August 10, 2009

Global Market Comments

August 10, 2009

Featured Trades: (SHANGHAI), ($SSEC),

(UUP), (USO), (SPX), (TBT)

1) The Mad Hedge Fund Trader will be presenting a lecture to San Francisco?s prestigious Commonwealth Club of California at 5:30 pm on Tuesday, August 11, 2009. It is entitled Does America Have a Future? I will give a brief history of the hedge fund industry, and then launch into a broader explanation of the long term investment trends that will dominate for the next decade. An extended Q & A will follow. This is your chance to question the logic, the analysis, and yes, even the sanity of The Mad Hedge fund Trader in person. It will be held at the club headquarters at 595 California Street, second floor, San Francisco, CA 94105, which is right at the Montgomery Street BART station. Non members are welcome, but you must buy tickets in advance for $15, as the event is expected to be a sellout. For more information, please go to this link to the lecture at, or go to the club website. Please leave the bags of rotten tomatoes at home, as I don?t want to get stuck with a cleaning bill.

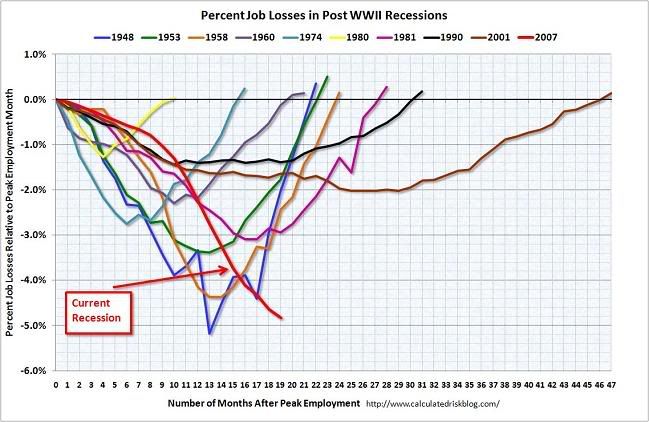

2) Looks like I am going to have to be the designated driver at this brewfest. The Friday nonfarm payroll showing losses of only 247,000 jobs, with upward revisions to May and June, is signaling to many that the bull market is back. We?re definitely getting worse at a slower rate. You might as well put a giant neon sign on your roof saying ?party here tonight.? One can never underestimate the animal spirits here. I?m sure the newspapers are going to call the 0.1 % micro improvement in the unemployment rate to 9.4% as the beginning a major trend. But look at the chart below, which shows were aren?t close to a turnaround in the worst jobs turndown since the thirties. I don?t see any new consumers on this chart, and I was able to breeze through my favorite restaurant at lunch because it was still half empty. I think what is really happening here is that having priced in Armageddon in March, we are now pricing it back out. What?s an Armageddon worth? Some 3,000 Dow points, or 350 S&P 500 points, about where we are right now, sounds like the right price to me. Let me know when you?re ready to go home, and I?ll pile your inebriated carcasses back into the car. I?ll even take the breathalyzer test.

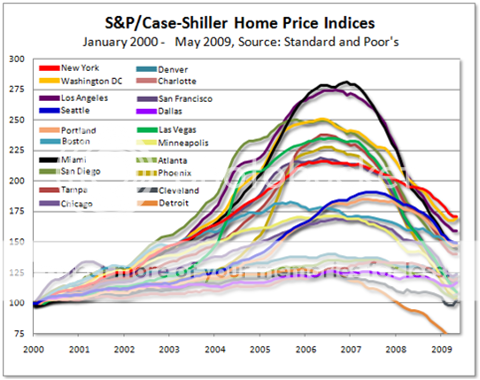

3) Deutsche Bank has put out a report on residential real estate that will raise the hair on the back of your neck, if you still own your own home. Prices have not hit bottom and have another 14% to fall by 2011, putting in a 42% fall from top to bottom. By then, almost half of all mortgage holders in the US will be underwater. The list of the top underwater cities in the US is not good news for the Land of Fruits and Nuts, where lending was the most aggressive, imaginative, and oops, illegal:

Merced, CA 85%

El Centro, CA 85%

Modesto, CA 84%

Las Vegas, CA 81%

Stockton, CA 81%

The murder weapons in these nearly home equity free cities break out as the following:

Option ARMS 89%

Subprime 69%

Alt-A 66%

Jumbo 46%

Conforming 41%

These forecasts tell us that a second stimulus package is a sure thing, that unemployment will soar over 10%, and that a ?W? shaped recession is a lock. Gee, do you thing the stock market might go down on this?

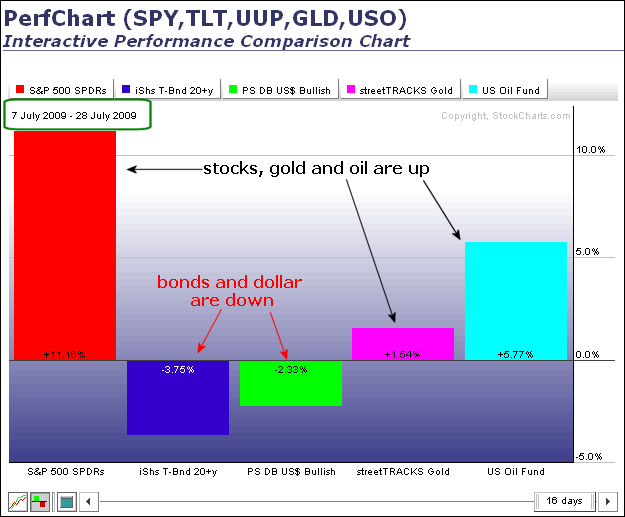

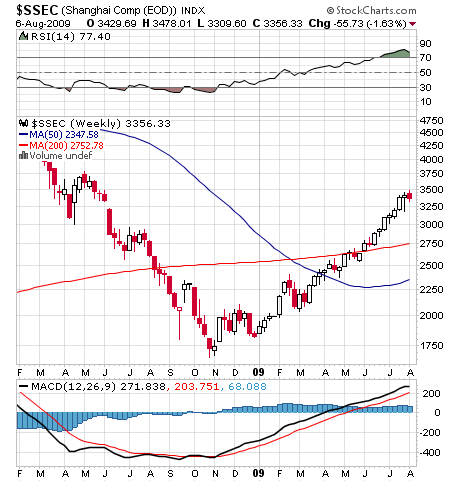

4) When the stock market rolls over, don?t expect to be able to hide anywhere, except in cash. If someone mentions the word ?decoupling?, turn around and walk away, delete their number from your Blackberry, delink from their Facebook page, and block their Tweets. Knowing this individual will be seriously injurious to your wealth. To see how highly correlated markets are these days, take a look at the chart below from StockCharts.com. It shows high correlation between stocks (SPX) , gold (GLD), and oil (USO), and similarly high inverse correlations with bonds (TBT) and the dollar (UUP). I have always viewed diversification as a great way to lose more money in varied places with more exotic sounding names. When the Dow drops, the Shanghai market ($SSEC) will probably fall twice as fast, as it did last year.

QUOTE OF THE DAY

?The big rally since March has been all about backing out the fat tail of Armageddon. It is premature to start discounting the fat tail of a boom. If the market want to go that far, then get me off the train,? said PIMCO?s Paul McCulley.