August 25, 2011 - Macro Millionaires Post One Day Gain of 120% on Gold Shorts

Featured Trades: (THE BUBBLE HAS BURST IN GOLD), (GLD)

2) Macro Millionaires Post One Day Gain of 120% on Gold Shorts. It's d??j?? vu all over again. I spoke to a friend in Tokyo two nights ago who told me that local gold scrapage companies were seeing lines extending out the door. This is exactly what I saw in Johannesburg in 1979, when gold then made a similar hyperbolic move to peak at $900, beginning a 22 year bear market. Throw that in with the margin increase for gold contracts announced in Shanghai, and I had the last piece of information that I needed to start piling on aggressive shorts in the barbarous relic at $1,886 an ounce.

I happen to know some gold bug friends who are seeing the same thing in the US. Traditionally, 60% of the world's supply of gold comes from the mines, while 40% is generated by scrapage. But recently the scrapage rates have been sharply rising. This has prompted some gold bugs to sell positions that are so old they have hair on them. These were accumulated back in the nineties, when the barbarous relic was universally despised for not paying any interest or dividend, and therefore, of no intrinsic value.

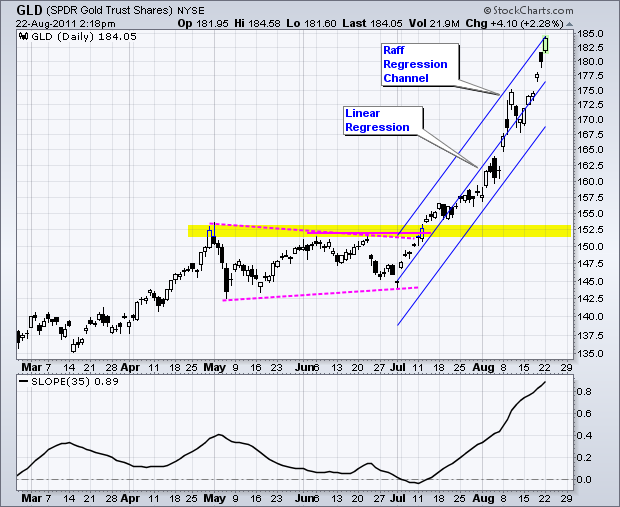

I still think that the yellow metal can hit my target of the old inflation adjusted high of $2,300 in coming years. But looking at the charts below showing a move up of $310, or 20% to $1,910 in less than a month, I had to conclude that enough is enough. It all had the smell of a blow off top to me.

Since gold has no book value, price/earnings multiple, valuation is immune to analysis and independent of the thought process. So I took a shot in the dark and piled followers of Macro Millionaire into the short side of the yellow metal. Bottom line: we caught $136 of a one day, $161 collapse in gold that enabled our puts to soar by 120%.

The trade allowed me to boost the year to trade performance of Macro Millionaires to an impressive 24.5%, versus a loss of 1.5% for the S&P 500 index during the same time period. If you have further interest in this innovative trade mentoring program, please email John Thomas directly at madhedgefundtrader@yahoo.com .

-

-

The Bubble Has Burst