August 23, 2010 - Why Your Next Car May be a Hyundai

Featured Trades: (SOUTH KOREA), (EWY)

(FXI)

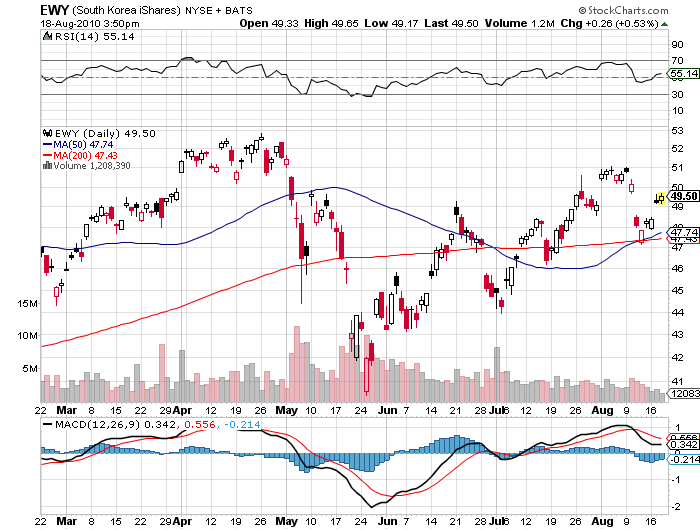

South Korea iShares ETF

iShares FTSE Xinhua China 25

1) Why Your Next Car May be a Hyundai. I have been banging on about South Korea (EWY) for some time now as the 'K' that should be in the acronym 'BRICK', the country that has successfully carved out a niche between the rock and the hard place, China and Japan. So when the recent Vice Minister of Finance for the ROK, Byongwon Bahk, passed through town, I leapt at the opportunity to have dinner.

The wrenching, soul searching rebuilding and re-regulation of the financial system the US is suffering now, South Korea went through during the Asian financial crisis in 1998. That meant Korean banks entered the recent meltdown with less leverage, better balance sheets, and a healthier consumer loan book than its American counterparts. These institutions have non performing loan ratios to kill for.

The happy dividend was a classic 'V' shaped recovery last year, it's GDP hand springing in a matter of months from a -5% rate to a +5.75% in a quarters, according to the IMF. That enabled the KOSPI, the main Korean stock index, to outperform China's, bringing in a 57% return in 2009--no mean feat. An export led recovery boosted the current account surplus, suddenly transforming the Won into a hard currency.

This stellar performance gained Korea membership into the exclusive G-20 club of industrial nations. Korea is now pursuing a clever export strategy by climbing up the value chain from below and getting American and European consumers to replace more expensive Japanese and German cars with KIA's and Hyundai's, which deliver the same quality for half the price.

South Korea has become a de facto indirect China play, as the country now ships 25% of its exports there, bumping the US from the number one spot, which now only takes 11% of exports. Upwardly mobile Chinese consumers clamor for Samsung and Hyundai products.

I was blown away when I heard that Korea Electric Power won the contract to build four giant 1.4 megawatt electric power plants in the United Arab Emirates for $20.4 billion. The announcement was a thumb in the eye for the deserving French, whose EPR 1600MW reactor was thought to be the hands down winner. No doubt some old fashioned incentives were in play, but the harsh reality is that the KEPCO bid was thought to undercut competitors by as much as 50%. My only regret about this deal is that I will no longer be able to fly my Cessna down a long uninterrupted stretch of the Emirates coast, a restricted area almost certainly about to pop up on? my navigation chart. Last time I checked, those planes didn't carry anti missile countermeasures.

The deal speaks volumes about the direction the global economy is taking. In one fell swoop, South Korea leveraged its low labor cost to take a great leap up the international value chain, using what is basically a simple technology. What is a nuclear power plant, but a fancy way to boil water? Bottom line: South Korea takes a quantum leap ahead in the race for global competitiveness, while the US falls further back into the dust.

There are challenges longer term. Korea has to win the race to develop a service economy, while its elephantine neighbors are still over reliant on manufacturing. Think medical tourism a la Bangkok and New Delhi. It also has the world's lowest birth rate, which at 1.19, is far below the replacement rate of 2.2. Seoul is the easiest major city in the world to flag a taxi, drivers outnumbering New York by 7:1 on a per capita basis, as this is a traditional parking palace for the unemployed.? As I know you are all astute followers of demography, you'll immediately grasp that fewer babies today mean a dearth of consumers in 20 years. There is also the small issue of the psychotic megalomaniac who lives next door with the starving million man army.

Use this global correction to accumulate the South Korea ETF (EWY). And those who don't see this as a life or death contest for economic survival that we can no longer take for granted, better get their heads out of the sand.

The only downside of the dinner for me was that after gulping down huge quantities of garlic soaked kimchee, my social life was put on an indefinite hold.

The Only Unknown for South Korea