May 4, 2009

May 4, 2009

Featured Trades: (RCC), (CUK), (SFD), (CHL), (EWT), ($XJY)

1) San Francisco Bay looks like Normandy on D-Day today, invaded by a flotilla of cruise ships diverted by the swine flu from Mexican destinations. Two ships from Carnival (CUK) and one from Royal Caribbean (RCC) are docked at piers normally occupied by garbage scows and tugboats. Operators of a total of 28 ships have asked the Port of San Francisco for emergency landing rights, disgorging 1,000 to 2,000 free spending passengers each on the City by the Bay. Those who booked holidays looking forward to 90 degree temperatures, tacos, and tequila grumbled when they were delivered bone chilling fog, Dungeness crab, and Napa wine. Good luck getting a seat on a cable car this weekend. In the meantime, the government is going through great pains to convince us that you can't catch the bug from pigs. You can get heart disease, diabetes, obesity, and hardening of the arteries from pork, but definitely not the flu. Take a look at Smithfield Foods (SFD), which has dropped 30% since the pandemic fears hit.

2) March pending home sales jumped a surprising 3.2%, according to the National Association of Realtors, prompting another tidal wave of calls that we have hit bottom in the real estate market. Obama's $8,000 tax credit for first time purchasers ($14,000 in California), record low mortgage rates, a feeding frenzy by sharks and flippers, and the lowest prices in a decade were the cause.?? Contracted purchases were up 3.9% in the West (California) and down 5.7% in the Northeast (Michigan). I think we are anything but out of the woods. Several state and federal moratoriums on foreclosures are about to expire, unleashing another onslaught of foreclosures and short sales on the market. While inventories are shrinking for the moment because of the near shut down on new home construction, unemployment induced delinquencies are still soaring. At this stage of the economic cycle, you can count on seeing a raft of contradictory data. I'm afraid that I'm a glass half empty guy on this one. With all of the reasons to buy listed above, where are the multiple offers and the bidding wars? Continue to rent.

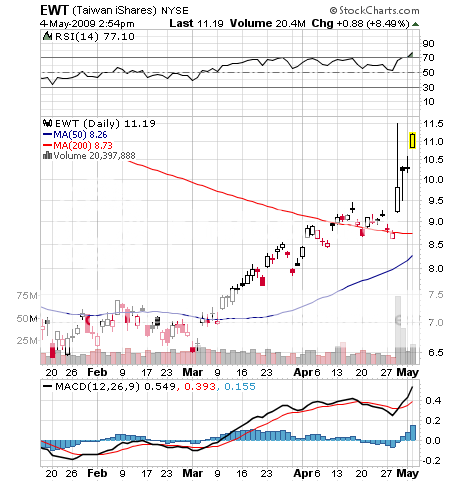

3) Regular readers of this letter are well aware of my aggressive recommendations to buy emerging markets China and Taiwan. Now you have another reason to buy both. The Middle Kingdom's China Mobile (CHL), the world's largest cell phone company, bought 12% of Far Eastone Telecommunications (4904.Taiwan). Although a small deal, it represents the first ever direct investment by a mainland company in the rebellious former province. The move could trigger a takeover binge by big Chinese companies of their offshore cousins. It was only a few years ago Taiwanese businessmen were arrested for just visiting, let alone investing in China, which they have done in a major way for 30 years. The iShares MSCI Taiwan fund ETF (EWT) has popped by 32% since the announcement last week, and is now up a gob smacking 74% from the March lows. Having endured daily shelling from the mainland (at exactly 12:00 noon every day) while on the small Republic of China island of Quemoy, this is more than just a symbolic gesture for me. I guess if you can't beat them, buy them.

QUOTE OF THE DAY

'The best time to buy stocks is when business is lousy,' said Warren Buffet, CEO of Berkshire Hathaway (BRK/A) and the Sage of Omaha.