This Big Pharma's Grand Divorce Shows Promise

While most corporate breakups end with shareholders reaching for antacids, Novartis (NVS) investors are popping champagne instead.

The Swiss pharmaceutical giant's 2023 divorce from its generics business Sandoz (SDZNY) has transformed the company from a pharmaceutical conglomerate into a focused innovation machine – and the numbers would make even the most jaded among us whistle in appreciation.

I've watched pharmaceutical reorganizations for decades, and most resemble rearranging deck chairs on the Titanic. But Novartis has executed something genuinely transformative.

By jettisoning vaccines, ophthalmology, and generics, they've engineered a corporate metamorphosis that delivered 10% revenue growth to $51.7 billion in 2024.

Novartis now operates with laser focus on four therapeutic areas. Entresto, their heart failure medication, generated $7.8 billion in 2024 – up 31% year-over-year. That's roughly the GDP of Montenegro flowing from a single pill.

Cosentyx pulled in $6.1 billion (up 25%), while Kisqali and Kesimpta both jumped nearly 50%. These aren't merely drugs; they're annuities with patent protection.

The scale defies easy comprehension: nearly 300 million patients worldwide received Novartis medications in 2024. That's treating almost every American, then adding Japan for good measure. When pharma executives dream of market penetration, this is what they see before their alarm clocks rudely interrupt.

What separates Novartis from the pack is their capital allocation strategy. They're investing $9 billion annually in R&D – not throwing darts at a scientific board but methodically advancing a pipeline designed to replace blockbusters as patents expire.

Their 2024 acquisition of Chinook Therapeutics exemplifies this approach: precise, strategic, and focused on enhancing their nephrology portfolio rather than empire-building.

The geographic distribution of Novartis's revenue reveals similar strategic clarity. While 43% comes from the United States, their China strategy deserves special attention. Sales there surged over 20% in local currency during 2024.

Having tracked emerging markets throughout my career, I recognize the pattern – Novartis is positioning itself at the confluence of demographic shifts, increasing chronic disease prevalence, and expanding healthcare access.

For those who prefer hard numbers to market philosophy, Novartis delivered EBIT growth of 29% to $16.3 billion, with operating margins expanding to 31.55%. Net profit jumped to $11.9 billion, with margins at 23% – among the industry's highest.

Despite returning $15.9 billion to shareholders through dividends and buybacks, their balance sheet remains fortress-like.

Net debt stands at just $18 billion, with a Net Debt/EBITDA ratio below 1x – meaning they could extinguish their entire debt in less than a year with current cash flows.

Unlike pharmaceutical giants that bet everything on a single therapeutic area, Novartis has positioned itself as a formidable player across multiple high-value niches.

In oncology, rather than challenging Merck (MRK) or Roche (RHHBY) directly, they've developed unique assets like Pluvicto and Kisqali that face minimal head-on competition.

For cardiology, while Entresto faces patent expiration in 2025, they're already advancing next-generation therapies like Leqvio.

Meanwhile, the global prescription drug market exceeded $1.7 trillion in 2024 and should grow at 7.7% annually through 2030. Novartis has strategically positioned itself precisely where that growth curve steepens most dramatically.

No investment thesis is complete without acknowledging risks, and Novartis faces several significant challenges.

Entresto's patent cliff in 2025 creates a $7.8 billion revenue gap that needs filling. Cosentyx follows in 2027-2028.

Without Sandoz, they can't offset these losses with their own generics. Pricing pressure from Medicare and competition from other pharmaceutical giants present additional headwinds.

And pharmaceutical innovation remains inherently unpredictable – even with billions in R&D, clinical trials fail with alarming regularity.

