April 30, 2025

(THE STOCK MARKET IS HEADED HIGHER NEXT YEAR ACCORDING TO THIS SIGNAL)

April 30, 2025

Hello everyone

Have you ever heard of the Zweig Breadth Thrust?

Well, last Thursday, April 24, it was signalled.

And yes, that’s a good thing.

The Zweig Breadth Thrust was developed by legendary investor Martin Zweig. He published a major stock market newsletter in the 1970’s. He is perhaps best known for predicting Black Monday in 1987, when stocks lost over 20% in one day.

He developed the Zweig Breadth Thrust after realizing that a shift from widespread selling to buying in 10 days or less had led to significant gains over the following year.

The Zweig Breadth Thrust triggered on April 24 is just the 20th since 1945, according to Carson Investment Research. The last time we saw one was near the S&P 500’s low in November 2022.

In the past, the benchmark S&P 500 has produced gains 100% of the time one year later, with an average and median return of over 23%.

Zweig Breadth Thrusts are uncommon because they require a period of extremely broad selling immediately followed by extremely broad buying.

The measure is calculated by dividing a moving average of the number of NYSE stocks advancing by the total number of advancing plus declining stocks.

Initially, a ratio of 0.659 was considered a buy signal, while 0.366 was a sell signal. However, the indicator’s buy signal has since been modified to be when the 10-day exponential moving average of stocks rises above 61.5% after being below 40% within the past two weeks

The S&P 500 has historically delivered robust returns after a Zweig Breadth Thrust.

Not only was the S&P 500 up one year later by an average of nearly 24% following every previous occurrence, but it has also delivered impressive short- and intermediate-term results.

The average historical return over the following one, three, and six months is 5%, 8%, and 15%, with a 95%, 79%, and 100% success rate.

But the lesson here is to be cautious. Rightfully so, this signal is one to respect. But remember that stocks have retested and even made new lows in the past following them, including in 2023, when we got two signals, one in spring and the other in the fall.

Investors have plenty to be concerned about. Inflation, unemployment numbers are rising, and a decelerating (GDP). And then there is the muddy tariff landscape on top of that, which can influence people’s spending habits.

In short, a Zweig Breadth Thrust doesn’t mean we have escaped the bear just yet. Stocks often require back-filling of gains, meaning a retest or new low isn’t out of the question.

Nevertheless, the returns associated with a Zweig Breadth Thrust are undeniably encouraging for long-term investors with horizons longer than six months or one year.

