An Attractive Real Estate Tech Play

Special purpose acquisition company (SPAC) mania continues to bring a plethora of new tech names to the public market increasing the range of assets the Mad Hedge Technology Letter can look at.

The latest is the VC-backed real estate tech company Matterport (GHVI).

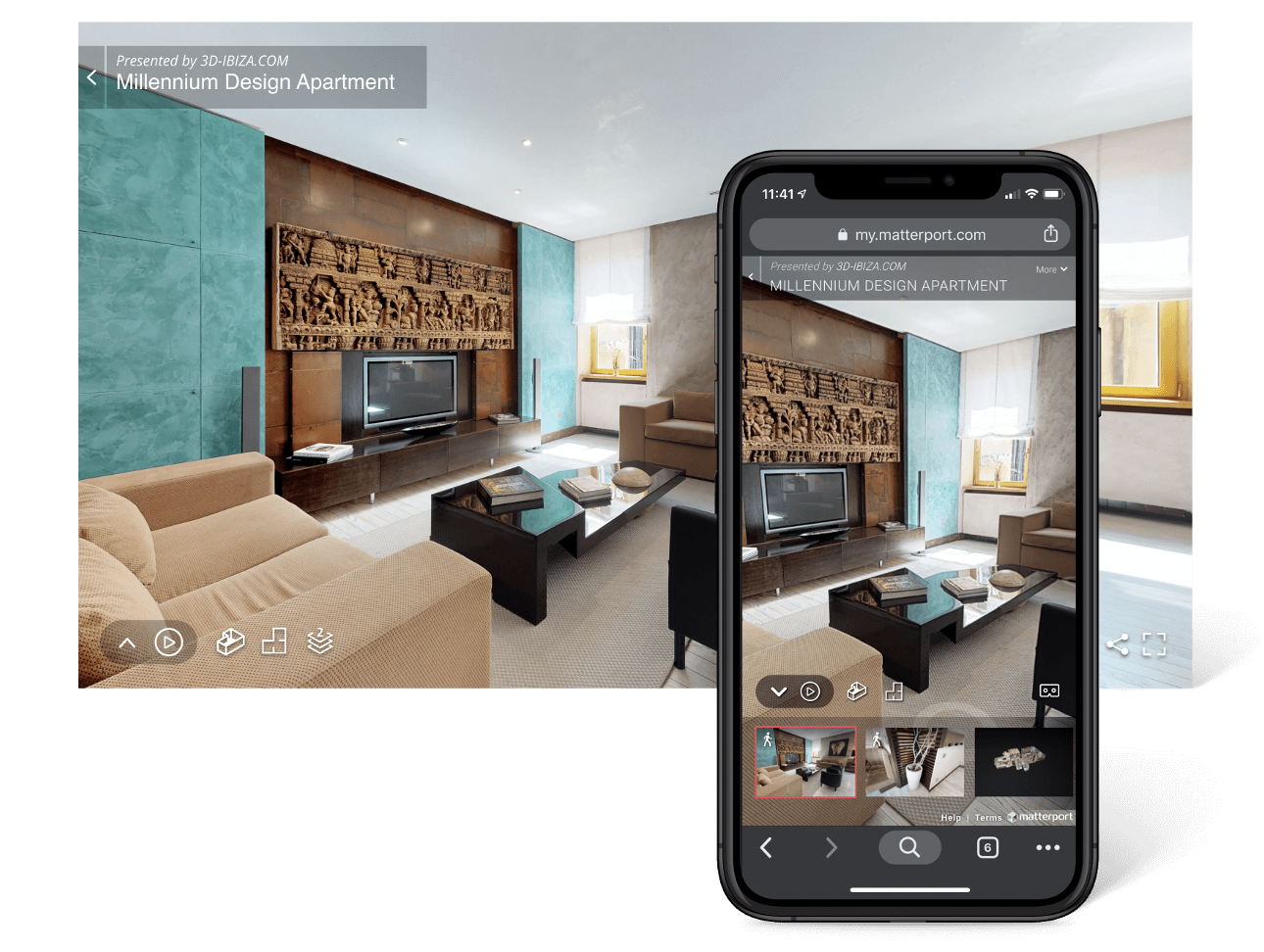

Matterport has built the world’s most advanced platform for quickly and easily creating, modifying, and distributing 3D models of real-world spaces.

The company has amassed the largest repository of 3D space data in the world for industries including real estate, architecture, construction, insurance, hospitality, and more.

Matterport leverages this data to drive its AI and deep learning algorithms to create unparalleled digital reconstruction of physical spaces, with an understanding of the spaces themselves and the objects within them.

This firm went public with Gores Holding VI, a special-purpose acquisition company founded late last year by investment firm The Gores Group.

Virtual walkthroughs of properties have mushroomed during the pandemic, especially in regions of the U.S. where in-person showings were prohibited.

Matterport’s 3D technology is used in more than 130 countries by clients, which include Redfin and Marriott International.

Some prominent investors include DCM Ventures and the venture arms of Advanced Micro Devices and Qualcomm.

The SPAC popularity has now migrated to real estate, with several companies — including Opendoor and Porch.com — going public in 2020 via blank-check firms.

Matterport keeps improving its software with a major update this week, specifically for iPhone 12 Pro and iPad Pro 2020.

This update injects improved dimensional accuracy with LiDAR for those two devices.

This means that the 3D sensor at the back of the device will be deployed to capture and recreate a more life-like iteration than ever before.

Matterport has been around for a while and this app and the company behind it have been capturing 3D models.

But now the new application of LiDAR on these most advanced devices gives this software a better dimension.

This is really the first step to the real estate industry becoming more integrated with technology.

Matterport is also an expert in the handling and display of 3D-captured content from a variety of cameras, both standard flat and 3D / spherical.

Other fusion real estate technology companies are also getting in on the act hoping to go public via their own SPAC.

Recently, Compass, a New York-based real estate brokerage startup that heavily markets its technological prowess, filed paperwork to do an IPO of its own.

Alternative notables to keep an eye out for are Chattanooga, Tennessee-based tech-enabled moving company Bellhop and San Francisco-based residential real estate marketplace Sundae plan to raise more private capital before pursuing public listings.

Co-founder Gregor Watson said Oakland-based home rental marketplace RoofStock could eventually go public or sell a large strategic stake.

Carmel, Indiana-based Realync could also be an acquisition target after raising capital in 2020, according to co-founder and CEO Matt Weirich, who named RealPage and Santa Barbara, California-based Yardi Systems as logical buyers for its virtual leasing and engagement platform for multi-family residences.

I also have a good feeling about Matterport’s management.

Matterport’s CEO RJ Pittman also has a strong track record at his previous companies like having most recently served as Chief Product Officer for eBay following leadership positions at Google, Apple, and Groxis.

Pittman’s appointment coincides with a period of significant growth for Matterport, which has built a library of 1.4 million 3D models, with 600 million model views since the company’s inception.

We are barreling towards a tipping point in market adoption of 3D models to transform how building environments are designed, developed, experienced, and managed.

The commercial applications are quickly unfolding, and Matterport’s industry-leading technology is well-positioned to drive rapid market expansion.

I am convinced that management at Matterport will unlock the full potential of the breakthrough technology and unparalleled 3D media and data.

This company is on the verge of driving transformation and creating high-performance teams that will then attract world-class industry talent and accelerate the next phase of growth.

Matterport’s underlying shares have been the recipient of unbridled optimism in the accruing of future revenue and shares have already appreciated by around 100% since going public around a month ago.