A Legacy Tech Company You Have to Buy

You cannot accuse Autodesk (ADSK) of ignoring the prodigious migration to digital and full-blown automation.

The company gives credence to the tech theory of taking a pretty darn good software product, repackage it as a subscription, then watch revenues and marginal profitability go through the roof.

Autodesk is one of the original pioneers of AutoCAD, a commercial computer-aided design (CAD) and drafting software application.

Before AutoCAD was introduced, most commercial CAD programs ran on mainframe computers or minicomputers, with each CAD operator working at separate graphics terminal.

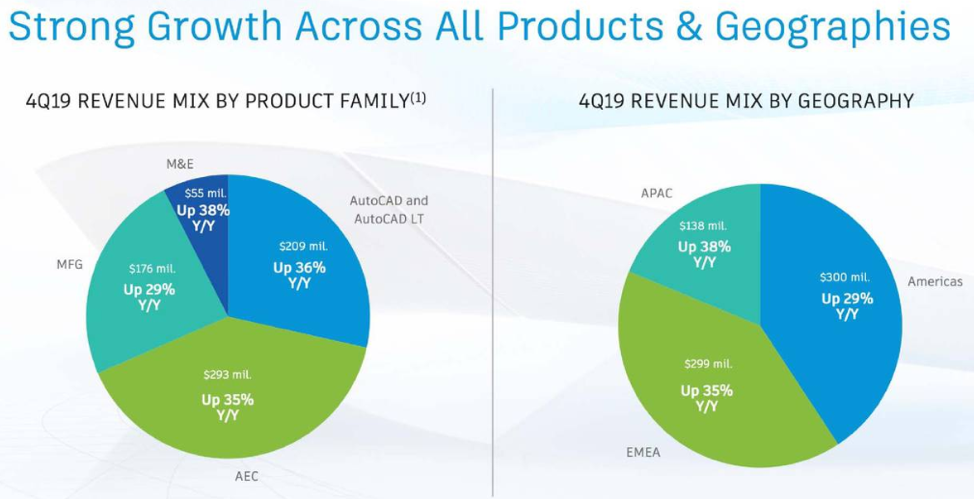

Autodesk’s AutoCAD and Revit software are mainly applied by architects, engineers, and structural designers to design, draft, and model buildings.

Being one of the flagbearers of the industry has its perks with Autodesk’s AutoCAD software being involved in world-renowned projects from the One World Trade Center to Tesla electric cars.

Once I roll through their 2018 achievements, it will be impossible not to define this company as part of the cloud aristocracy.

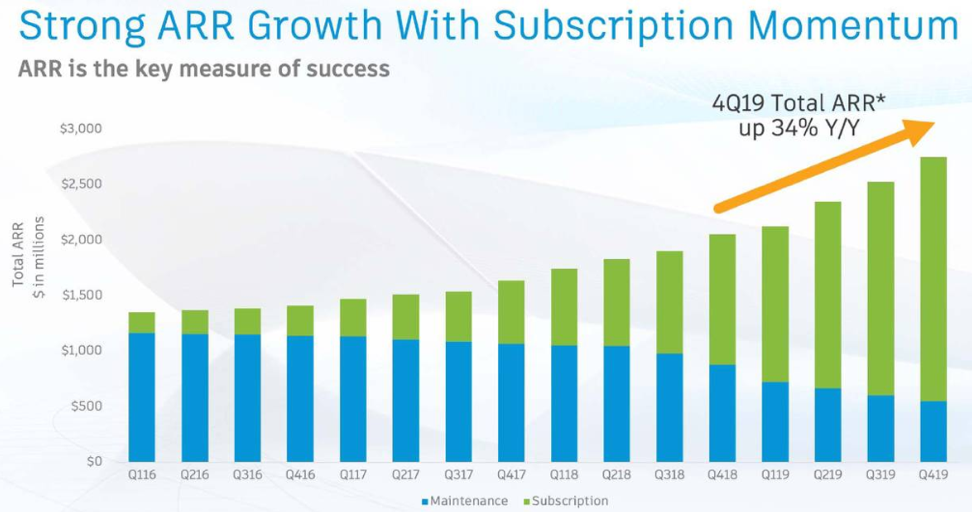

Scrolling through the numbers, my eyeballs pinpoint at the all-important Annual Recurring Revenue (ARR) as the starting point for clues to its success.

