A Pharma Giant Built For The Long Haul

I was sitting in my 1946 Ercoupe at the Nevada airfield last weekend, waiting for clearance to take off for a quick joy flight, when my phone buzzed with a text from a longtime Concierge client.

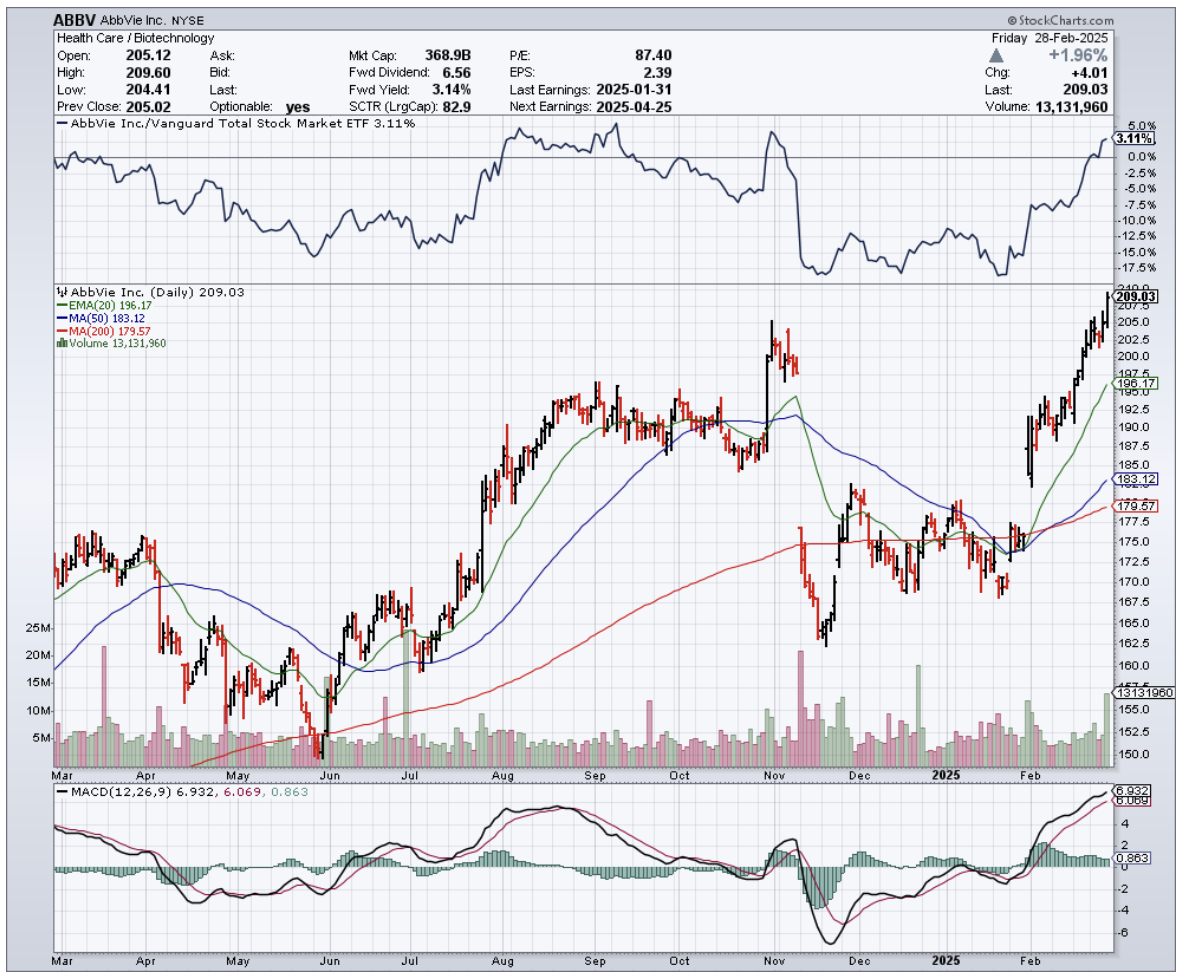

"What's the deal with AbbVie (ABBV)?" he wanted to know. "Is it worth adding to my portfolio now?"

The timing was perfect. I'd just spent the previous evening poring over AbbVie's financials while sipping a particularly good Napa Cabernet I'd picked up at an estate sale for $15 (retail: $95).

There's something about the methodical drone of analyzing pharmaceutical company balance sheets that pairs beautifully with a rich red wine.

With a market cap north of $340 billion, AbbVie isn't exactly flying under anyone's radar.

But what fascinates me about this pharmaceutical behemoth is how it's managed to construct a business that's both defensively positioned and aggressively growing. It's like finding a Sherman tank that can also win drag races.

