A High Risk Strategy

“Heavy losses” is something that any investor would not want to hear but over time, it has become synonymous with short sellers.

Tech stocks are unusually volatile so it has been fashionable in the past to start a fund proclaiming that great performance can be secured by finding the most likely tech stocks to drop.

It’s like shooting fish in a barrel? Right?

Not even close.

In reality, it is hard to predict a big drop and identify the perfect timing in which tech stocks will blow up.

Even if a short seller guesses right, the timing could be off by years and to hold a position forever eats at the profitability.

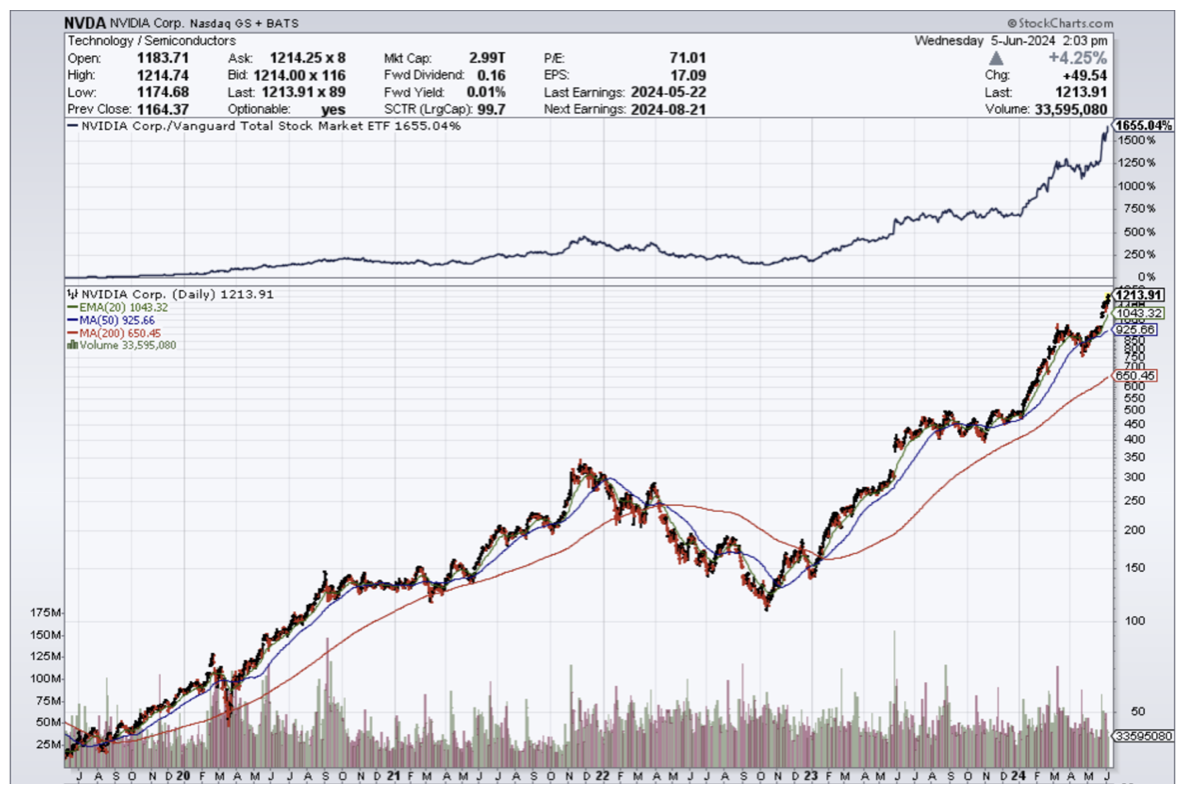

If anyone knows a successful trader that has made a nice living shorting Nvidia (NVDA) in the last year then I would like to meet that person.

