Apple Running Out of Time

At some point, Apple (AAPL) might realize that they won’t be able to find that “next big thing.”

That would be a death sentence.

I’ve been warning Apple shareholders for years that they are headed into a growth winter if they can’t find the next big thing to replace the iPhone.

The consensus was that Apple had time to figure it out.

When I say time, Apple management was quite relaxed about it because the iPhone had been making so much money for years.

Management didn’t think they had much to worry about for 5 to 7 years.

But that was then and things have changed.

Tech has advanced with lightning speed and has left Apple in the dust.

The iPhone numbers keep getting worse and Apple is still scratching their head.

The insurmountable lead they had in smartphones should have been used as a springboard into something even grander and more impressive.

Yet here we are over a decade later with Apple barely moving the needle such as changing the color of the lock screen and trying to pass over other minuscule changes as real upgrades.

Other tech behemoths migrating into artificial intelligence have made Apple look even more outdated in 2024.

Reports show Apple has been exploring a mobile robot that can follow users around their homes.

The iPhone company also has developed an advanced tabletop home device that uses robotics to move a display around.

It shelved an electric vehicle project in February, and a push into mixed-reality goggles is expected to take years to become a major moneymaker.

With robotics, Apple could gain a bigger foothold in consumers’ homes and capitalize on advances in artificial intelligence. But it’s not yet clear what approach it might take. Though the robotic smart display is much further along than the mobile bot, it has been added and removed from the company’s product roadmap over the years.

The iPhone accounted for 52% of the company’s $383.3 billion in sales last year leading to many calling the company the iPhone company.

A car had the potential to add hundreds of billions of dollars to Apple’s revenue.

If the work advances, Apple wouldn’t be the first tech giant to develop a home robot. Amazon.com Inc. introduced a model called Astro in 2021 that currently costs $1,600.

A silver lining to Apple’s failed car endeavor is that it provided the underpinnings for other initiatives. The neural engine — the company’s AI chip inside of iPhones and Macs — was originally developed for the car. The project also laid the groundwork for the Vision Pro because Apple investigated the use of virtual reality while driving.

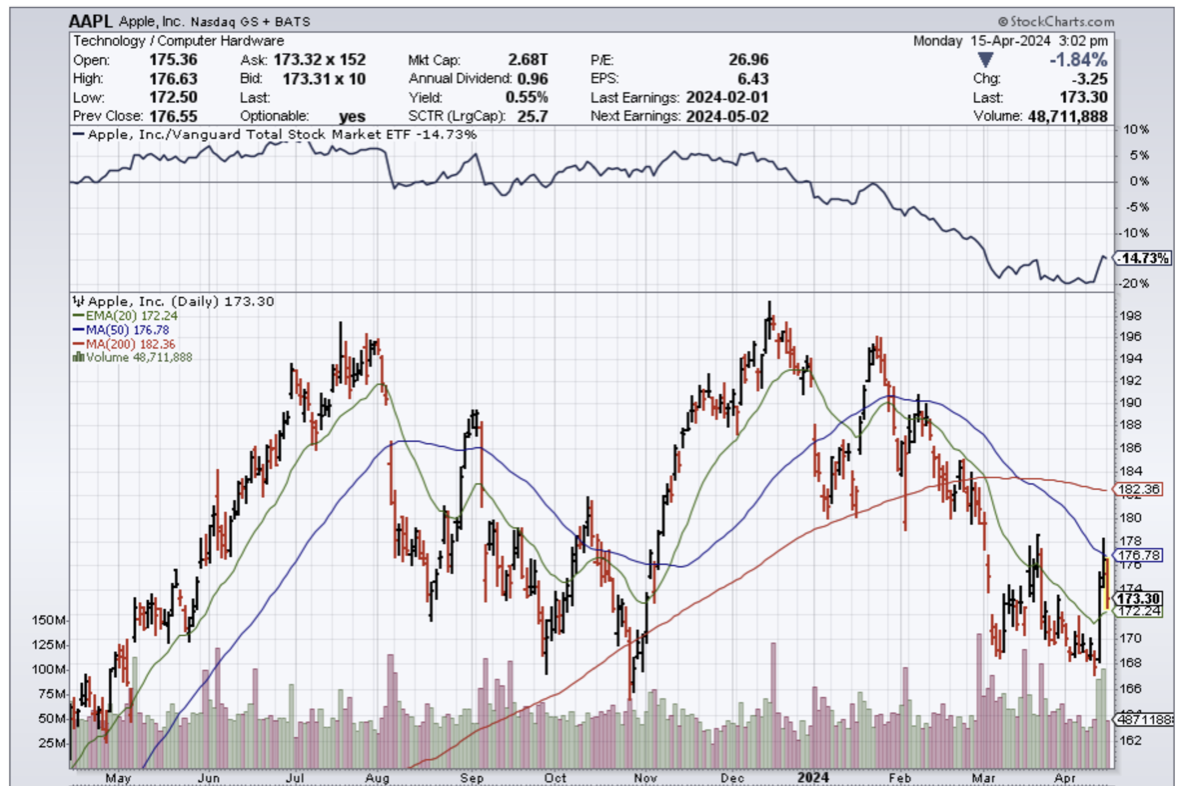

Apple stock is slightly down from the end of 2021.

That’s disheartening news for many shareholders because this stock was the perennial gem that overdelivered on every metric including the share price which is what matters most.

Apple was once the cornerstone of the stock market, and that title has disappeared unceremoniously with its smartphone lead.

With earnings fast approaching, I expect a lackluster report from Apple at best.

Any rallying will be done on less bad news than first expected and many companies already know that is a game you cannot win.

Even worse, the price to find the “next big thing” has multiplied significantly from 10 years ago with the cost of labor, supply parts, and the regulatory mood has soured.

The longer this goes on, the more Apple will be forced to deliver a royal flush when least expected.

The probability of Apple taking back the mantle as the forerunner of tech is dissipating by the day, and I would avoid the stock in the short term.

There is a reason why the stock has slightly down over the past 365 days.

If the stock pops on the earnings, I would be inclined to sell the rally.