How the Fed Will Trigger the Next Crash

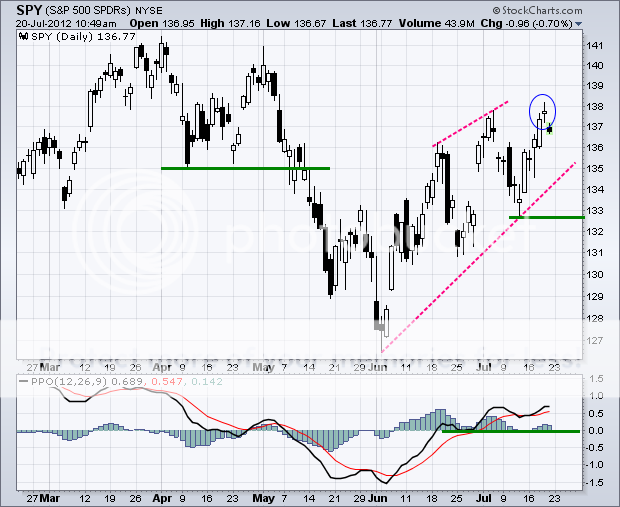

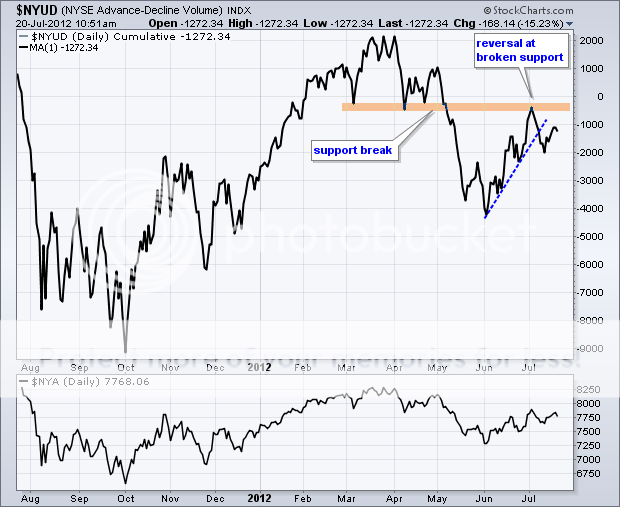

Over the last two months, I have witnessed one of the least convincing rallies in the US stock market in recent memory. Looking at the chart for the S&P 500 below you can clearly see a modest, low conviction, declining volume rally in an ever-narrowing channel. This is further confirmed by the chart of the NYSE advance/decline ratio that is failing at the March support level, which has now become resistance.

Look at any other asset class and it is flashing warning lights. Ten year Treasury bonds are within a hair?s breadth of blasting through to an all time low yield below 1.42%. We all know from hard earned experience that stocks and bonds never go up together for more than short periods, and that it is almost always the debt markets that get the longer-term trend right.

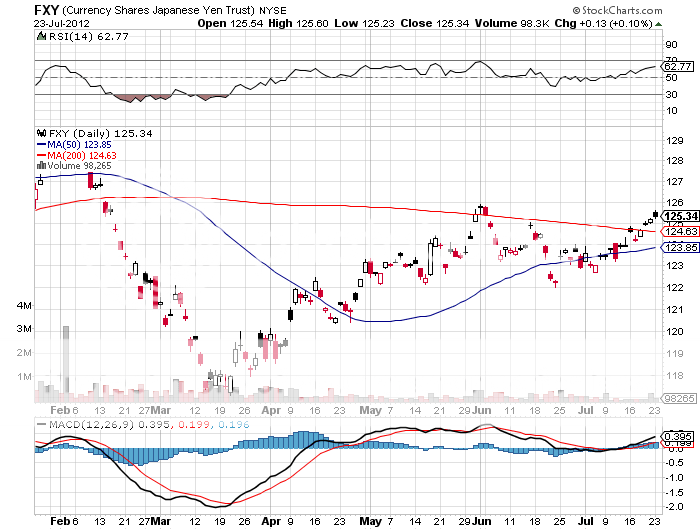

That flight to safety currency, the Japanese yen, is also screaming at us that trouble is just around the corner. It made it to the ? 77 handle, or over $125.00 in the (FXY) in recent days. People are certainly not buying the Japanese currency because they like Japan?s long-term fundamentals and demographics, which are the worst in the world. Nor are they buying for the yield, which is zero.

It appears that stocks have rallied because traders believe that the Federal Reserve will launch QE3 at its upcoming August 1 meeting. Bonds have been rallying because they think it won?t. Only one of these markets is right. That means the Fed won?t be able to take further easing action until early next year, well after the presidential election. By then, it will have every reason in the world to launch QE3, with the ?fiscal cliff? at the top of the list. That?s why Ben Bernanke is not inclined to waste ammo now.

In the meantime, The US, China, and Japan are all slowing and Europe is falling off a cliff. I was speaking to a hedge fund friend of mine this morning who told me the German paper he read said that they were abandoning Greece. I replied, ?That?s funny, the German paper I read said that they were abandoning Spain.? What ECB rescue funds that are in place are being challenged in the German Supreme Court, creating further uncertainty.

Travel around European main streets, as I have done for the last 10 days, and the ?FOR SALE? signs are everywhere. These are not a signal that I should rush out and buy equities right now, no matter how high the dividends are. They will be higher still, later.

All of this is setting up for an August that could be grizzly. A Fed disappointment will lead to a rapid unwind of the recent stock market rally, and could take us down to the 2012 low at 1,266 pronto, or more. A pop to a 1.25% yield in the ten-year Treasury is a chip shot.

Sign of the August to Come?