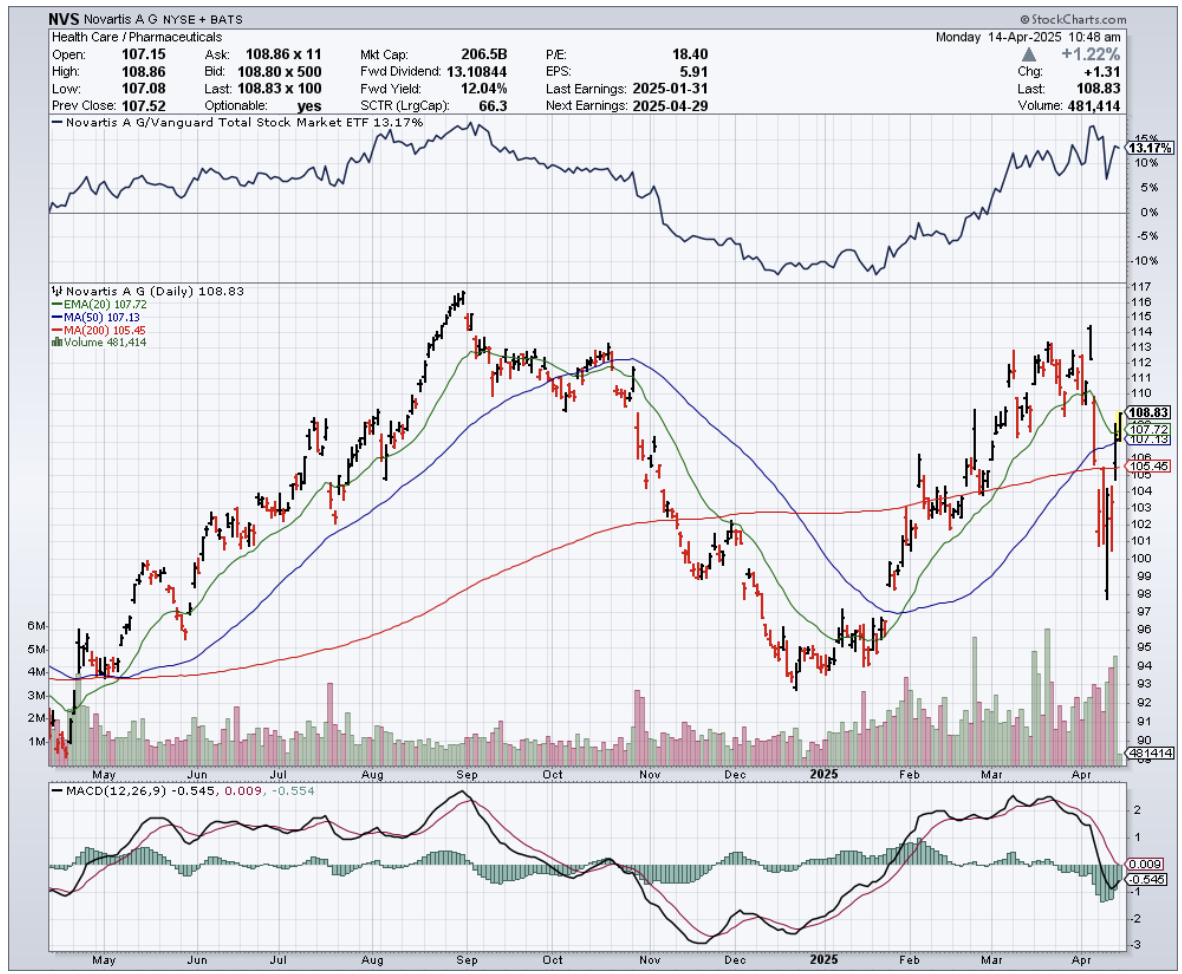

Despite these concerns, Novartis shares still appear undervalued after rising nearly 19% over the past year.

The company trades at a P/E of 18.69x – substantially below the industry average of 55.91x. Its EV/EBITDA ratio of 10.97x represents a significant discount to peers.

Throughout my market-watching career, I've developed healthy skepticism toward corporate transformations. They typically generate more PowerPoint slides than actual results.

But Novartis has delivered tangible financial improvements that flow directly to shareholders. For those seeking healthcare exposure without betting on clinical-stage biotechs with binary outcomes, Novartis offers a compelling package of growth, income, and relative stability wrapped in Swiss precision. I suggest you buy the dip.