August 25, 2011 - Time to Double Up on the (TBT)

Featured Trades: (THE BUBBLE HAS BURST IN BONDS TOO), (TBT), (TLT)

3) Time to Double Up on the (TBT). I have mentioned in recent days that the stock market is close to fully discounting a recession that isn't going to happen. The bond market is saying that recession is a certainty, that we are already well into it.

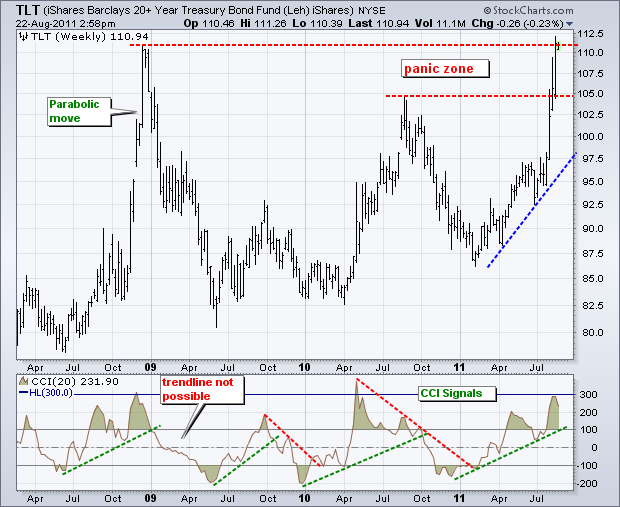

I think the bond market has got it wrong this time, or is at least early by a year. So I am going to double up my position in the ProShares Ultra Short Lehman 20+ Year Treasury ETF (TBT), the 200% leveraged fund that profits when Treasury bond prices fall and yields rise.

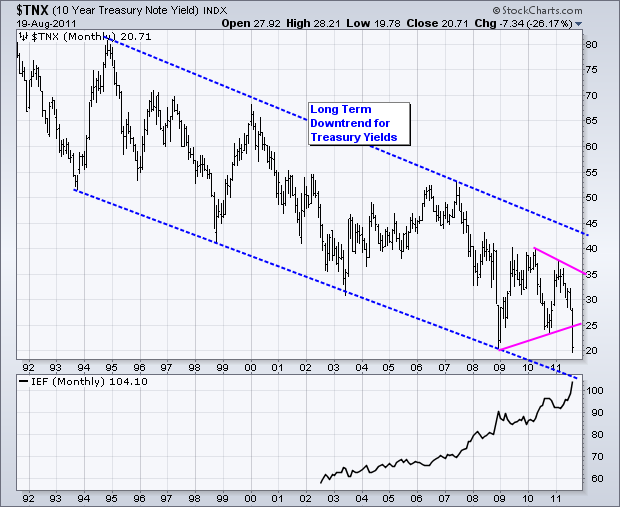

The price movements in the bond market have been so extreme that they have reached multigenerational highs. You have to go back to 1946 to find yields this low, or so historians tell me.

Take a look at the charts below. Even if I am dead wrong, there is still room for a five point rally in the TBT and still maintain its down trend. This is the five points that I am shooting for right now. If I am right, then we are seeing the beginning of a rally that will take yields back up to 4.10%, and the (TBT) back up to $43.

That gives us a potential gain of 80%. Worst case, yields plummet to 1.80%, knocking another 10% off the (TBT). This is the kind of risk reward that I am looking for, 8:1 in my favor.

There is another point to mention here. With the 30 year bond now yielding 3.5%, the cost of carry of the (TBT) has dropped to around 7.5%, the lowest it has ever been. This is down from the 11% carry we saw only six months ago. This ETF has never been such a bargain.

-

-