March 26, 2010 ? The Days Are Numbered for US Treasury Bonds

Featured Trades: (TBT), (TBF)

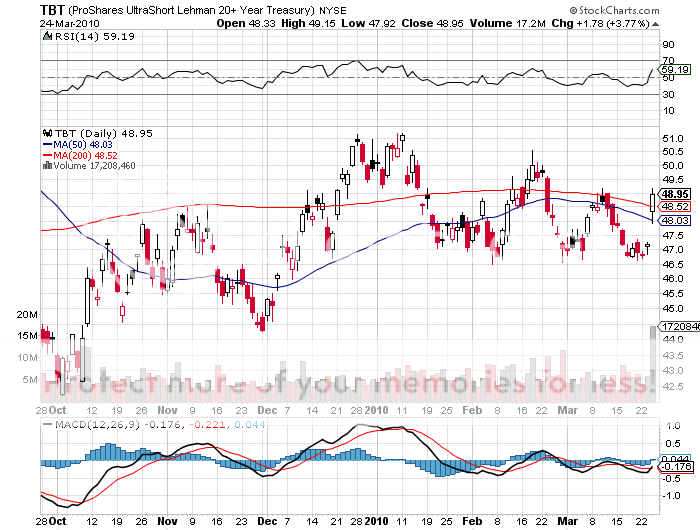

1) The Days Are Numbered for US Treasury Bonds. I was so busy writing about the collapse of the yen yesterday that I didn?t have a chance to comment on the nearly failed Treasury auction. The government offered? $42 billion five year bonds for sale which came in at a surprisingly high yield of 2.605%, with a bid to cover ratio at an uncomfortably high 2.55. The traders now choking on this paper looked like they had been kicked in the scrotum, and falsetto voices were breaking out everywhere in an odd disharmony. Apparently, it is not a good idea to hold a bond auction a week before the Fed ends its $1.2 trillion quantitative easing program. The continuing debt crisis in Greece has many investors asking if the next shoe to fall will be on American soil. Some analysts suggested that the buyer?s strike was the result of the health care bill which passed on Sunday, paving the way for larger and longer deficits. There were also suspicions that China was boycotting the issue to protest the ?currency manipulator? hearings scheduled for congress on April 15. I vote for all of the above. The leveraged short Treasury bond ETF (TBT) certainly liked it, popping nearly 10% this week from $46.60 to $50.25. Don?t go apoplectic yet. I still think the zero interest rates and the disinflationary deep freeze will push the big break out for this fund further into the future. So keep trading the range at every opportunity. Deleveraging is such a bitch.