August 23, 2011 - How to Play Jackson Hole

Featured Trades: (HOW TO PLAY JACKSON HOLE),

(DBA), (FXE), (USO), (CU), (PALL), (UUP),

(GLD), (SFS), (FXJ), (FXA), (FXC)

2) How to Play Jackson Hole. I remember when the meeting of economists at Jackson Hole was one of those boring, under the radar, non-stories that only those with an interest in the arcana of macroeconomic affairs bothered to take notice. In other words, people like me.

Today that is anything but the case. All eyes will be focused this week on the remote gathering, particularly Ben Bernanke's keynote speech on Friday, August 26. Unless you have been living in a cave on a remote Pacific island without a broadband connection, you probably already know that Ben launched QE2 in his address at the same event last year.

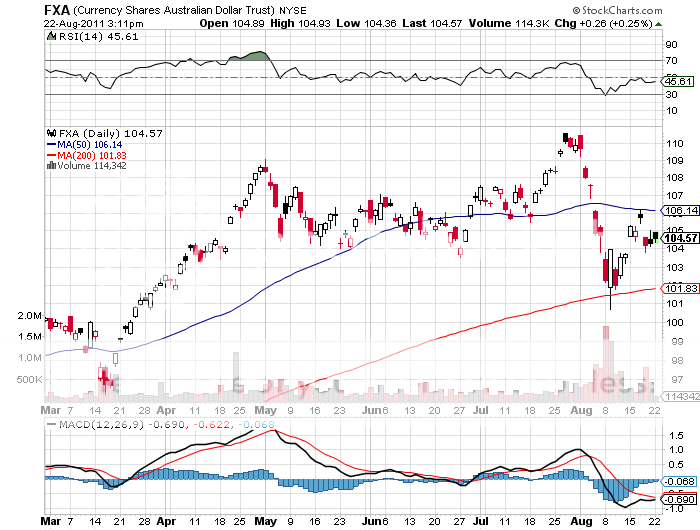

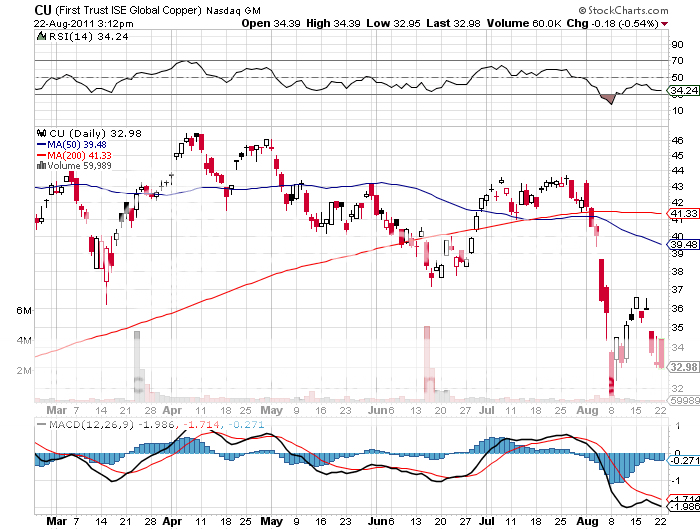

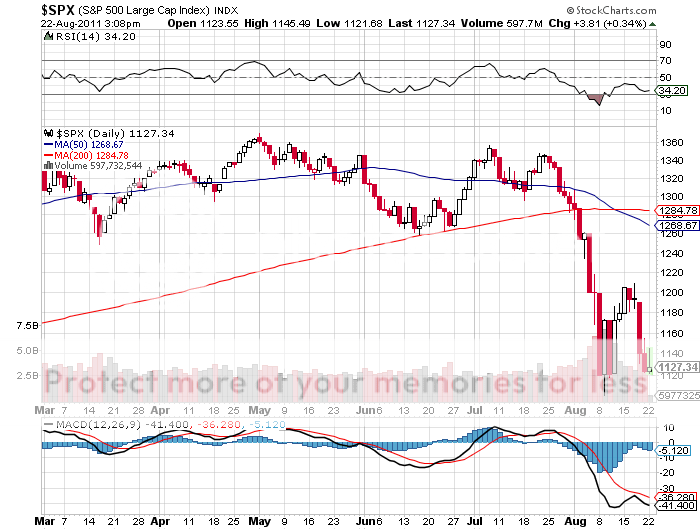

Traders will be hanging on every word, sifting for any evidence of bold, new measures to rescue our sagging economy. If Ben delivers, the markets will riot. The 'RISK ON' trade will be on with a vengeance, and you will want to pile into stocks (SPY), commodities (DBA), the euro (FXE), the Australian (FXA) and Canadian (FXC) dollars, oil (USO), and the industrial metals (CU), (PALL).

If Ben disappoints, 'RISK OFF' lives for a few more weeks, and you want to chase gold (GLD), the Swiss franc (SFS), and the yen (FXY). A weakening economy the 'RISK OFF' trade implies means that a rapidly shrinking trade deficit and the repatriation of American capital from abroad will strengthen the dollar. Please pass the steroids to Uncle Buck (UUP). Equities will probably put in their low for the year.

I vote for the latter. The Federal Reserve has a long history of taking slow deliberate, measured steps. It really couldn't be any other way, given that it is managing a supertanker of an economy. They adopt a policy, and then sit back for six months to see if it works. The tendency to panic is pretty much nil. Since the last bombshell, pegging short rates at zero for two years, landed as recently as August 8, I think the likelihood of further reparative measures this soon is unlikely.

I expect that one thing Ben will mention is that his outlook for the economy is considerably more positive than either you are I might have. He might even say that he expects the second half of the year to be stronger than the first half. If that is the case, the markets will welcome Ben's comments about as much as a loud fart at a Sunday church service.

-

-

-

Casting for the Right Economic Policy at Jackson Hole

-

Please Pass the Steroids to Uncle Buck