A.I Bubble Continues To Inflate

Expect a half a trillion dollar investment into data centers.

This should propel AI stocks higher and the new administration understands the last leg the tech market is standing on is the AI bubble.

It is debatable to say if these tech stocks are in a bubble, but they aren’t cheap and today’s announcement puts fuel in the fire forcing stock prices to go nowhere but up.

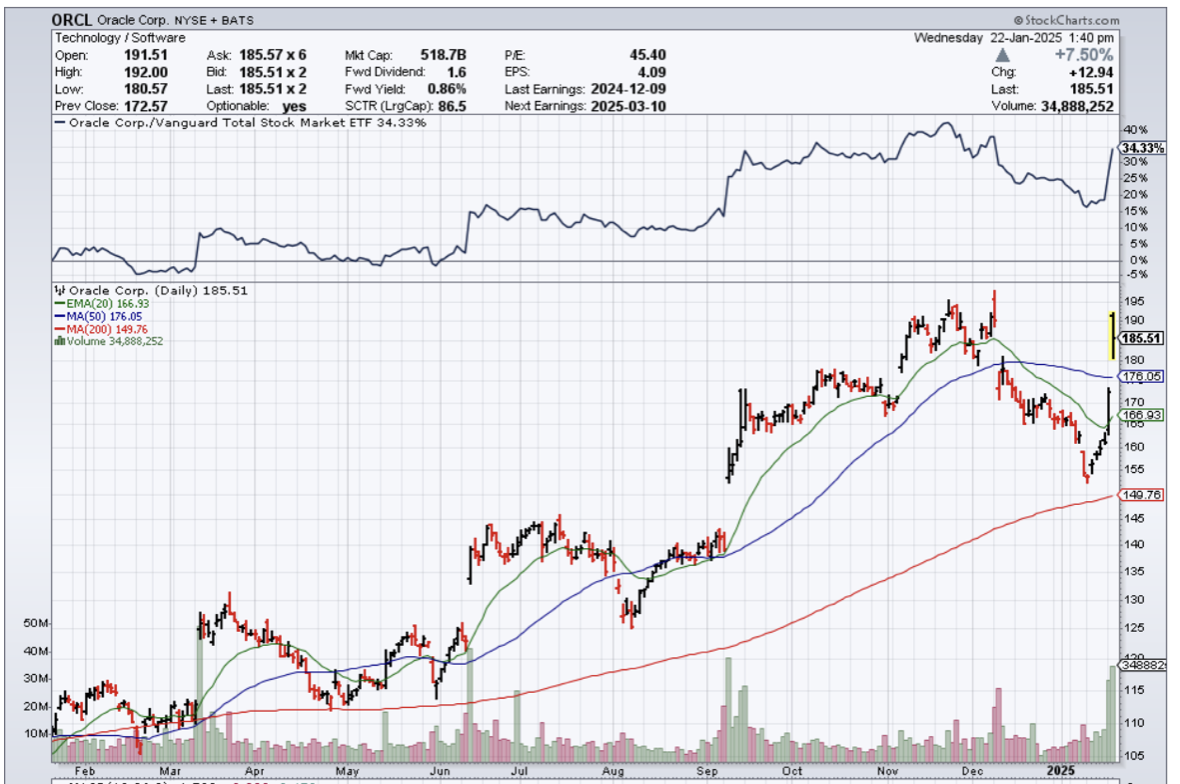

OpenAI says that it will team up with Japanese conglomerate SoftBank and with Oracle to build multiple data centers for AI in the U.S.

The joint venture, called the Stargate Project, will begin with a large data center project in Texas and eventually expand to other states. The companies expect to commit $100 billion to Stargate initially and pour up to $500 billion into the venture over the next four years.

SoftBank chief Masayoshi Son, OpenAI CEO Sam Altman, and Oracle co-founder Larry Ellison were in attendance.

