August 26, 2010 - Don't Buy That Treasury Bond

SPECIAL BOND BUBBLE ISSUE

Featured Trades: (TREASURY BONDS), (TIPS), (TBT)

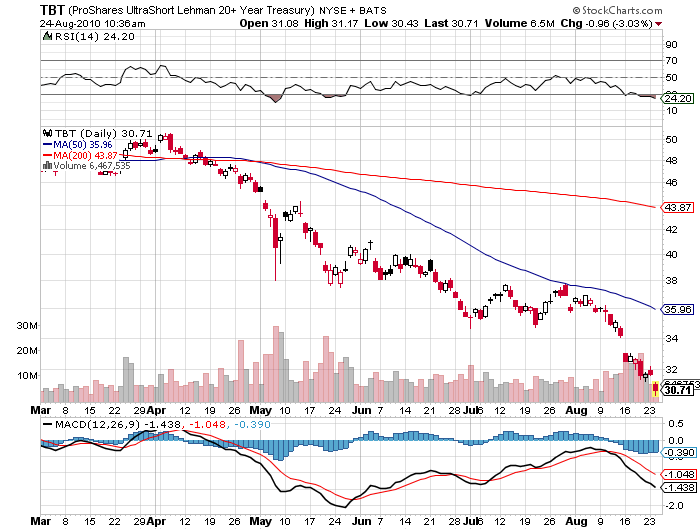

ProShares Ultra Short 20 year +Treasury ETF

1) Don't Buy That Treasury Bond. Another week later, and Treasury bond prices have raced up to even dizzier heights, breaking more records for over valuation. According to the Investment Company Institute, outflows from equity mutual funds over the last two years totaled $232 billion, while inflows into bond funds soared to a staggering $559 billion. Today, 'bond funds' ranked with 'Miss Universe' and 'Lindsey Lohan' among Yahoo's top ten search terms. Companies, like FedEx, are looking to issue corporate bonds maturing in 100 years. No doubt the prospect of 80 million baby boomers bailing on equities so they can become coupon clippers for life is providing some extra juice for this market.

In a Wall Street Journal article last week, the Wharton School's Jeremy Siegel pointed out that ten year inflation protected securities (TIPS) with yields under 1% are selling at a PE multiple equivalent of 100 times, the same valuation that dotcom stocks saw a decade ago (click here). Bonds with four year maturities have negative real yields.

The last time this happened, in 1955, ten year bonds brought in an annual return of only 1.9% for the following decade. The potential capital losses for these securities now loom large. In the meantime, the short Treasury ETF (TBT) trades at $30.60.

Let me run some numbers here. If the yield on the 30 year Treasury bond runs up to last year's low of 3%, the TBT will fall to a new all time low of $27. If I'm right, and we move back up to the 2010 high of 5.05%, the TBT pops back to $51.50. Running a downside risk of 11% to capture a potential gain of 68% sounds like a pretty good risk/reward ratio to me. But it might get better. Don't forget that my long term, multi year target for this ETF is $200.

If the futures players get this right, a move in the December long bond (ZBZ0) on the CBOT from today's high of 134.5 to this year's low of 111.50 multiplies your minimum margin requirement from $3,375 to $23,000, a 6.8 fold return.

But wait, there's more! If you don't feel like making big bets until you figure out what the new normal looks like, try a limited risk position through the TBT options. The March $30 strike calls are trading at $4. A run up by the ETF to this year's high puts these babies at $21 at expiration, a net profit of $17, a gain of 425%.

I'll tell you some key targets to watch for to determine the timing on this: when the yen approaches ?80, the S&P 500 touches 950, the 30 year yield tickles 3%, and the ten year yield slams into 2%, it will all be over but the crying. I'm still keeping my powder dry for taking another shot at this trade, but my trigger finger is getting mighty itchy.

Getting an Itchy Trigger Finger for the TBT

Not as Popular as a Bond Fund?