(ARR) is a crucial metric used by software-as-a-subscription (SaaS) businesses who define the contract length and the (ARR)’s specific dollar value contracted in return for proprietary software.

You’d be chuffed to bits to discover that Autodesk’s (ARR) delivers 95% of total annual revenue which amounted to almost $2.6 billion in fiscal 2018, a record for this company headquartered in San Rafael, California.

On an annualized basis, (ARR) growth amounted to 34% and billings cruised past the $1 billion mark for the first time last quarter.

Autodesk would be lying if they said subscriber growth isn’t the lynchpin to growing revenue, it certainly is, and they are doing their best to take advantage of this opportunity.

When talking about the strengths, we must look at Autodesk’s AutoCAD software which featured among the top 10 fastest growing skills in technology job searches.

According to Upwork’s latest quarterly index, Revit expertise is highlighted among the top 15 hardest skills for freelancers in the U.S. job market.

Building information modeling (BIM) is a process involving the generation, production, and management of digital representations of physical and functional characteristics of places.

Clayco, an ambitious construction design firm based in Chicago, has been an Autodesk customer for years.

They use BIM 360, Assemble, PlanGrid and Building connective as they are single-mindedly focused on fully embracing the digitization of construction.

BIM adoption remains one of the underlying reasons of investments in the infrastructure space.

An industry-wide cry for adopting BIM drove another seven figured enterprise agreement with a large European infrastructure provider last quarter.

Autodesk doubled the contract with the customer as the company hopes the adoption of BIM for building and managing will enhance the quality of infrastructure projects.

Autodesk’s unique portfolio design tools are allowing them to expand from products like AutoCAD and Inventor into Revit the world’s leading BIM design tool.

On the manufacturing side, generative design and investments in Fusion continue to attract global manufacturing leaders to collaborate with Autodesk.

A vivid example is the cloud agreement signed with Korean automobile maker Hyundai Motor Group who plan to leverage Autodesk’s software to generate innovative car designs.

Taking a microscope to the financials, the average revenue per user (ARPS) increased 17% because of the 13% boost in the number of subscriptions.

The subscription plan subs grew by 291,000 organically.

Continued adoption of BIM 360 solutions gave a 51,000 boost to cloud subs.

Autodesk is finishing up migrating the maintenance customers to subscription packages.

In Q4, 110,000 customers moved from maintenance to product subscriptions, meaning Autodesk has switched over nearly 800,000 maintenance customers to subscriptions since the inception of the program.

The maintenance plan was abandoned in the fall of 2016 as a way of driving revenue momentum. Before, Autodesk offered software upgrades and the latest product releases for free.

Dramatically shifting to a subscription model has laid the pathway to monetize their software through a monthly recurring payment system.

The company also offers a discounted three-year subscription that 3rd parties can lock in if they are serious about a long-term relationship with Autodesk.

At the end of this month, Autodesk plans to increase the cost of certain subscription plans by between 2.5% and 10% allowing the company to deliver more value to the engineers that religiously rely on Autodesk.

Even though maintenance plan packages are slowly winding down, after this small group’s special discount expires, they will be recommended to join the new subscription program.

As it stands, less than 20% of revenues is generated from the maintenance agreements as the subscription revenue model has furthered Autodesk’s financial interests, effectively executing Autodesk’s growth strategy.

The shift to a cloud-based subscription setup is one of the crucial ways Autodesk has maximized free cash flow and has been a massive catalyst of a profitability surge.

The company is smack in the middle of growth sweet spot benefitting the top line and combined with gross margin expansion, I trust Autodesk shares to be an outsized winner of the cloud aristocracy.

Buy Autodesk on the dip.