May 12, 2025

(CHINA AND THE U.S. AGREE TO A TRADE DEAL IN SWITZERLAND)

May 12, 2025

Hello everyone

WEEK AHEAD CALENDAR

MONDAY, MAY 12

8:30 a.m. Australia Consumer Confidence

Previous: -6%

Forecast: 2%

TUESDAY, MAY 13

6:00 a.m. NFIB Small Business survey (April)

8:30 a.m. CPI (April)

WEDNESDAY, MAY 14

9:30 p.m. Australia Unemployment Rate

Previous: 4.1%

Forecast: 4.1%

THURSDAY, MAY 15

8:30 a.m. Initial jobless claims (week ended May 10)

8:30 a.m. Retail sales (April)

8:30 a.m. PPI (April)

8:30 a.m. Empire State mfg index (May)

8:30 a.m. Philadelphia Fed mfg index (May)

9:15 a.m. Industrial production (April)

10:00 a.m. Business inventories (March)

10:00 a.m. NAHB survey (May)

FRIDAY, MAY 16

8:30 a.m. Housing starts (April)

8:30 a.m. Import prices (April)

The U.S. & China meeting in Switzerland: will it deliver?

The news has just come through…

U.S. and China have agreed to slash tariffs for 90 days in a major tariff breakthrough. Reciprocal tariffs will be cut from 125% to 10%. Both the U.S. and China said they will continue discussions on economic and trade policy. What is in doubt is whether the 90-day pause is enough time for the two sides to reach a detailed agreement. But at least we have some movement on negotiation. Dow futures have jumped 1000 points, gold has fallen, and the U.S. dollar has surged.

In other news…

The health of the consumer will be clearly visible this Thursday when we see retail sales data and the producer price index report. We will also see the CPI report which will tell us how the trade conflict has affected inflation.

The S&P 500 has already rallied more than 13% from its April 8 lows, so the market may need a positive surprise on the trade front to take another big jump.

I tend to believe the limited ranges we have been seeing have been in anticipation of some de-escalation out of China, and as such, when the actual news comes out, the market reaction might be rather ho-hum and could even mark a tactical top, regardless of what the news is.

This level in the market could be a good time to re-establish short positions or add to them if you have them already.

They don’t make things like they used to…

White goods, toys, heaters, whatever you can think of – most of these things don’t have a long life.

Some products don’t even outlast the warranty period before they break down and stop working, or need a part replaced, which is not even worth the cost.

Consider the cost of getting someone to your house to replace the part and the cost of the part. It’s often not worth it.

I remember growing up with a Kelvinator refrigerator, which lasted around 30-40 years. Can you imagine anything lasting that long today?

Today, companies make products that are designed to break down, so the consumer must go back and buy another one.

Forty and fifty years ago, we didn’t have the technology we have today, so why, with all the technology we have now, is it so difficult to make quality products?

I’m not saying all products are poorly made, but you must admit that the quality overall is not evident.

It seems companies making money trumps making quality – so disappointing.

MARKET UPDATE

S&P500

The index is up 13% since the April lows at 4835. No confirmation that we have seen a top yet, although upside momentum is slowing and suggests further gains would likely be limited, as the potential of a peak for at least a few weeks/months is rising. So far, we have had a high of S&P 500 5832 in the futures.

Support: 5575/85, 5475/85

Resistance: 5760/85 area/5830

GOLD

Bearish technical data is visible in the gold chart (sell mode on the MACD) & and an overbought pattern. However, we could still see more ranging/consolidation before gold completely rolls over.

Support: $3268/73 & $3197 & $3075

Resistance: $3353 & $3438/43

BITCOIN

We’ve seen Bitcoin move sharply higher – the long-term view remains in focus with a target between $125k and $150k. The market is getting overbought with such a sharp move, so some consolidation might be in front of us before further moves to the upside.

