March 3, 2010

Global Market Comments

March 3, 2010

Featured Trades: (JON NAJARIAN), (OPTIONMONSTER), (AUSSIE/EURO CROSS), (ETHANOL), (CORN)

His firm maintains a 10 gigabyte per second conduit that transfers data at 6,000 times the speed of a T-1 line, the fastest such pipe in the civilian world. Jon then distills this ocean of data into the top movers of the day, which he puts up for free on his website, and offers much more detailed analysis through a variety of premium subscription products. Jon is also co-founder of an online brokerage called ?TradeMonster? off the back of this impressive research effort. ?As with the NFL,? says Jon, ?you can?t defend against speed.?

The system catches big hedge funds, pension funds, and mutual funds in the midst of shifting large positions, giving subscribers a peak at the bullish or bearish tilt of the major players in the market. It also offers accurate predictions of imminent moves in single stock and index volatility. Long and short vol traders take note. If anything, the profusion of? dark pools and high frequency trading, now thought to account for 50% of the daily? volume, makes Jon?s tools more valuable because that are exacerbating the quantitative nature of the markets. Some 200,000 traders are believed to be following Heat Seeker?s advice.

Jon started his career as a linebacker for the Chicago Bears, and I can personally attest that he still has a handshake that?s like a steel vice grip. Maybe it was his brute strength and ability to take abuse that enabled him to work as pit trader on the Chicago Board of Options Exchange for 22 years, where he was known by his floor call letters of ?DRJ?. He formed Mercury Trading in 1989, built it into a substantial business, and then sold it to the mega hedge fund, Citadel, in 2004.

Jon developed his patented algorithms for Heat Seeker? with his brother Pete, another former NFL player (Tampa Bay Buccaneers and the Minnesota Vikings), who like Jon, is a regular face in the financial media.

Jon thinks that if China is serious about throttling back its economy, it will have a dampening effect on global financial markets for some time. The S&P 500 is going to stick around the 1100 level, and commodities are going to stay in a big sideways range. Volatility is going to die.

To hear my interview with Jon at length on Hedge Fund Radio, please click here.

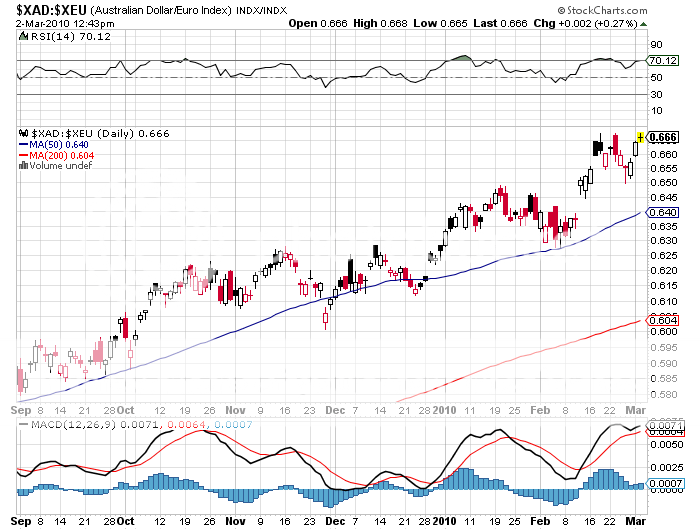

2) Last night the Reserve Bank of Australia raised overnight cash rates from 3.75% to 4%, spurred on by a healthy, resource fueled economy and a booming jobs market. The move put a spotlight on the Aussie/Euro cross, which I recommended traders buy a month ago at $AUS 62.5 (click here for the call). With the cross now tickling 67, traders are sitting pretty, with the chart going, as Dennis Gartman likes to say ?from the lower left hand corner to the upper right.? The trade quite simply gets you long a country where everything is going right, and short a region where things are deteriorating by the day. The yield spread between the two currencies is now wide enough to drive a truck through, call that a lorry, and that gap looks to broaden further. Call this ?Cross Trading 101 for Dummies,? but sometimes the easiest trades work the best, because so many investors can understand them.

3) One of my biggest disappointments with Obama so far is his continued support of the ethanol boondoggle. The program was initiated by the Bush administration to achieve energy independence by subsidizing the production of alcohol from domestically grown corn. Add clean burning moonshine (yes, it?s the same alcohol? C2H5OH), whose combustion products are carbon dioxide (CO2) and water (H2O), to gasoline and emissions also go down. The irony is that if you include all the upstream and downstream inputs, the process consumes more energy than it produces. It also demands massive quantities of fresh water, which someday will become more valuable than the oil the ethanol is supposed to replace, turning it into toxic waste. Never mind the image of spendthrift, obese Americans burning food so they can drive chrome wheeled black Hummers to Wal-Mart, while much of Africa and Asia starves. Ethanol consumption of corn has soared from 1.6 billion bushels in 2006 to an anticipated 4.3 billion bushels this year. Ethanol?s share of our total corn crop has skyrocketed from 14% to 33% during the same period. This ignores the reality that Brazil, the world?s largest ethanol producer, can ferment all the ethanol it wants at one third our cost because they make it from much more efficient sugarcane, which has five times the caloric content of corn. However, protective import quotas and tariffs prevent meaningful quantities of foreign ethanol imports. Bush financed all of this wasteful pork, because Iowa has an early primary, giving it an outsized influence in selecting presidential candidates, and has two crucial Senate seats as well. Well, it turns out that Obama needs Iowa even more than Bush, where the Democrats are ahead 3-2 in the House, and have a tie in the Senate (1-1), so the ethanol program not only lives on, it is prospering. Shame, and double shame. Better to drink it than burn it, I say.

QUOTE OF THE DAY

?The dollar hating crowd is hating themselves now. Things in Europe aren?t improving any time soon,? said Jon Najarian of OptionMonster.