August 19, 2009

Global Market Comments

August 19, 2009

SPECIAL DEMOGRAPHIC ISSUE

Featured Trades: (VIETNAM), (VNM),

(POPULATION PYRAMIDS)

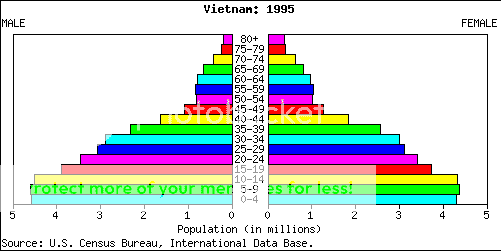

1)Desperate homeowners counting on a 'V' shaped recovery in residential real estate prices better first take a close look at global demographic data, which tells us there will be no recovery at all. I have been using the US Census Bureau's population pyramids as long leading indicators of housing, economic, and financial market trends for the last four decades. They are easy to read, free, and now available online at http://www.census.gov/. It turns out that population pyramids are something you can trade, buying the good ones and shorting the bad ones. These graphical tools told me in 1980 that I had to sell any real estate I owned by 2005, or face disaster. No doubt hedge fund master John Paulson was looking at the same data when he took out a massive short in subprime securities, earning himself a handy $4 billion bonus in 2007. To see what I am talking about, look at the population pyramid for Vietnam. This shows a high birth rate producing ever rising numbers of consumers to buy more products, generating a rising tide of corporate earnings, leading to outsized economic growth without the social service burden of an aged population. This is where you want to own the stocks and currencies.

2) Now look at the world's worst population pyramid, that for Japan. These graphs show that a nearly perfect pyramid drove a miracle stock market during the fifties and sixties which I remember well, when Japan had your model high growth emerging market economy. That changed dramatically when the population started to age rapidly during the nineties. The 2007 graph is shouting at you not to go near the Land of the Rising Sun, and the 2050 projection tells you why. By then, a small young population of consumers with a very low birth rate will be supporting the backbreaking burden of a huge population of old age pensioners. Every two wage earners will be supporting one retiree. Think low GDP growth, huge government borrowing, deflation, and a terrible stock and housing markets. Dodge the bullet.

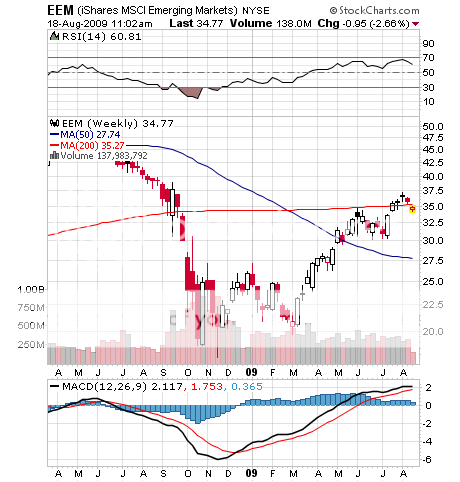

3) Where does the US stand in all of this? Brace yourself. It shows that we are turning into Japan. As a silver tsunami of 80 million baby boomers retires, they will be followed by only 65 million from generation 'X'. The intractable problems that unhappy Japan is facing will soon arrive at our shores. Boomers, therefore, better not count on the next generation to buy them out of their homes at nice premiums, especially if they are still living in the basement. They are looking at best at an 'L' shaped recovery, which means no recovery at all. What are the investment implications of all of this? Get your money out of America and Japan, and pour it into Vietnam, China, India, Brazil and other emerging markets with similar population pyramids. You want the wind behind your investment sails, not in your face with hurricane category five violence. Use this dip to load the boat with the emerging market ETF (EEM).

4) Now that we have figured out that Vietnam is a great place to invest, we welcome the news that the Van Eck group is about to launch its own Vietnam Index Fund (VNM). The venture will invest in companies that get 50% or more of their earnings from that country, with an anticipated 37% exposure in finance, and 19% in energy. This will get you easily tradable exposure in the country where China does its offshoring. Vietnam has been one of the top performing stock markets this year, at its peak rising by an amazing 110%.?? It was a real basket case last year, when zero growth and a 25% inflation rate took it down 78% from 1,160 to 250. This is definitely your E-ticket ride. Vietnam is a classic emerging market play with a turbocharger. It offers lower labor costs than China, a growing middle class, and has been the target of large scale foreign direct investment. General Electric (GE) recently built a wind turbine factory there. You always want to follow the big, smart money. Its new membership in the World Trade Organization is definitely going to be a help. Until now, the only way to get involved with this country was to go through the tedious process of opening a local currency brokerage account, or buy a region sub emerging market ETF. I still set off metal detectors and my scars itch at night when the weather is turning, thanks to my last encounter with the Vietnamese, so it is with some trepidation that I revisit this enigmatic country. Throw this one into the hopper of ten year long plays you only buy on big dips, and go there on vacation in the meantime. Their green shoots are real. But watch out for the old land mines.

QUOTE OF THE DAY

'A weaker dollar over time is part of the solution. It facilitates the rebalancing that everyone needs. It allows Asia to consume more and it allows us to produce more. It needs to go down slowly,' Said Mohamed El-Erian, co-CEO of bond house PIMCO.