Apple Redux

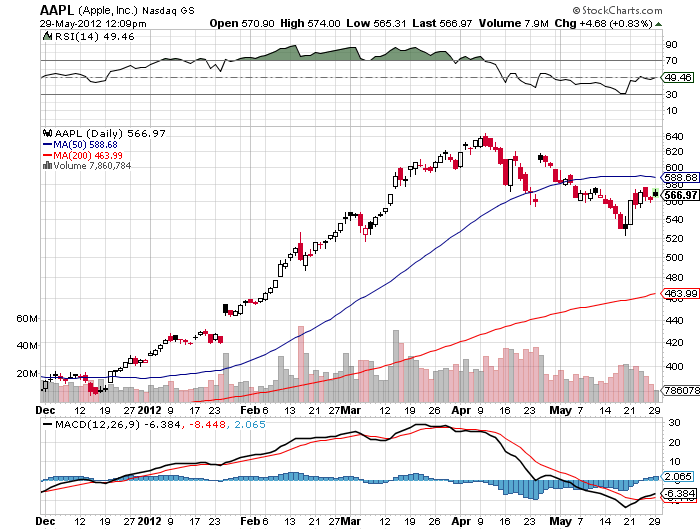

The news out this morning that Apple (AAPL) may launch its HD television product in time for the Christmas holidays caused a nice pop in the stock this morning, so I thought I would quickly review the fundamental case behind owning the company. The story originated from rumors in China that its main manufacturer, Foxcon, had already placed orders for key component parts. It will be another web to lure consumers into the Apple ecosystem and then trap them there for life. It also makes my 25% core long position in an August deep in the money call spread look pretty good.

Apple earnings have grown at a rate of 76% a year for the last seven years, and there is no sign that ballistic growth rate will abate anytime soon. The iPhone 5 launch in September will be an absolute blowout and the firm?s biggest new product launch ever. Even I have lined up a buyer of my almost new iPhone 4s at a big discount so I can get the vastly more powerful upgrade.

There are longer term strategic considerations too, such as the fact that Apple has only scratched the surface in China, the world?s largest cell phone market. A China Mobile (CHL) deal looming which will give Apple access to 600 million potential new subscribers. After refusing to support Apple products for decades, corporations are now adding Apple products in large numbers, urged on by the convenient and imminent demise of (RIMM)?s Blackberry.

The real icing on the cake here is that Apple is still one of the cheapest stocks in the market. Back out the $120 billion in cash it will soon have on its balance sheet, and you have in your hands a hyper growth company that is selling at an earnings multiple of only 8X. Look at a full year earnings target of $110 a share and rerate it up to a 10X multiple and you get a 12 month price target of $1,100.

There are some outliers that could pee on Apple?s parade. If the Android operating system somehow takes off that could slow growth. You also have to wonder how much of this amazing story is already baked into the price and when will the law of large numbers kicks in for this $532 billion company.