The Affordable iPhone From Apple

A $599 cheaper iPhone with worse features is clearly a sign that Apple (AAPL) is on its way down from peak innovation.

This new cheap phone won’t save the company, but the company doesn’t really need saving.

The company is on auto-pilot mode. Let me explain.

At this point, CEO Tim Cook has done the calculations and he has decided that the company doesn’t need to innovate.

Apple needs to milk its subscriber base whom are famously loyal to its ecosystem.

Apple users are the least likely to just jump ship and switch to the Android ecosystem.

Cook knows that which is why he can push through annual increases in service charges.

Apple’s balance sheet is also another key part of the story and Cook will wield it with extreme efficacy through shareholder returns.

It could be true that we are past the stage of Apple delivering big growth numbers.

That looks to be a thing of the past.

Now, competing with China on cheaper phones is a massive step back and it won’t flow through to the bottom line.

It’s easier to argue that this phone will cannibalize sales of Apple’s more expensive phones.

We have arrived at this point and it is sad for most technologists.

Apple AAPL expanded the iPhone 16 family with the launch of a cheaper iPhone 16e version powered by the latest A18 chip and supporting Apple Intelligence.

iPhone 16e is available in a 6.1-inch display size and has the best battery life ever on this display size offered by Apple. The iPhone 16e, available from Feb. 28, will cost $599 compared with $799 for iPhone 16 and $999 for iPhone 16 Pro.

Although iPhone sales decreased 0.8% year over year to $69.14 billion in the first quarter of fiscal 2025, Apple saw better iPhone 16 sales in those regions where Apple Intelligence was available. iPhone’s active installed base grew to an all-time high and saw a record level of upgrades in the reported quarter. The iPhone was a top-selling model in the United States, Urban China, India, the U.K., France, Australia and Japan.

AAPL maintained its lead over Samsung for the second consecutive year, with a market share of 23% compared with the latter’s 16%. Xiaomi trailed both Apple and Samsung with 13% market share. Global smartphone shipments increased 7% year over year to $1.22 billion units in 2024.

Apple has more than 1 billion paid subscribers in its ecosystem and the focus is entirely on them. There are only 8 billion people on this planet and Apple has decided it is not worth going after the other 7 billion.

If they haven’t adopted an Apple phone or tablet then this last cheap phone is the last chance. Even then, the reason they most likely haven’t adopted an Apple device is because they cannot afford it.

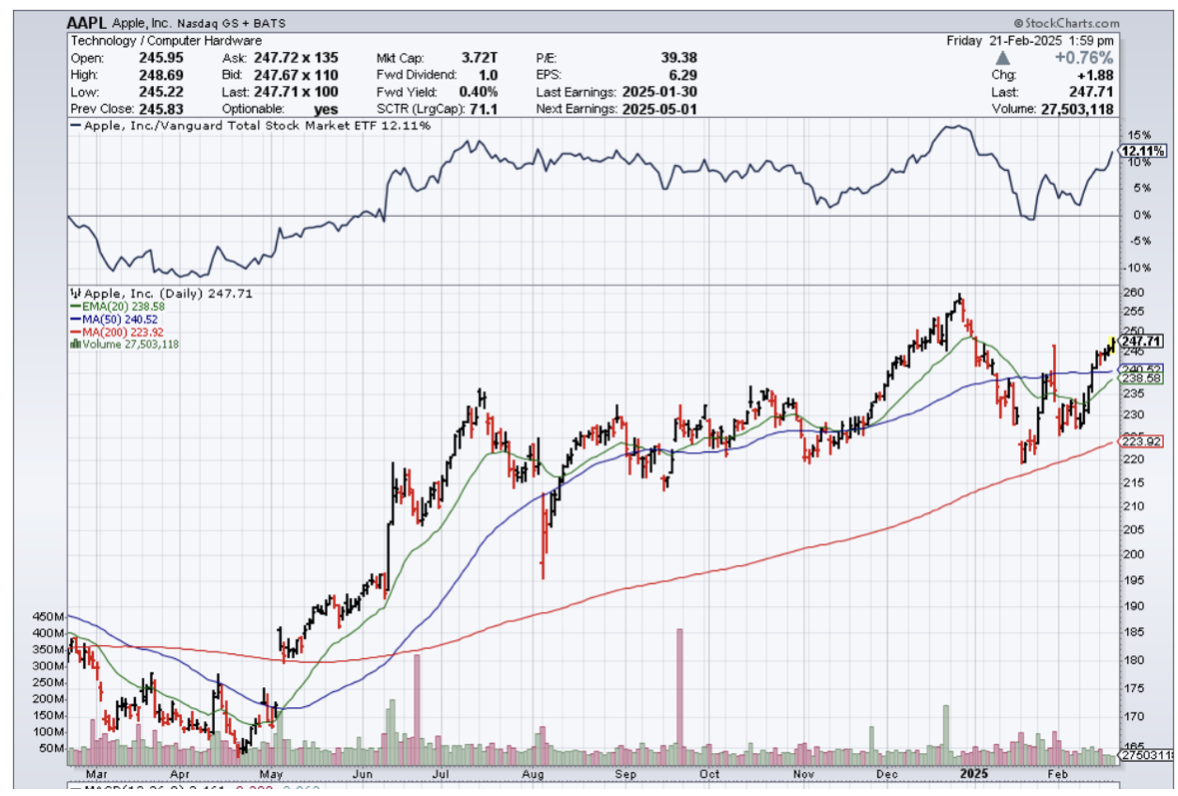

Apple shares are down 1% this year at the time of this writing and I still believe this is a buy-the-dip stock even with a weakening business model.

Apple knows they can withstand earnings whenever they want by just increasing their dividend.

Another headwind is that Apple is not one of the leaders in AI and shareholders will wait to see how that plays out.

Buy the dip in Apple, but don’t hold it long-term.