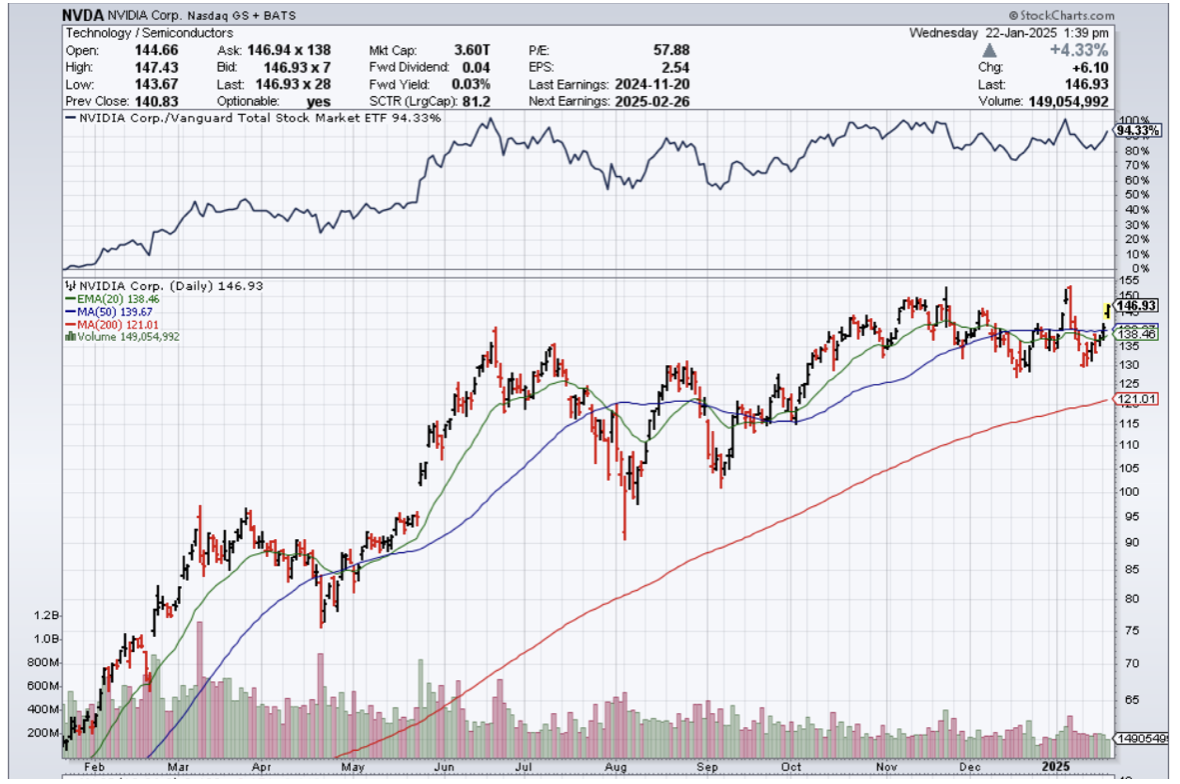

Microsoft is also involved in Stargate as a tech partner. So are Arm and Nvidia.

The data centers could house chips designed by OpenAI someday. The company is said to be aggressively building out a team of chip designers and engineers, and working with semiconductor firms Broadcom and TSMC to create an AI chip for running models that could arrive as soon as 2026.

Abilene, Texas will be Stargate’s first site, and OpenAI says that Stargate, by 2029, could scale up to 20 data center installations.

Microsoft, which recently announced it is on track to spend $80 billion on AI data centers showing it’s an industry-wide trend.

It’s clear to everyone and also investors that propping up the AI tech world is a must because the drop in shares would be devastating to not only the retail holders but also to corporate America.

Much of the recent inflation has been paid by stock appreciation and history has shown that the current US president highlights accelerating stock prices as a barometer of US economic health.

The interesting part of this is building a slew of data centers doesn’t translate into revenue one-to-one.

The jury is still out there whether there will be a revenue windfall out of it.

At the very minimum, we know that data centers will make the price of electricity higher for everyone because they guzzle energy non-stop.

The revenue accrued will need to be higher than the cost of electricity or this is just another massive transfer from retail consumers to the corporate tech world.

Ironically, Elon Musk tweeted that the money isn’t available right now leading the investor to believe this is more about keeping the AI bubble alive than anything else.

Rumor has it that Musk doesn’t really like OpenAI CEO Sam Altman who took OpenAI from non-profit to for-profit and harvesting a multi-billion dollar payday.

Until now, kicking potential revenue creation can down the road is the order of the day, and as long as investors can buy this idea that AI data centers will mean higher revenue opportunities, then shareholders will still pile into this bubble until they don’t.

That is why stocks like Nvidia, Oracle, and ARM are seeing double digit gains in just one day.

Buy these three companies on the dip until the AI bubble pops.