October 7, 2010 - The Heads I Win, Tails You Lose Market

Featured Trades: (MONETARY INFLATION)

1) The Heads I Win, Tails You Lose Market. Ben Bernanke has privatized the upside of the global stock, bond, currency, commodity, energy, and precious metals markets, and socialized the downside, with his much publicized move towards quantitative easing. While former Treasury Secretary Hank Paulsen spoke about a bazooka in his pocket, Helicopter Ben is hinting that he has a 100 megaton thermo nuclear weapon.

If you recall, I predicted a six month bull market in global equities on September 1, inviting much abuse at the time (click here for 'My Equity Scenario for the Rest of 2010'). My logic then was that once the market spent six months sucking in bears into expanding their positions, it would quickly reverse and race to the upside. The triggers would be better than expected corporate earnings, and the removal of the midterm elections as an unknown. What I did not expect was the Bernanke assist. After spreading gasoline everywhere with zero interest rates, Ben has now slyly produced a book of matches.

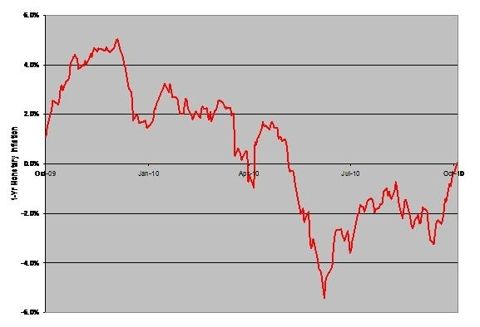

As you can see from the chart below, the stimulative impact of his strategy began to work almost immediately. Monetary inflation took off like a rocket in September and is about to punch through the threshold to positive numbers. Emboldened 'double dippers' were pooh poohing this prospect only four weeks ago. Those few of us long enough in the tooth to remember real price hikes can tell you that monetary inflation is the certain precursor of the real kind, where the prices of actual goods and services go up.

The net of all of this is that we may see the broad based rally in the prices of everything continue far longer than we realize. It makes the 1220 target for the S&P 500 I put out only a few weeks ago look conservative (click here for 'Bring on the Bernanke Put'). We may get some profit taking and a dip going into the midterm elections. If we do, get on board the money train for a year end ride.

This Didn't Work

So We'll Try This

Yes, I Remember Inflation Well