A Short Term Trade

Uber’s (UBER) stock is almost 30% down from all-time high’s, and the stock was on a nice run from the lows of 2023 when the stock was trading around $25 per share.

There has been great optimism around the business, with revenge travel stoking a huge growth bump in the ride-sharing business.

Uber once burned through money like there was no tomorrow, but now it is a profitable business.

However, there are outsized risks just around the corner, and the stock has pulled back because the next risk might be existential.

They are running into one of the greatest innovators the world has ever seen.

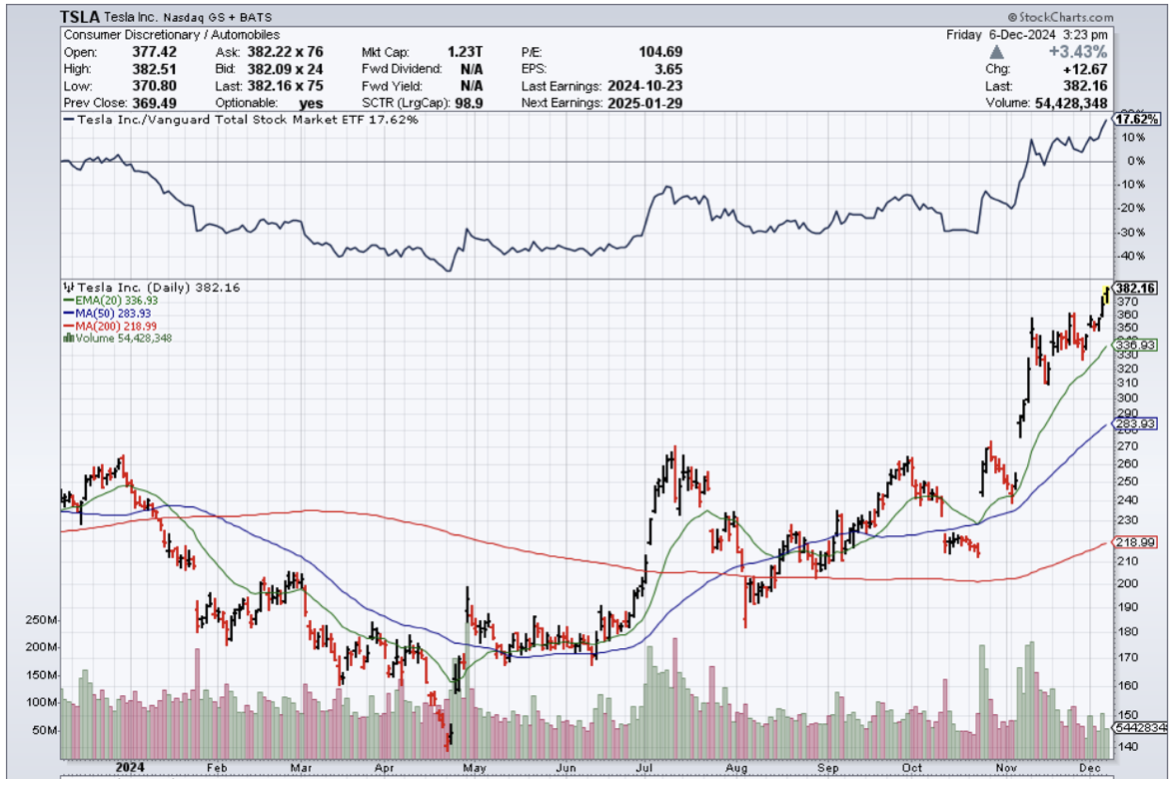

Tesla (TSLA) and Elon Musk have made a lot of noise lately about self-driving robotaxis, and they do have their proprietary software with billions of driving hours of data.

Uber has nothing like this, and the more Elon Musk elbows out the competition about the self-driving technology, the more Uber’s share price sinks.

Uber is the tech company most affected if Musk successfully implements robo taxis as a main part of Tesla’s business.

By now, it is becoming quite apparent that EVs aren’t the holy grail of technology Musk is chasing after. It is merely a placeholder until he goes onto greater projects and technologies.

Sure, first, it would be rockets and space, but on Earth, Musk is after artificial intelligence through robots, and one of those applications would be self-driving automobiles.

Google’s Waymo is another long-term investors in self-driving tech that will destroy Uber’s business model as well.

Uber just said it would partner with robotaxi maker WeRide (WRD) to launch ride-hailing in Abu Dhabi. Uber said it would be the first time AVs are available on the Uber platform outside of the US and that Abu Dhabi would be the largest commercial robotaxi service outside the US and China when it launches in 2025.

Waymo (GOOGL) lately said it would expand its robotaxi service to Miami, Florida.

Waymo has previously tested vehicles in Miami, the company said, a city that provided “challenging rainy conditions” for its driverless vehicles, and Uber’s stock crashed 10% on this news itself.

Waymo said it is already providing 150,000 trips per week in Phoenix, Los Angeles, San Francisco, and Austin.

Uber still has to pay for over 160 million month active riders to get shuttled around on its app, and when they are muscled out of the technology by Google and Tesla, it is not guaranteed they will be able to license this high level of proprietary technology from these big tech stalwarts.

If you are Google or Tesla, why ever involve Uber when you could pick up their riders for pennies on the dollar after Uber bankrupts itself because of the high cost of employing human drivers?

Long term looks quite grim for Uber, and I don’t believe there is a magical elixir for the self-driving software. They are too far behind.

The one hunch I have is that over the past year, Waymo and Tesla have made the concept of the masses taking self-driving technology as a real service closer and closer.

Each day, we inch closer, and the day of full implementation will be a death knell for Uber.

However, in the short term, I do believe Uber’s stock is oversold, and it could stage a bounce back in the short to mid-term.

Any dive into the high $50 range would be a great buying opportunity for a quick trade in Uber. I wouldn’t buy and hold for the long haul, there are better options.