Airbnb Poised For A Great Follow-Up Year

One tech firm that should get the benefit of the doubt from investors and traders moving forward is travel-sharing firm Airbnb (ABNB).

I’m not only recommending them because I use their product, but I do believe in their business model moving into the summer months of 2023.

Many travel agencies were waiting for a major pullback in travel for 2023 after revenge travel 2022 meant that consumers aggressively spent in 2022 after waiting in draconian lockdowns for the past 2 years.

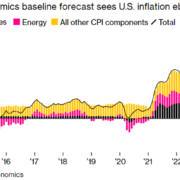

Well, the cliff drop in travel revenue following 2022 will not come to pass as consumers are materially aware of higher inflation, but still not willing to sacrifice travel.

One of the epiphanies that many people had during the government lockdowns was that it is essential to get a change of scenery once in a while to refresh.

It’s one of the few new non-negotiable items on people’s lists now.

What are people doing to combat inflation?

Looking at more budget-friendly options and downgrading on accommodation, transport, entertainment, and even going to more affordable destinations.

Instead of Monaco, people are going to Marseille, instead of London, people are heading to Birmingham, and so on.

Its 2022 fourth-quarter revenue of $1.9 billion and earnings per share (EPS) of $0.48 were up 24% and 500%, respectively, on a year-over-year basis.

The full-year numbers were fantastic, too. 2022 was the first time that Airbnb was profitable for an entire fiscal year.

The strong financial performance was bolstered by some key trends highlighted by the management team. Nights and experiences booked increased 20% year over year in Q4. Cross-border, urban, and long-term stays also showed outstanding growth.

Airbnb's platform continues to add headcount as it now has 16% more active listings (or 900,000 more) than a year ago.

A near-term catalyst for Airbnb is the ongoing recovery of the Asia-Pacific region, which saw nights and experiences booked increase by 40% versus bookings in Q4 2021.

Chinese tourists are heading to Thailand and Malaysia in droves, packing the jumbo jets with rice crackers on the way there.

With its heavy reliance on cross-border travel, Asia-Pacific was decimated because of the health crisis. The easing of travel restrictions and the reopening of China will help provide a boost.

Airbnb's rapid rise to prominence has resulted in its name being used as a verb, which all but solidifies its place in consumers' minds. This is a powerful position to be in, especially in an economy that favors major internet-based brands. This situation bodes well for Airbnb's long-term relevance.

This year’s projections appear rosy with forecasts of year-over-year revenue and EPS growth of 14.3% and 22%, respectively, in 2023.

Although 2022 was quite the travel season, the follow-up year is shaping up to not be too shabby.

Definitely don’t expect a flop like a Spanish soccer player.

Shares in the first few months of the year got ahead itself and now after a deep pullback from February highs, I do believe this stock is a great "buy the dip" for the rest of 2023.

Rinse and repeat for the rest of 2023.