Apple Ramps Up Its Game

A steady hand on the tiller – that was the key takeaway from the recent Apple release event that saw updated iPhone models poised to hit stores in October.

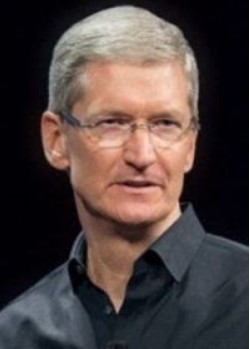

There was nothing of substance to steal the show or radical revelations awing the patient neutral, but that is how Apple CEO Tim Cook likes it.

iPhone XS, iPhone XS Max and iPhone XR were conveniently named after their predecessor the iPhone X.

These smartphones are of the same ilk but in a refreshed way.

The iPhone XR is the lower-grade version of the three, but shares many of the same specs as the superior versions.

This version could be the model that lures in Apple lovers that avoided upgrading last cycle, because the inner workings are similar enough and the look is premium enough, but hundreds of dollars cheaper than the XS and XS Max models.

Check, check, and check.

I wouldn’t label it an “entry level” smartphone, but it hits all the right notes for iPhone fans that can’t cough up the big bucks for the higher-priced products.

The phone’s price tag has been a lingering concern especially in the emerging world.

Apple smartly widened the range of premium phone prices to the lower and higher range - the net effect will be a moderate bump in the all-critical average selling price (ASP), which is a huge winner in all of this.

At the top end of the range, the iPhone XS Max with 512 GB of memory will command a hefty $1,449.

This is the priciest iPhone ever made.

Larger screen sizes in the 6.5" XS Max and 6.1" XR will appeal to their fan base driving additional incremental business to the company that Steve Jobs left his indelible mark on as well.

The covert winner in all of this is Apple’s share price.

Apple’s share price is notorious for being slashed and burned before their new iPhone release events and the run up to earnings season.

The lack of apocalyptic behavior in its recent share price surely has the bulls rejoicing.

Basically, these new iPhone models aren’t worrying Apple investors even one scintilla.

Apple going forward is not betting the ranch on hardware anymore and investors have approved in spades.

Last quarter’s earnings report highlighted the Teflon nature of Apple’s iPhone demand by proving to investors that Apple could successfully sell smartphones over $1,000.

The seminal shift breaking psychological price barriers is indicative of Apple’s relentless pursuit to produce the best phone in the world.

This perpetual chase has seen the company almost surpass the $1,500 price tag this time around and will smash this price point next time around.

The strength in recent Apple price action wholeheartedly signifies that Apple is a software and service company now and not a hardware company.

Apple was able to make the transformation with grace and elegance and avoiding any damaging blowups.

Apple is on pace to double services revenue to $15 billion per quarter by 2020 creating a $60 billion per year revenue beast of a division.

The software and services are where all the high margin activity is migrating in Apple’s ecosystem.

I have incessantly urged readers to stay with the highest quality tech companies that continue to unlock value at a breathtaking pace, especially amid a precarious backdrop of global trade spats and brutal competition.

Investors are migrating up the value chain storing their hard-earned capital in the best of tech as the weak hands are flushed out by the regulation and global trade police.

Apple is one of these companies with a dazzling portfolio of products.

Their steady march upward in quality is confirmed by products such as the Apple Watch Series 4.

Wearables have become a strength of Apple’s product line after botching the initial debut.

The new watch is redesigned, sleek, and mesmerizingly beautiful.

The display is more than 30% larger than its old design and offers flawless software functionality.

Apple’s shift into health is partly driven by monetizing its watch and other wearables.

Apple hopes its watch can be a natural part of sportsmen and sportswomen’s lives.

If Apple’s watch can be your lovable sports companion going forward, then an entire new avenue of revenue can break ground and be redistributed to shareholders.

The Cupertino company packed a ton of heat into this sensational device. It is a big reason why industry insiders believe that half of the 43.5 million smartwatches expected to be sold in 2018 will come from Apple.

Google's Wear OS lags distantly behind with a forecasted 12% market share, and it will be tough going to compete with Apple in this space.

Not only is the watch’s screen bigger, the speakers are also 50% louder.

The larger screen will allow users up to eight shortcuts on the screen for apps.

Apple also noted that the watch’s battery life will last 18 hours with an outdoor workout time of six hours.

Another groundbreaking feature is the ability to take electrocardiograms (ECG) reaffirming Apple’s pivot into the health sector through their shimmering new watch.

According to Apple, this revolutionary feature is the first time an (ECG) product has been available to retail consumers.

To admire the full beauty of this scintillating watch, click here to watch a video.

Earlier this year, Apple CFO Luca Maestri told the Financial Times that wearables in the past year have experienced a “60% growth in revenue terms. Adding up the last four quarters, wearables revenue now exceeds $10 billion.”

Apple’s wearables are classified under “other products” and include AirPods, Watch, Beats, and the HomePod.

Watch this division to continue its robust performance going forward.

In a nod to the emerging markets, Apple decided to introduce its first dual sim card inside the new iPhone models.

One of the slots will be an “eSIM” slot – a nascent technology that hasn’t been widely adopted yet.

For all the newbies unsure of what an eSIM card is - “Electronic SIM card” removes the hassle of poking a paperclip through your sim tray to switch out your sim card, which is a little smaller than your pinkie finger nail.

Rather, eSIM cards only need a compatible network requiring support, and it bypassed the need for a physical sim card and sim card tray altogether.

This move could syphon off even more revenue for phone network carriers if the eSIM technology mushrooms.

Apple will be the gatekeeper of the eSIM tech since it will have total control over it, even opening up the possibility to rotate between more than two carriers in the future if a physical sim card is not needed.

This could pave the way for Apple to get rid of the sim card slot entirely for the next iPhone iteration and use the space to develop something even better.

Technological innovation requires bold moves, to which Apple is no stranger.

In fact, only 10 countries currently support eSIM technology - Austria, Canada, Croatia, the Czech Republic, Germany, Hungary, India, Spain, the UK, and the U.S.

Demonstrating that dual sim cards are a way of life in the emerging world is data showing that 98% of Indian smartphones come with embedded dual sim card functionality, 92% in the Philippines, 90% in China, 77% in Indonesia, and just 4% in the U.S. in the third quarter of 2017 to the second quarter of 2018.

The ease of swapping in and out contract less sim cards is useful for any digital nomad. Buy a sim card for a few dollars at the airport, activate it, and you’re on your merry way.

In another nod to the Chinese customer, Apple will forgo the eSIM technology entirely and stick with the physical dual tray, allowing mainland Apple fans to physically implant two sim cards at one time.

Whether enhancing the phone, recreating its beloved watch, or rolling out audacious new technologies – Apple is satisfying all the naysayers.

It’s no wonder this company is a buy on the dip and hold to eternity stock.

Still Doing What They Do Best

Apple’s Health Pivot Via the Watch

________________________________________________________________________________________________

Quote of the Day

“Price is rarely the most important thing. A cheap product might sell some units. Somebody gets it home and they feel great when they pay the money, but then they get it home and use it and the joy is gone,” said Apple CEO Tim Cook.