June 3, 2011 - My Big Miss of the Year

Featured Trades: (MY BIG MISS OF THE YEAR), (FXF)

2) My Big Miss of the Year. If you had to name one asset that has benefited from every macro trend under the sun this year, it has to be the Swiss franc. No matter what happened, be it the coming Greek default, the European banking crisis, the Japanese tsunami, the Libyan Civil War, the commodity collapse, and now the slowing US economy, all seemed to trigger kneejerk buying of even more bushels of Swiss francs.

Switzerland is certainly a country with many attractions. The economy is healthy, with the most recent retail sales up 7.5% and unemployment at an enviable 4.2%. It is home to several world class companies, like, Nestle, Roche, Novartis, and Swatch. It has perennially run a strong current account surplus. Its 347 banks control assets amounting to seven times the country's GDP, and account for 40% of stock market capitalization (compared to 9% in the US). Despite shunning membership in the European Community, it has developed a world class export industry in heavy and precision machinery, pharmaceuticals, and high quality textiles. It is not all about watches, cheese, and Swiss army knives.

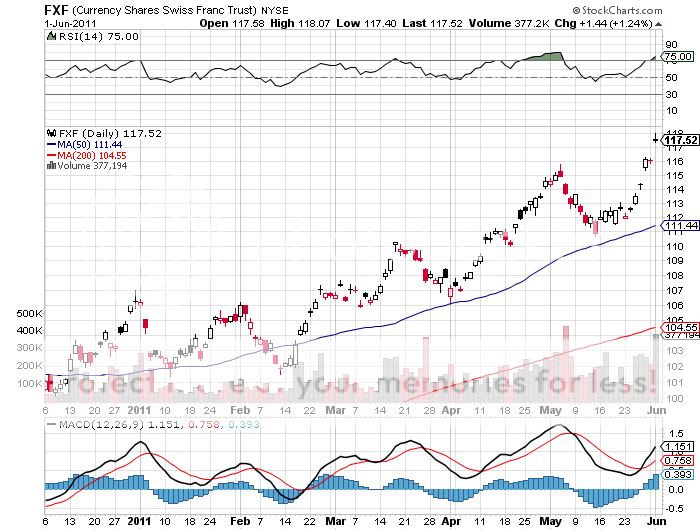

None of this explains why the Swiss franc has been so strong. Since the beginning of the year, the currency has soared by 17% to 85 centimes to the dollar. Note that the ETF (FXF) is priced in the inverse to the cash market, meaning that it takes $1.17 to buy one Swiss franc. To give you some long term perspective on this, the dollar is now 72% cheaper than when I first visited this alpine paradise 43 years ago, when is cost SF3.00 to purchase a greenback.

As strong as the fundamentals are for Switzerland, they have nothing to do with the strength of the currency. It has become the flight to safety currency of choice for Europeans. This is not a new development. While a director of Swiss Bank Corporation, I personally saw gold bars imprinted with the German eagle secreted there by high ranking Nazi's and never reclaimed. This is one theory why the Germans didn't invade Switzerland during WWII.

Later, asset protecting investors believed that the Swiss Army's formidable mountain redoubts could hold the Soviet army at bay. To this day, there are still formidable stockpiles of weapons in the basements of the big Swiss banks, and many of the senior staff double as army officers.

One reason the Swiss franc has been a speculative target is that the country has a Lilliputian GDP of $642 billion, only 4.4% of America's. The tide of money into the franc has been so large that the Swiss can do little to stop it. The Swiss National Bank has lost billions of dollars buying euros and selling francs to slow the ascent, losing billion in the process, on paper anyway.

I missed this whole move this year because I focused on the country's fundamentals, which are quaint but irrelevant in the global scheme of things, and not the capital flows. It is clear that the latter is overwhelming the former. And concluding that capital flows are now the driver, you can cobble together an argument that the move is coming to an end. We have seen the early stirrings of what could be a global, 'RISK OFF' move into the dollar. Once it gets up a decent head of steam, it would not be a stretch to see this spill into the Swiss currency as well.

I'm not saying you should sell short the Swiss franc here, but the bull move is certainly getting long in the tooth, and could suddenly die of a heart attack. As for my miss, I shall be punished severely when I visit Switzerland in a few weeks for a round of mountain climbing and have to pay through the nose for my fondue, russet potatoes, raclette, and schnapps.

-

-

-

Switzerland is Looking a Little Toppy to Me