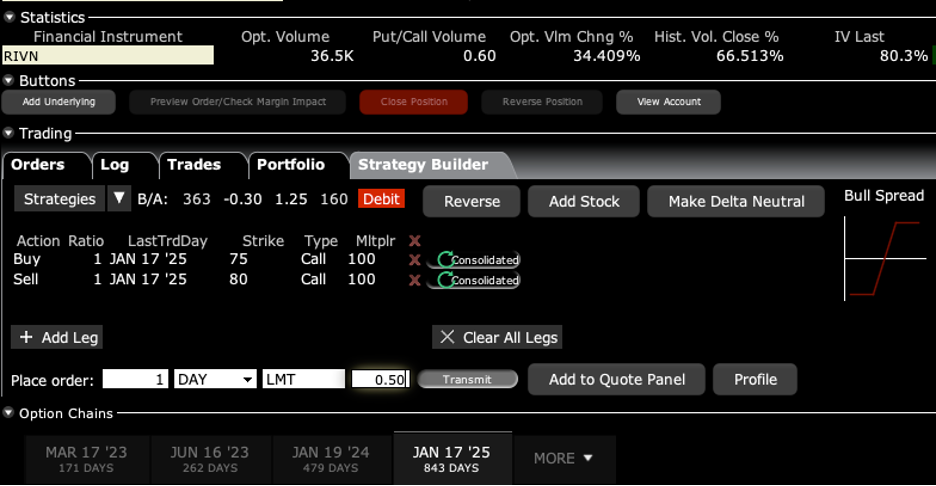

BUY the Rivian (RIVN) January 2025 $75-$80 out-of-the-money vertical Bull Call spread LEAPS at $0.50 or best

It is likely that the stock market will hit its final low in this bear market in the next month or two. Worst case, the S&P 500 (SPX) could momentarily trade as low as down 10% or 20% from here.

That will make it the best time to enter LEAPS in this decade.

You don’t necessarily have to execute this trade today. Just put in very low bids and on market sell-off days, you might get filled. Start with one contract to discover where the real market is.

Trade Alert - (RIVN) – BUY

BUY the Rivian (RIVN) January 2025 $75-$80 out-of-the-money vertical Bull Call spread LEAPS at $0.50 or best

Opening Trade

9-28-2022

expiration date: January 17, 2025

Number of Contracts = 1 contract

You may not have noticed, but we have just entered the golden age of the electric vehicle, thanks to climate change and massive government support. We are also entering the golden age of LEAPS.

Rivian is the one electrical vehicle maker most likely to make it after Tesla (TSLA). Its largest outside shareholder is Amazon, which helped start the company with an order for 100,000 electric delivery vehicles. Yes, I hate to say it, but Rivian could be the next Tesla and I did pretty good with the last one.

With Rivian, we have a 90% decline in the share price that is right behind us. As the company ramps up production, I believe it is possible for the shares to rise from today’s $40 to the old high at $180. That makes it a perfect LEAPS candidate.

A Rivian passed me on the road the other day and it’s the coolest thing I’ve ever seen. Don’t bother trying to buy one as there is a two-year waiting list, even at $69,000 each stripped down, and I don’t care who you know. Fully loaded they are selling for $89,000 list with a 400-mile range, and $140,000 on the black market.

Volume mass production is the key to the electric vehicle business. Rivian should manufacture 20,000 EVs this year. When Tesla (TSLA) hit 20,000, the stock went up 1,000%. So, 20,000 seems to be the key number.

To learn more about the company, please visit their website at https://rivian.com

I am therefore buying the Rivian (RIVN) January 2025 $75-$80 out-of-the-money vertical Bull Call spread LEAPS at $0.50 or best.

Don’t pay more than $1.20 or you’ll be chasing on a risk/reward basis.

January 2025 is the longest expiration currently listed. If you want to get more aggressive with more leverage, use a pair of strike prices higher up. Please note that these options are illiquid, and it may take some work to get in or out. Start at my price and work your way up until you get done.

Look at the math below and you will see that a 140% rise in (RIVN) shares will generate a 900% profit with this position, such is the wonder of LEAPS.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it.

This is a bet that Rivian will not fall below $80 by the January 17, 2025 options expiration in 2 years and 4 months.

Here are the specific trades you need to execute this position:

Buy 1 January 2025 (RIVN) $75 calls at………….………$7.50

Sell short 1 January 2025 (RIVN) $80 calls at…………$7.00

Net Cost:………………………….………..………….......….....$0.50

Potential Profit: $5.00 - $0.50 = $4.50

(1 X 100 X $4.50) = $450 or 900% in 2 years and 4 months.

If you are uncertain on how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.

Cool!