Let's dissect this beast, shall we?

Half of AbbVie's revenue comes from its immunology portfolio. The rest flows from neuroscience, oncology, and—here's where it gets interesting—aesthetics. This diversity isn't just window dressing; it's strategic positioning in markets growing far faster than inflation or GDP.

Take the immunology market, which analysts project will deliver a 10.2% CAGR over the next decade. That's the kind of growth that makes central bankers nervous and investors giddy.

AbbVie dominates this space with Rinvoq, Skyrizi, and the now-patent-expired but still lucrative Humira.

Speaking of Humira, it's worth noting what happened when this superstar drug lost patent protection in 2023.

After nearly two decades of market dominance, Humira finally faced the onslaught of biosimilars (think generic drugs, but for biologic medications).

Most pharmaceutical companies would have curled into the fetal position watching their golden goose get plucked. But AbbVie had been preparing, transitioning patients to newer offerings like Rinvoq and Skyrizi.

How well did that strategy work? These two upstarts now command a jaw-dropping 50% market share in inflammatory bowel disease indications.

If you've ever had to overcome entrenched competition in a market, you'll appreciate just how remarkable that achievement is.

Then there's neuroscience, where AbbVie's footprint includes Botox (not just for smoothing frown lines, folks), Qulipta, and Ubrelvy.

This Central Nervous System therapeutics market is projected to grow at 10.5% annually through 2030. Again, that's the kind of growth that makes you sit up straight in your ergonomic office chair.

The oncology space is a bit more challenging for AbbVie, with other pharmaceutical giants claiming larger market shares.

Still, AbbVie managed 10.8% revenue growth in oncology for 2024. Not too shabby for a supposedly "smaller player."

But the real head-turner is aesthetics medicine, projected to grow at a blistering 12.8% CAGR through 2030.

AbbVie isn't just participating here – it's dominating with Botox and Juvéderm holding 60% and 40% market shares in the U.S. toxins segment, respectively.

I remember speaking with a plastic surgeon at a conference in New York last year who told me, "When someone walks in asking for 'Botox,' it's like when people ask for a 'Kleenex' instead of a tissue. The brand has become the generic term."

That's market penetration you simply can't buy with advertising.

AbbVie's growth strategy is two-pronged: aggressive R&D investment (which increased from 13.44% to 15.22% of revenue year-over-year) and strategic acquisitions.

The company maintains a robust pipeline of new products, with several in late-stage FDA approval processes. They're also not too proud to partner with other pharmaceutical companies to develop new offerings—a pragmatic approach I've always admired in business leaders.

For income-focused investors, AbbVie offers a particularly compelling story.

The company just declared a $1.64 quarterly dividend per share, translating to a 3.4% forward yield.

More impressively, AbbVie is a member of the S&P Dividend Aristocrats Index, meaning it has increased its dividend annually for at least 25 consecutive years.

Is AbbVie financially strong enough to maintain this dividend streak while funding growth? With over $7 billion in cash and moderate leverage, all signs point to yes.

The company's stellar profitability provides additional confidence, despite slightly higher R&D expenses eating into operating margins.

The latest quarterly earnings release should put any remaining doubts to rest, with Q4 year-over-year revenue growth accelerating to 5.6%—significantly better than previous quarters—and a slight improvement in gross margin.

Of course, no investment comes without risks.

Competition in pharmaceuticals is brutal, with both innovative giants and generic producers constantly nipping at AbbVie's heels.

The rapid decline in Humira revenue following patent expiration serves as a stark reminder of how quickly fortunes can change. While the company has successfully navigated this transition, there's no guarantee it will repeat this feat with future patent expirations.

Manufacturing complexity and supply chain vulnerabilities also present risks, though these aren't unique to AbbVie.

Perhaps more concerning is the political and regulatory uncertainty following Donald Trump's return to the White House, including potential trade wars and controversial appointments like vaccine critic Robert F. Kennedy Jr.

Despite these risks, AbbVie presents an exceptionally attractive combination of growth potential and income generation.

The company's diversified business mix, strong positions in growing markets, aggressive growth strategy, and shareholder-friendly capital allocation make it a compelling addition to almost any portfolio.

As I finally got clearance and my little Ercoupe lifted off the Nevada runway, I texted my Concierge client back: "ABBV is a buy on the dip. Rock-solid business with growth. Don't overthink this one."

One of the benefits of our Mad Hedge Concierge service is exactly this kind of real-time market guidance—though most questions don't catch me mid-takeoff.

Sometimes the best investment ideas aren't the most exotic or revolutionary. Sometimes they're just exceptionally well-run businesses selling products people need, returning value to shareholders, and positioned in growing markets.

AbbVie checks all of these boxes with room to spare.