August 24, 2010 - Why We're on the Slow Boat to Nowhere

Featured Trades: (THE RANGEBOUND MARKET),

(SPX), (FCX), (VIX), (USO), (GLD)

1) Why We're on the Slow Boat to Nowhere. After speaking to a gaggle of economists, portfolio managers, and traders the last few days, I've had one of those 'Eureka' moments, as the markets have shown their hands. Those that delivered the dramatic, heart stopping moves last year, like stocks, commodities, oil, and precious metals, are on the slow boat to nowhere. Last year's wall flowers, like currencies and their crosses, will trend nicely, delivering plungers some serious coin.

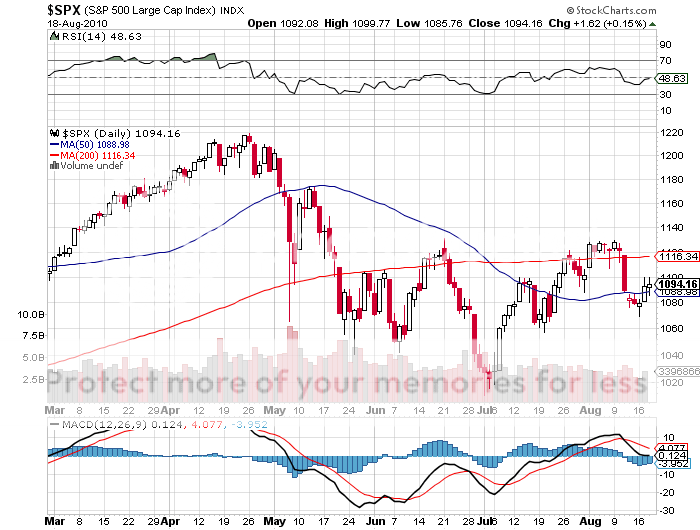

What's more, I think these trends, or non trends, will continue for the next several months, probably until the November election. That means that the S&P 500 (SPX) will remain around a tedious 1010-1140 range, and that implied volatilities for relevant options will continue to bleed to lower levels. The VIX is probably an outright short here.

This market is a portfolio manager's worst nightmare, and a trader's dream come true. Zero interest rates assure that we aren't going to crash any time soon, and flagging economic data and chronically high unemployment guarantee that we are not blasting out to the upside. They, the nimble and click happy, can confidently sell into every rally and buy each dip. Selling out-of-the-money straddles, last year's suicide trade, could be this year's steady earner. They say markets have to climb a wall of worry. This one has to climb Mount Everest.

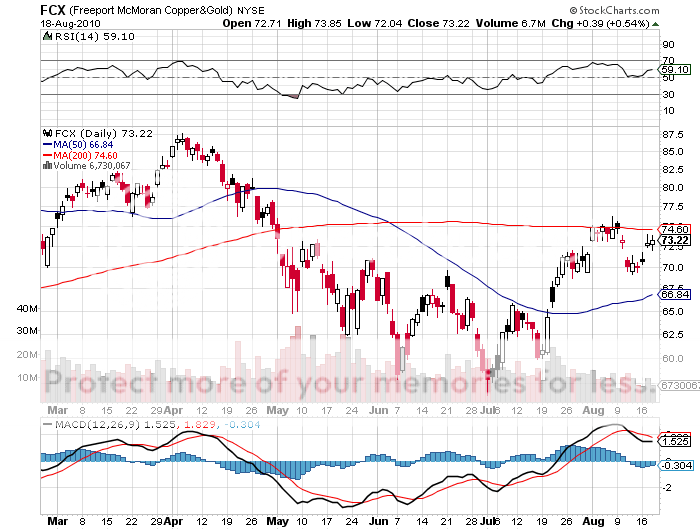

Commodities (FCX), oil (USO), and precious metals (GLD) are showing the same indecisive behavior. The cross trades I have been recommending, long Aussie/euro, Canadian/euro, and short the euro/yen, have been delivering reliably all year.

This is all happening because the markets are now transitioning from last year's parabolic 5.7% Q4 GDP rate to the more somnolencent 2%-2.5% growth scenario that I am predicting for this decade. Political gridlock and the attendant noise level don't help either.

You've got to work with the market you have, not the one you want, and these short volatility trades could be your bread and butter for the next several months.

Climbing a Wall of Worry