Hang On To The A.I Story With Meta

One of the reasons I believe this AI narrative will continue in the short-term is because cash cow tech firms like Meta (META) are pouring cash into AI infrastructure.

There is a lot we still don’t know about the direction of AI – the future is uncertain.

However, the one takeaway is that the AI infrastructure spend continues right now unabated, and we know that because Meta raised capital expenditures guidance for the 2024 fiscal year to between $38 billion and $40 billion, up from $37 billion to $40 billion previously.

They also expect capital expenditures to continue to grow significantly in 2025 due to an acceleration in infrastructure expenses.

Founder Mark Zuckerberg is desperate to not miss out on the “next big thing.” Remember, he whiffed big time at the smartphone, and he will never stop blaming himself for it. Apple has been a constant pain in the ass for his company because Meta still needs to go through Apple management and their app store to get their platform to users. They also changed the privacy settings, which were directly targeted at Meta.

Zuckerberg is also on record for saying that Meta would be twice as profitable if he could remove the costs of going through Apple.

Meta is still growing at 19% year over year, and that is quite impressive for a company this big.

The company reported 3.29 billion daily active people for the third quarter. That was up 5% year over year, and we can expect that percentage point to stick in the single digits.

Zuckerberg has been pointing to the company’s massive investments in artificial intelligence, which includes spending billions of dollars on Nvidia’s popular graphics processing units, as helping improve the company’s core online ad business in the aftermath of Apple’s 2021 iOS privacy update. The company has been improving upon and building more data centers to help provide the technology infrastructure needed for its AI strategy.

The company’s Reality Labs hardware unit posted an operating loss of $4.4 billion in the third quarter, which was less than analysts’ expectations of $4.68 billion.

Facebook Reality Labs is a research and business unit of Meta Platform that develops virtual reality (VR) and augmented reality (AR) products and technologies.

I do believe the jury is still out on the Facebook Google story. It is not a given that consumers will just adopt some ridiculously looking VR headset and venture off into daily life with that thing on. The over $4 billion of losses points to a challenging time to turn the VR business into something legitimate.

Apple has also had some issues with its VR headset as well.

In the short term, Meta is still highly profitable, and they roll these profits into trying out new businesses.

It only takes one new killer business for the stock to explode again, much like what happened when Zuckerberg doubled down in social media through the acquisition of Instagram.

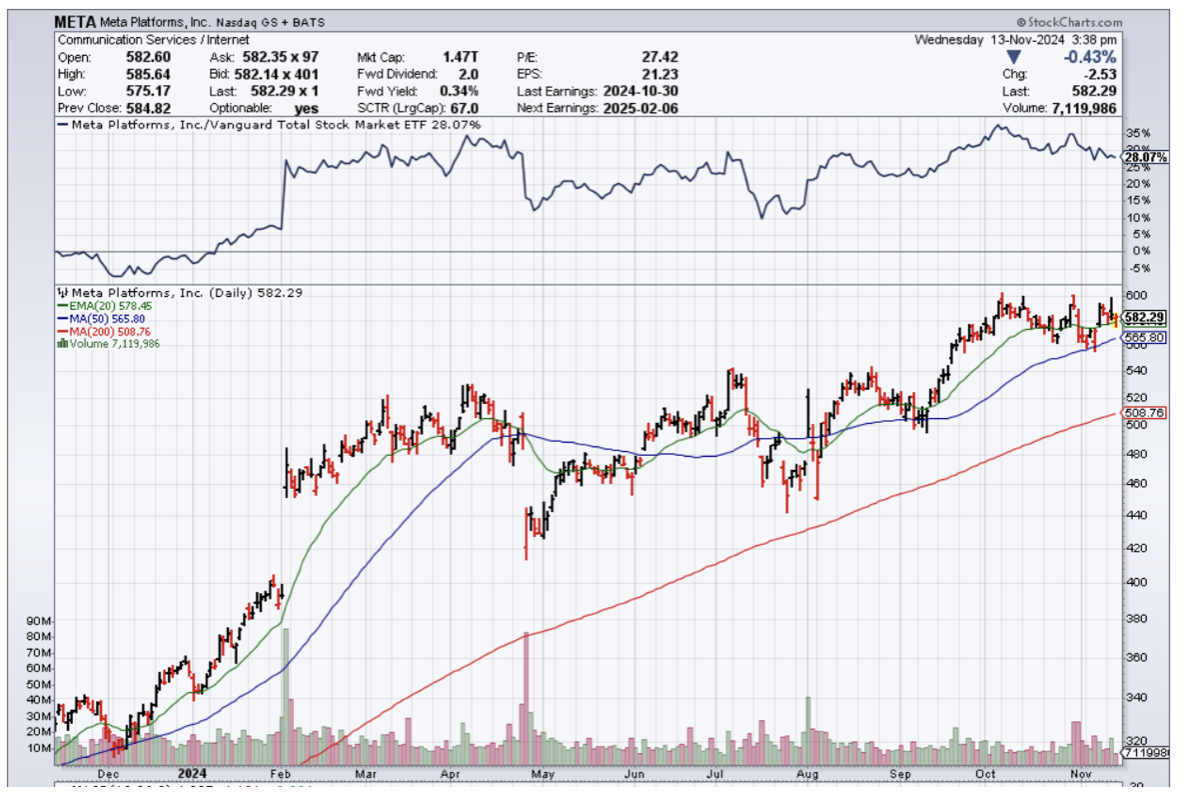

Investors need to be patient and keep a hold of META stock as it grinds higher.

In the event the stock does experience a mild sell-off, I am certain dip buyers will come to the rescue because of the nature of the stock being high quality.

Although digital ads aren’t the growth engine it once was, they are giving time and money for META to find the next path forward. 99% of tech companies don’t have that luxury.