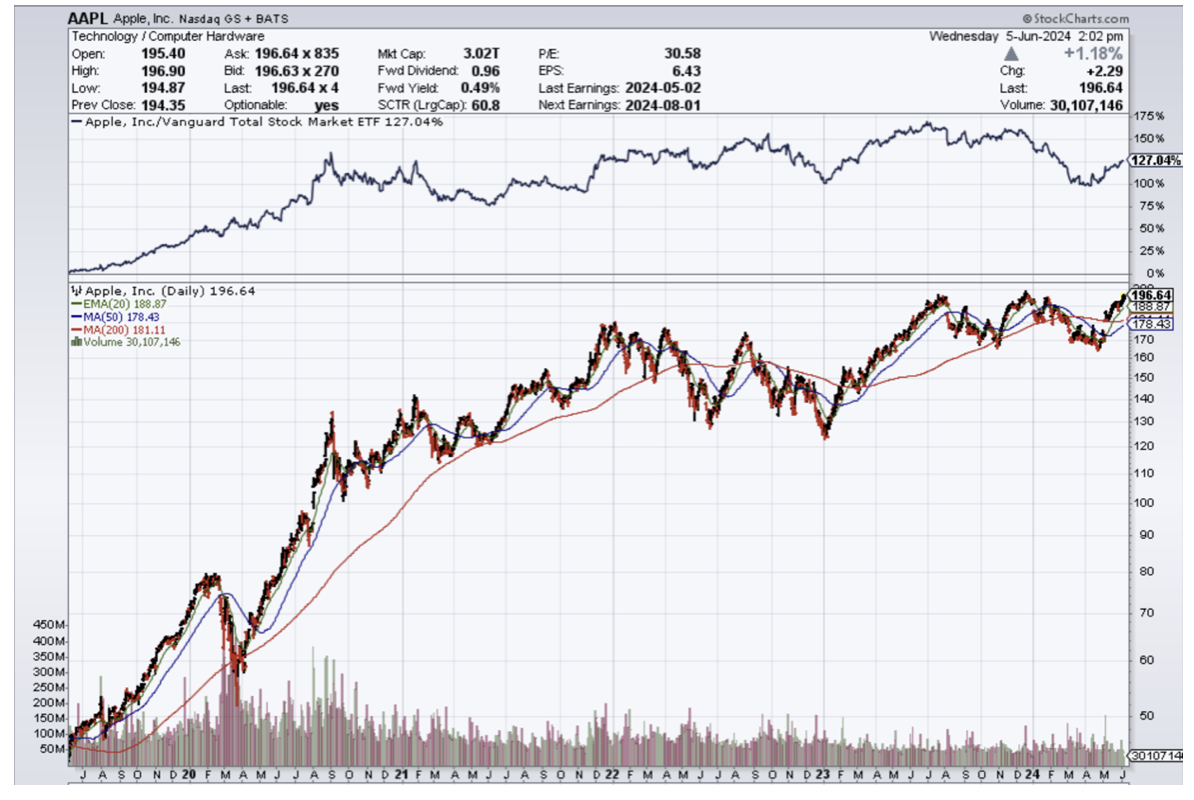

Likewise goes for Apple over their massive bull run.

Shorting the best tech stocks in the world usually meant financial underperformance.

Just in recent memory, the whole Gamestop spike up when a bunch of hedge funds had massive short positions.

Short sellers were the ones run over by the GameStop phenomenon.

Retail traders have flexed their muscles again in the past two months, with shares of several meme-stock favorites including GameStop surging anew.

Meme-stock dramas demonstrate a “gamification” of the market that has undermined the whole short-selling industry.

And remember that GME is a garbage company with paltry revenue that surges for alternative reasoning.

Practitioners say it’s getting increasingly difficult to attract new cash for a risky bearish approach (the downside of short selling is theoretically limitless), whether for an activist firm or simply a short-biased fund.

Assets in his RC Global Fund, which wagered against tech companies both in China and the US, had dropped to $200 million from about $1.7 billion six years earlier. The Asia positions had paid off, but going against mighty American megacaps hammered performance.

The longer the cycles go, the more short selling seems to be simply a bad investment strategy and out of favor.

The idea is that a relentlessly rising market not only creates the kind of overvalued companies short sellers will ultimately feast on, it also masks badly run and sometimes fraudulent businesses.

That may be especially true when short selling is at such a low ebb since bearish activity has been shown to act as a brake on bad corporate behavior and keep the prices of companies with questionable financial statements in check.

Yet even as central bankers around the world have lifted interest rates back to levels not seen in decades — usually a handbrake on equity markets — stocks have generally churned higher, making it difficult to sustain bearish bets for any length of time.

In an era of 5% interest rates, it is not viable to borrow that capital to bet against skyrocketing AI stocks like Nvidia.

Why not ride the elevator up with Nvidia?

The absence of short sellers has meant “all systems go” for tech stocks and they have been off to the races with almost no pushback.

The bullishness has been so intense that the faster rate hike cycle in the modern financial history has done little to dissuade investors from pouring into tech stocks.

As interest rates lower from 5% to 2 or 3, tech stocks are likely preparing to lift off into another stratosphere.

If lowering rates catalyzes tech stocks to the upside, imagine how demoralizing for the few if any short sellers left shorting tech.

I am bullish on tech stocks in the short-term with the Central Bank telegraphing a drop in Fed Funds rates.