August 17, 2011 - Lessons From the Crash of 2011

Featured Trades: (LESSON OF THE CRASH OF 2011),

(SPX), (OIL), (COPPER), (GLD), (PALL)

2) Lessons From the Crash of 2011. The Dow only moved double digits today, down 78 points, finally delivering the sort of quiet, somnolescent, low volume day one would normally expect during the dog days of August. Last week was one of the most violent in market history and traders are bracing themselves for more. So let us take pause to analyze what we got right in the melt down, and what went horribly wrong.

Running small, limited risk positions, such as through short dated options, certainly saved the day. The source of endless abuse when the bull was running, my caution is now the reason we are still in business. While losses are painful, they were anything but life threatening.

Followers of my trade mentoring program, Macro Millionaire, are up 24% since inception. This is well down from the 42% gain we saw in the spring, but it still places us in the top 1% of all hedge fund managers. What is most important is that we live to fight another day. I know many top hedge fund managers who would kill for these returns right now (sorry, John).

My view that the current market multiples were a myth was truly vindicated. I was getting tired of the endless procession of permabulls who kept insisting that at a 15 times multiple, the S&P 500 was cheap. The last time I heard this was in 2000, when NASDAQ multiples went from 100 to 50, on their way to 10. Before that, it was in Japan in 1990, when multiples went from, guess what, 100 to 50 on their way to 10. Some 20 years later, Japanese multiples remain at 15. Here we are at an 11 times multiple in the US, and sell side brokers are still insisting that equities are cheap.

When I first entered the stock business in the seventies, typical equity earnings multiples were in the seven to eight neighborhood. If you performed exhaustive stock screens, which then involved paging through endless reams of 10-k's, newsletters, and tip sheets printed in impossibly small type, you could occasionally find something at a two multiple, the kind Graham and Dodd wrote about as 'cigar butts with one puff left.' Anything over ten was considered outrageously overpriced, fit only to be sold on to retail investors. This is when the prime rate was at 6%.

The sell off we saw this month is consistent with my long term view that we are permanently downshifting from a 3.9% to a 2%-2.5% growth rate, and the lower multiples this deserves. If you had any doubts, take a look at the $16 billion in equity mutual fund outflows last week, versus the tens of billions sucked in by bond mutual funds. I'm convinced that if the circuit breakers had not been installed, we would have been visited by another four digit instantaneous flash crash.

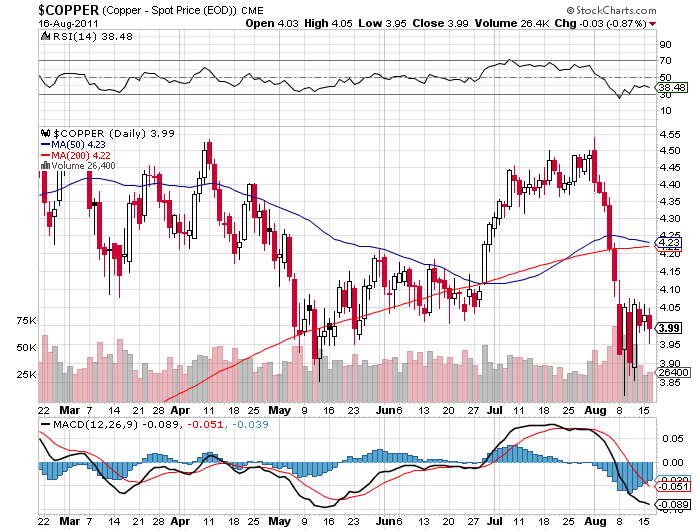

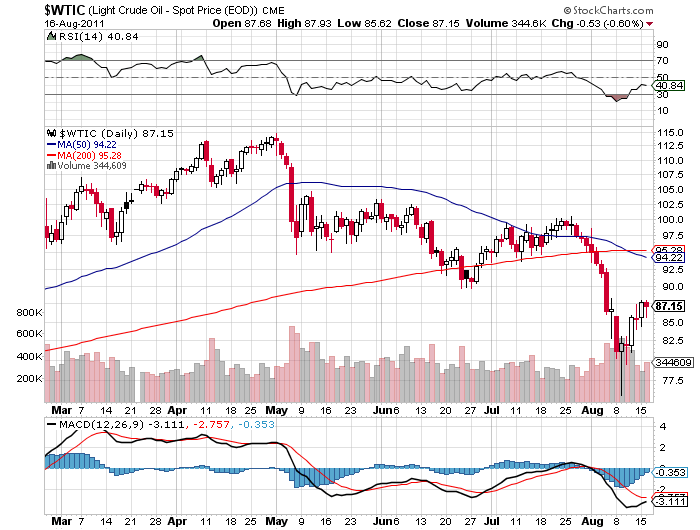

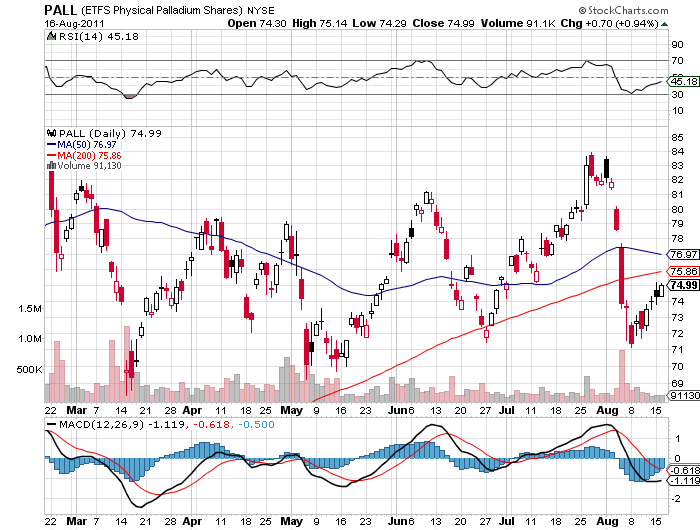

Another of my theories was also tested and found to ring true, that when the 'RISK OFF' light starts flashing red, there is no place to hide. While the S&P 500 (SPX) collapsed by 22%, oil (USO) was down 25%, and copper (CU) gave back 18%. Palladium (PALL) was pared by 20% in a single day. Gold (GLD) performed like a star, but don't kid yourself that it is a store of value offering a safe haven. All of the fundamentals true today were valid during the 2008 crash, when the barbarous relic gave back 32%. Gold has behaved well so far because the current crisis wasn't bad enough. The next one will be.

The flight to safety assets, bonds, the dollar, Swiss franc, and yen, did well, as I expected. The outlier here was the Treasury bond market, which saw yields plummet to new 40 year lows of 2.03%. These returns blow the mind of virtually every investment professional in the industry. How the purchasers can accept a real yield of negative 1% for a decade is beyond me and everyone else. But as the legendary economist, John Maynard Keynes, used to say, 'markets can remain irrational longer than you can remain liquid.' He should know, as he went bust twice in his career.

-

-

-

Ignore the 'RISK OFF' Signal and You Will Get Hurt