Support: $99.90/$100.4k & $96.0/$96.4k

Resistance: $104.4k

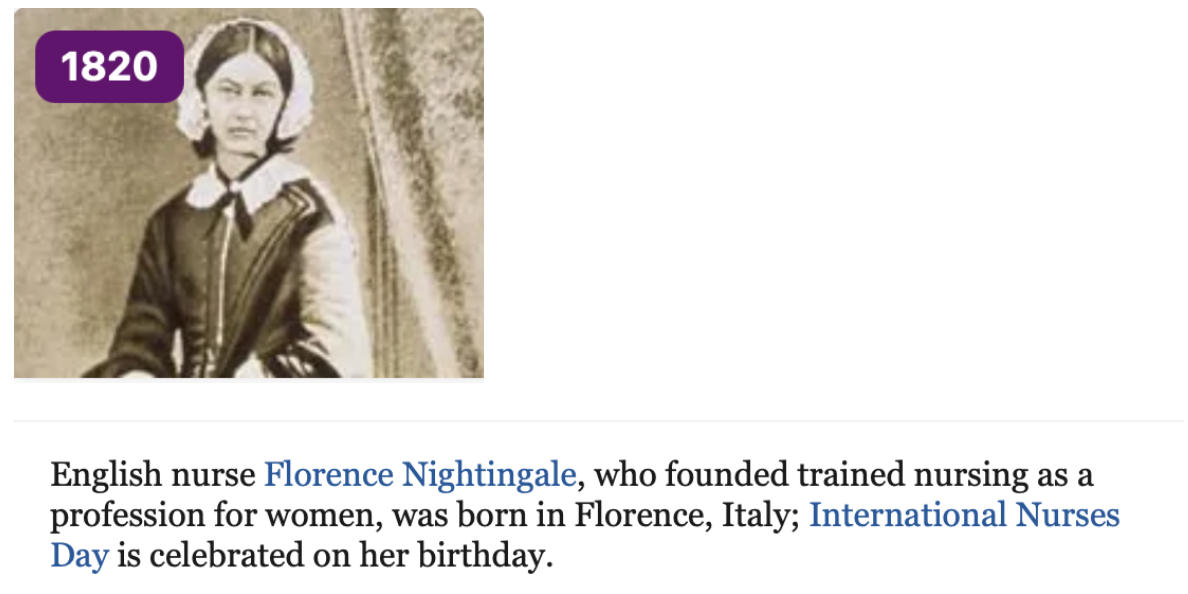

HISTORY CORNER

On May 12

QI CORNER

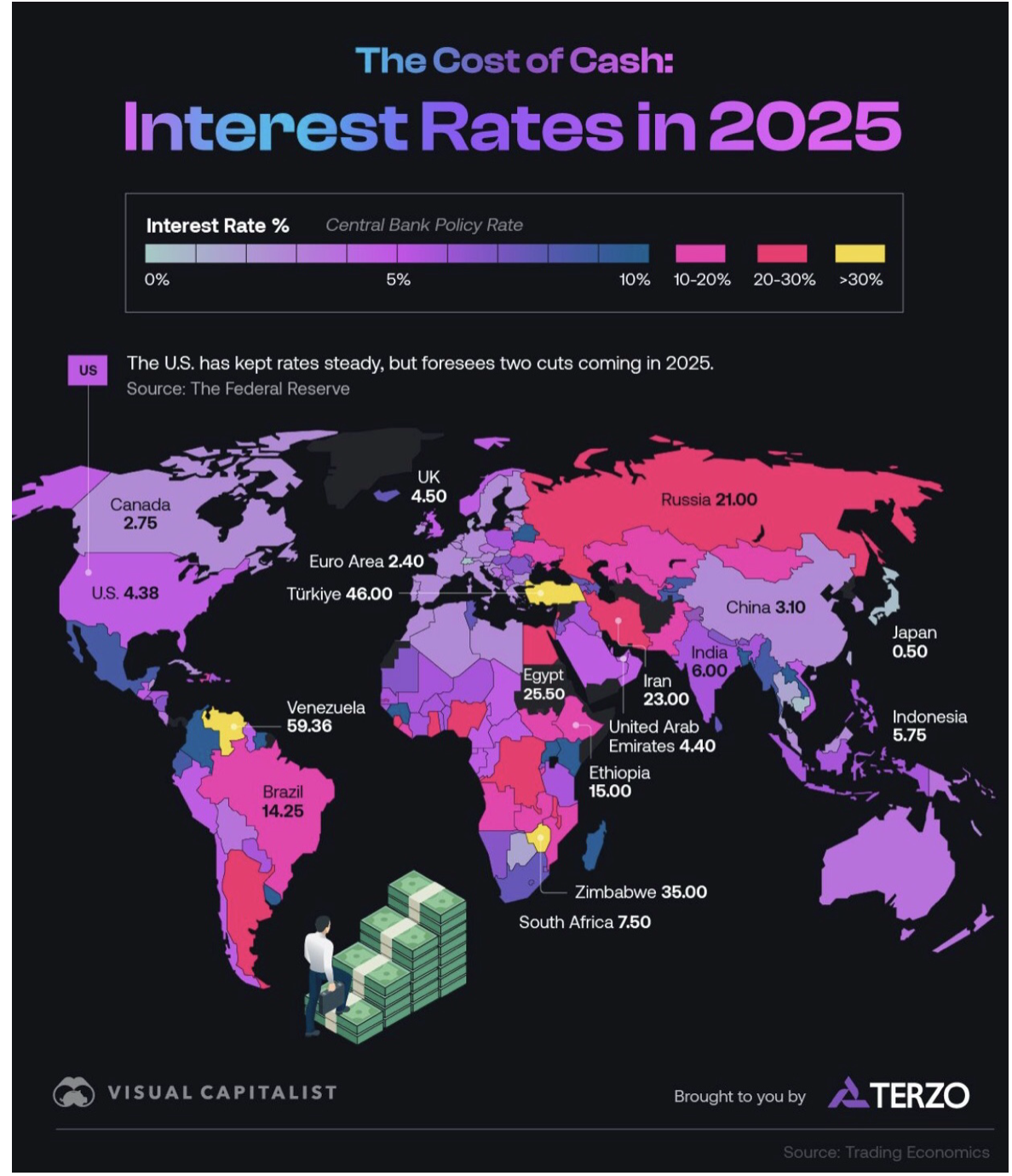

U.S. officials met with Chinese counterparts in Switzerland this past weekend to address the trade war between the