 23andMe board.

It has never been harder to make a profit in Silicon Valley and even though data leaks aren’t a big deal for big tech giants, they are a death sentence for an upstart.

A company like 23andMe never found a way to monetize its business model.

I remember the fad of getting your genes tested to see where you are from, but that spark was met with a big thud.

The truth is, how do you come back from a data leak when that is the sole value of your firm?

The answer is you don’t.

23andMe won’t be able to do much of anything to expand their revenue projections while they are mired in over 30 lawsuits.

Everything they will do will be like walking on a tightrope.

Better to just shut down the company and restart a new one.

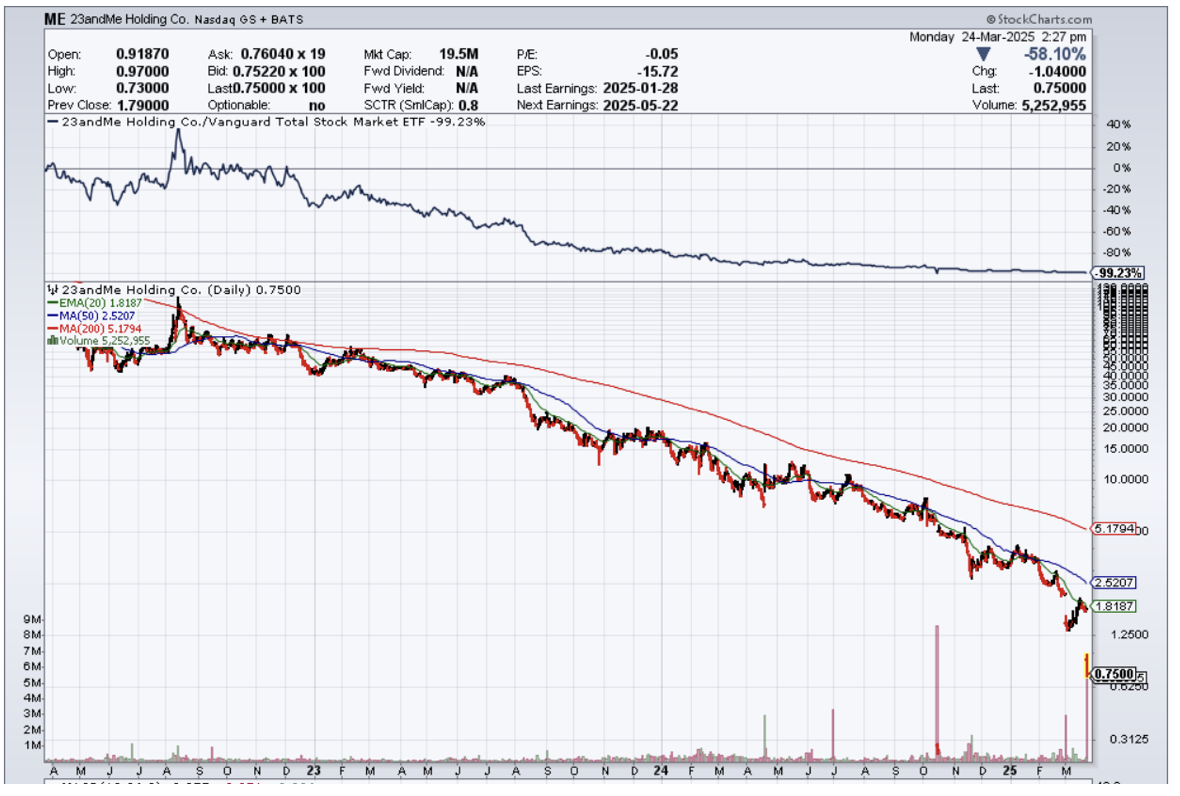

It’s hard to believe that in 2021, the company had a stock price of over $320.

Fast forward to today and the stock is trading under $1.

American capitalism is for no faint of heart and 23andMe’s story is a bruising anecdote to what happens when tech firms don’t safeguard their secret sauce.

That sauce has now gone rotten.