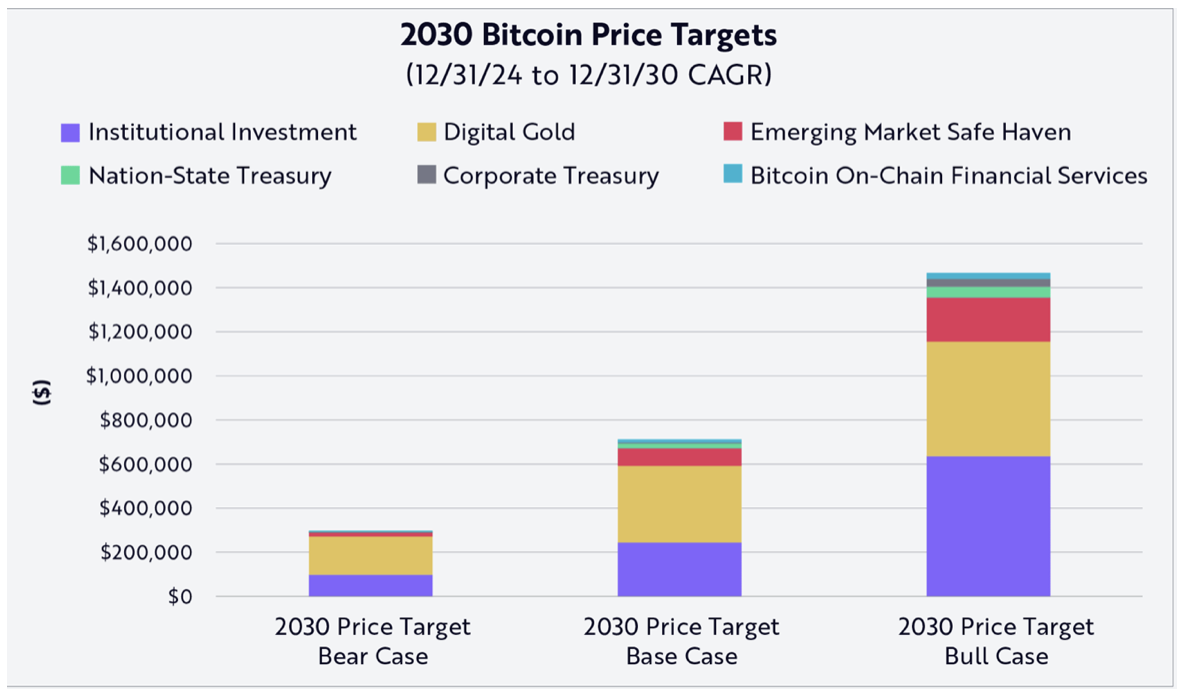

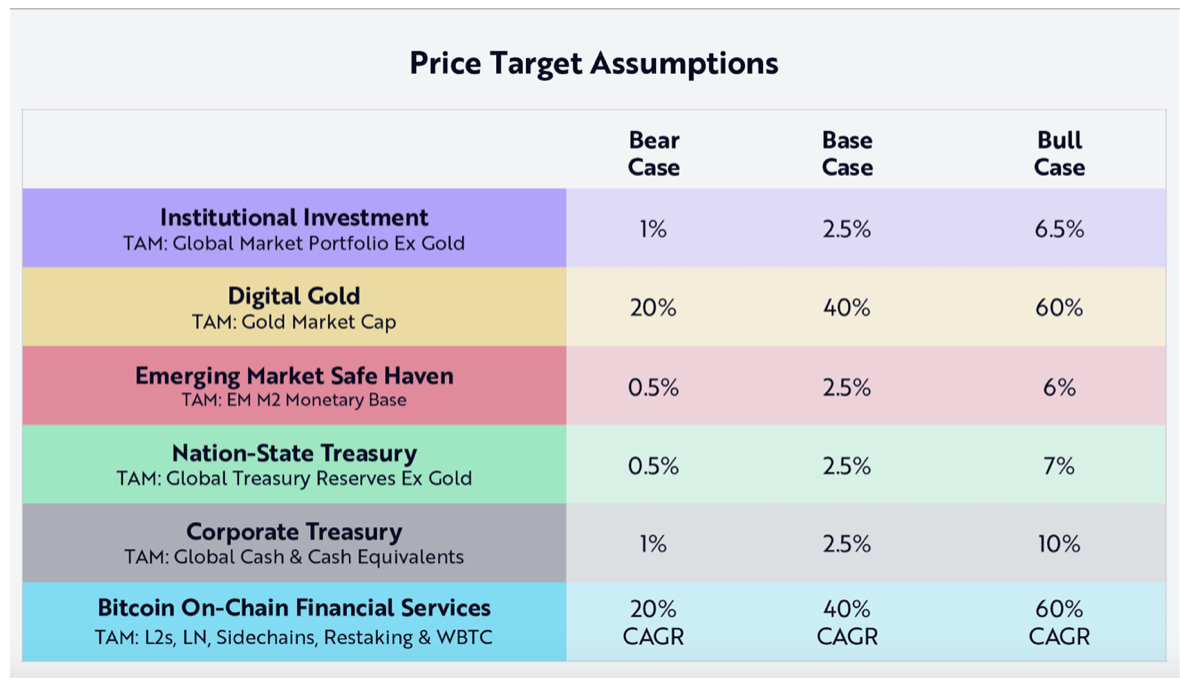

BITCOIN TARGETS ACCORDING TO AN ARK STUDY

An ARK study sees Bitcoin hitting up to $2.4 million by 2030, driven by institutional inflows, nation-state adoption, and growing on-chain utility.

The analysis by the firm highlights institutional investment — spot Bitcoin ETFs in particular — as the biggest driver in the bull case, contributing 43% of total capital inflows.

ARK Invest believes that Bitcoin’s future price targets are justified by its increasing role as a global financial asset that is receiving capital inflows from numerous avenues. It’s being considered a store of value, especially in developing countries where citizens face inflation and currency devaluation.

The spread of nation-state adoption, starting with nations such as El Salvador and Bhutan, also recently announced by President Donald Trump in the U.S., reinforces the bull case ARK is assuming.

Furthermore, growing corporate adoption of Bitcoin and the growth of on-chain financial services such as the Lightning Network and WBTC are further boosting the capital potential of Bitcoin. These dynamics, Ark says, lend their forecast structural validity.

Wrapped Bitcoin (WBTC) is an Ethereum token that is intended to represent Bitcoin (BTC) on the Ethereum blockchain. It is not Bitcoin, but rather a separate ERC-20 token that’s designed to track Bitcoin’s value.

The journey to 2030 through this vehicle will be full of peaks and troughs – put BITCOIN in the bottom drawer and leave it alone.

Cheers

Jacquie