August 1, 2011 - What the Tea Party Doesn't Know About the Bond Market

Featured Trades: (WHAT THE TEA PARTY DOESN'T KNOW ABOUT THE BOND MARKET)

3) What the Tea Party Doesn't Know About the Bond Market. I have spoken to several Tea Party leaders since the movement sprung up a year ago, and have come to several conclusions. This is a genuine, grass roots movement composed of people who are unhappy about the changes that have swept the country for the last 30 years. By and large, these are simple, decent, hardworking and retired people.

Their list of complaints is long, and include the downhill slide of public education, declining standards of living, falling wages for working people, the ballooning immigrant population, and the huge losses they suffered to their retirement savings and the value of their homes in the 2008 crash. They all want their lives to return to the simplicity of decades past. To a man, they want lower taxes and for the government to get out of their lives. I sympathize with them on many of their complaints.

They are also not financially sophisticated. They have no understanding of the global financial system and its many intricate moving parts. They distrust Wall Street and bankers, having been conned or victimized in the past. This is a big problem.

It is safe to say that the Tea Party leadership could care less about what happens in the bond market. The scary thing is that they think this market is something that can be simply turned on and off again like a light switch. They do not realize that:

1) US Treasury bonds are the lynchpin of the global financial system.

2) Once you break confidence in this instrument, you won't be able to put it back together again.

3) The pricing of all debt securities and loans around the world key off of US Treasury bonds.

4) Tamper with the pricing of your benchmark instrument, and the entire global financial system goes haywire.

5) The unintended consequences are uncountable.

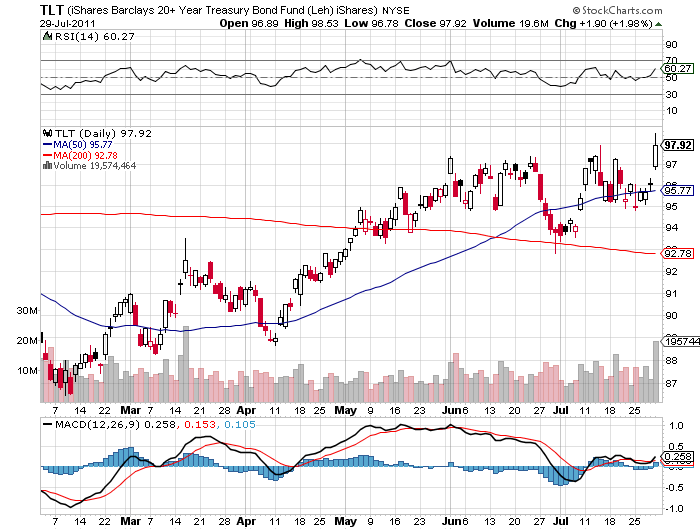

6) Interest rates will rise across the board. LIBOR rates have already started to creep up.

7) Since many financial institutions meet their capital requirements with Treasury bonds, any undermining of their credit worthiness forces a capital call which could trigger a secondary banking crisis.

8) Short term money markets will freeze up, starving corporate borrowers of cash. This has already started to happen.

9) Mess with Treasuries, and the value of your home is toast, if it is not already.

10) Dump 'full faith and credit' and you undermine the reserve status of the dollar, one of the greatest free lunches for America of all time.

The bottom line here is that you have a bunch of kids playing with matches in a fireworks factory. It is reminiscent of the first failed TARP vote in congress, when the same group of ideologically driven republicans ignored their party leadership and torpedoed their own president's bill.

You may recall that the Dow fell 700 points that day. I do. You may also remember that the following backlash at the polls set their party back a generation. I do. Wait until they have to explain on the campaign trail that their supporter's' IRA's dropped by half again because of a principal.

If this were any other country, the center of the democratic and republican parties would break off from their radical wings, create new parties, and then form a coalition government. But we are stuck with our 220 year old form of government, so that is not an option. But the final solution to the debt ceiling crisis may resemble something like this, subject to the confines of our own, arthritic political confines.

By the way, I want to thank the many readers who have been forwarding my letters to the White House, Senator Harry Reid's office, and John Boehner's staff. I have heard from all three. Keep up the pressure.

I am hoping for the best this weekend. But I am not holding my breath.

-

Must the Government Be Destroyed in Order to Be Saved?