Another Path Gets Shut Down

The best-kept secret is that Portugal was one of the biggest beneficiaries of loose crypto restrictions for the past decade.

The bulk of the Mad Hedge Concierge client list is made up of numerous crypto investors that got into bitcoin at less than $100 to ride the wave up.

Yet, it is common knowledge that the United States treats digital currency as property and taxes it similarly to stocks or real estate.

Why have crypto holders been flocking to Portugal?

Crypto gains were not taxed at all for most of the 2010s and early 2020s.

It made sense for any crypto success to apply for Portuguese residence and take proceeds of the crypto in Portugal without losing a dime.

Over the past decade, Portugal has become an appealing destination for international residents, who have flocked to the country due to its more flexible visa and immigration options and overall affordability.

The weather and food are amazing.

Why do I suddenly bring up Portugal now if it is such a crypto tax haven?

The Portuguese government implemented a new cryptocurrency tax framework in its 2023 national budget, which has been in force since January 2023.

Within the nearly 450-page macroeconomic strategy and fiscal policy report, a small section established a 28% capital-gains tax on cryptocurrency gains made within one year.

However, gains realized after one year of holding the crypto assets remain exempt under the finalized law.

The Portuguese government also applies stamp duty (10%) on gratuitous transfers such as gifts and inheritances, and a 4% stamp-duty charge on crypto-service-provider commissions.

The framework was designed to treat crypto as equal to other industries and to establish a clear, standardized taxation environment. Twenty-eight percent is the standard capital-gains tax rate in the country.

If these new crypto taxes are implemented, it is nothing short of a disaster for crypto holders who trade short term even if the ones holding over one year are exempt.

Expect trading volume to plummet.

I can guarantee it will face a mass exodus, like India, as companies and investors flee to lower-tax nations.

At this point, it appears as if bad news is piling on top of bad news.

Governments around the world are strapped for cash as historical debt loads worry finance ministers.

There’s a massive hunt for the incremental tax dollar and crypto was the low-hanging fruit in Portugal.

I don’t recommend any Bitcoin investor to apply for Portuguese residence because it lost its tax-free advantage in 2023, even though long-term gains are still not taxed.

The interest in crypto is at a 10-year low with some of the biggest daily outflows occurring during the market stress events of 2022–2023; current long-term exchange flows in 2025 are more stable.

Moreover, large exchange outflows did occur during that 2022–2023 period, though current 2025 figures no longer match those extremes.

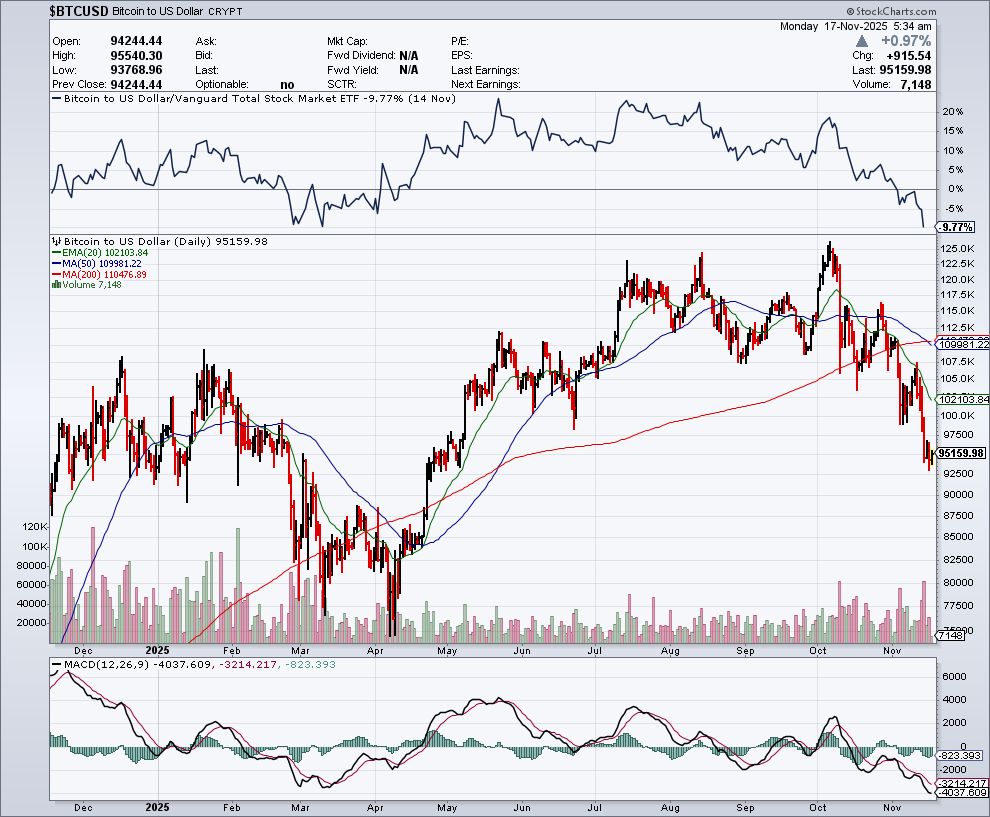

Investors have clearly lost interest in crypto which is why we are seeing sparse volatility.

Buyers and Sellers have both fled.

Now, cross Portugal off the list.

Moving forward, crypto investors must be nimble as the multiple crises around the world mean that governments will go after crypto dollars harder, giving fewer places to take proceeds for minimal or no tax.

These events are all highly negative for the price and health of Bitcoin.