world’s two biggest economies. This chart from Spencer Hakimian, founder of Tolou Capital Management, shows why a ratcheting back of rhetoric, at the very least, should be expected.

Ernst Imfeld (Family Office)

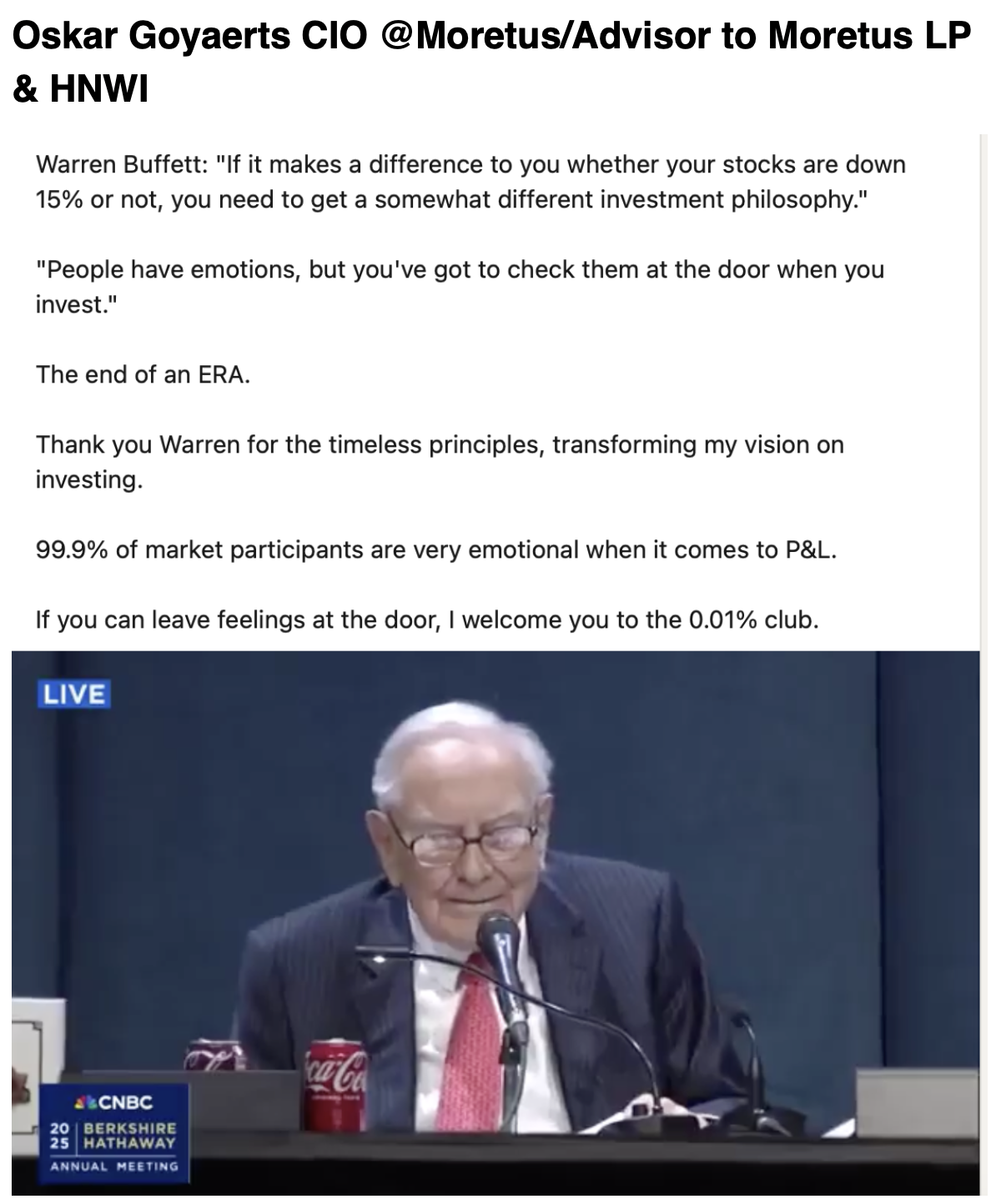

SOMETHING TO THINK ABOUT

Cheers

Jacquie