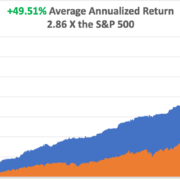

A Note on Next Week?s Options Expirations

We have an options positions that is deep in the money, and I just want to explain to the newbies how to best maximize their profits.

This comprises:

S&P 500 (SPY) August $214-$217 in-the-money vertical bear put spread with a cost of $2.50.

As long as the (SPY) closes at $214.00 or above on Friday, August 21, the position will expire worth $3.00 and you will achieve the maximum possible profit.

This will worth out to a 20% gain, something you have been able to achieve in only 17 trading days. Better than a poke in the eye with a sharp stick, as they say.

In this case, the expiration is very simple. You take your left hand, grab your right wrist, pull it behind your neck and pat yourself on the back for a job well done.

Your broker (are they still called that?) will automatically use the long put to cover the short put, cancelling out the positions. The profit will be credited to your account on the following Monday, and the margin freed up.

Of course, I am watching these positions like a hawk, as always. If an unforeseen geopolitical even causes the (SPY) to take off to the upside once again, such as Janet Yellen announces that there will never be another interest rate hike again.

You should get the Trade Alert in seconds.

If the (SPY) expires slightly out-of-the-money, like at $214.10, then the situation may be a little more complicated, and can become a headache.

On the close, your short put position expires worthless, but your long put position is converted into a large, leveraged outright naked short position in the (SPY) with a cost of $217.50.

This position you do not want on pain of death, as the potential risk is huge and unlimited, and your broker probably would not allow it unless you put up a ton of new margin.

This is not what moneymaking is all about.

Professionals caught in this circumstance then buy a number of shares of (SPY) on expiration day equal to the short position they inherit with the expiring $217 put to hedge out their risk.

Then the long (SPY) position is cancelled out by the short (SPY) position, and on Monday both disappear from your statement. However, this can be dicey to execute going into the close.

So for individuals, I would recommend just selling the $214-$217 put spread outright in the market if it looks like this situation may develop and the (SPY) is going to close very close to the $214 strike.

Keep in mind, also, that the liquidity in the options market disappears, and the spreads widen, when a security has only hours, or minutes until expiration. This is known in the trade as the ?expiration risk.?

One way or the other, I?m sure you?ll do OK, as long as I am looking over your shoulder, as I will be.

Well done, and on to the next trade.

Well Done and On to the Next Trade

Well Done and On to the Next Trade