August 18, 2011 - The Hardest Job in the World

Featured Trades: (THE HARDEST JOB IN THE WORLD), (FXI), (TLT)

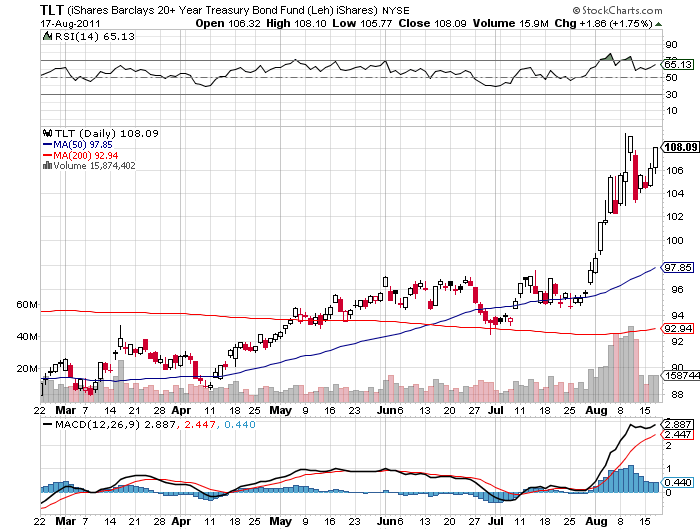

3) The Hardest Job in the World. US Vice President, Joe Biden, currently has the toughest job in the world. He has gone to China, hat in hand, to convince the country's leaders to buy even more US Treasury bonds than they already have. This he must do with ten year yields approaching 2.0%, delivering some of the largest negative yields in history. He is in effect saying, 'give me a dollar, and I promise to give you 90 cents in ten years.' Such a deal!

I'm sure that Joe's lifetime spent hobnobbing with local politicos in union halls, PTA's, and Boy Scout troops in rural Delaware has left him ill prepared for the task at hand. They used to say you could walk through Joe's deepest thoughts and not get your ankles wet. How he became the second most powerful man in the world, I will never know. Like string theory and Einstein's theory of relativity, politics can be difficult to fathom. Yet, he is going up against some of the most brilliant technocrats the world's oldest civilization has to offer.

China is already the planet's largest buyer of Treasury bonds, taking down up to 50% of the monthly auctions, its total holdings approaching $1.3 trillion. It will continue on the bid. You can forget about all of those Armageddon scenarios where China dumps its holdings, sending interest rates soaring. There is simply nowhere else to go with adequate size and liquidity. China is going to have to recycle its $250 billion a year bilateral trade surplus into dollar instruments of every description. Its total reserve now exceed $3 trillion, the largest in history

However, new buying of alternative assets has already begun. The recent run up in gold has Chinese fingerprints all over it. The Middle Kingdom was also a major player of the European refi's, no doubt attracted by sky high double digit yields. Much of the strength of hard assets last year, such as with copper, came from Chinese buying, not for consumption, but to use as a financial asset. It is also attempting to spread the wealth in a more subtle fashion through buying of minority stakes in many of the world's multinational blue chips.

I wish Joe the best of luck in his venture. Just watch out for the Peking Duck state dinner. This is when the greatest number of elderly American visitors die of heart attacks, according to an embassy official I know there.

-

-

Maybe I'll Have the Fish