August 3, 2011 - What the Markets Are Telling Us

Featured Trades: (WHAT THE MARKETS ARE TELLING US), (SPX), (TLT), (TBT)

1) What the Markets Are Telling Us. I spent the morning doing a round robin with hedge fund trader friends of mine trying to figure how we all got this so horribly wrong. I did this as the (SPX) was ticking down to 1249 and bond yields cratered to a one year lows at 2.62%.

The uproar of the debt debacle distracted us from what was really driving the markets, the economy. While listening to the hostage drama, where the Tea Party threatened to put a bullet in the head of the world economy unless it got its way, the economic data began a rapid deterioration.

Q2 GDP was marked down to 1.3%, with an even worse revision for Q1 down to 0.9%. This is not a development friendly to asset prices anywhere, and delivered us a huge 'RISK OFF' trade.

Everyone to a man was positioned for a relief rally on the passage of the debt compromise. That's why when the rally came, up to 1,307, it lasted only 15 minutes. When too many crowd one side of the canoe, it flips over. This is why we are all swimming in red ink. Usually, I am watching this happening to other traders, not myself.

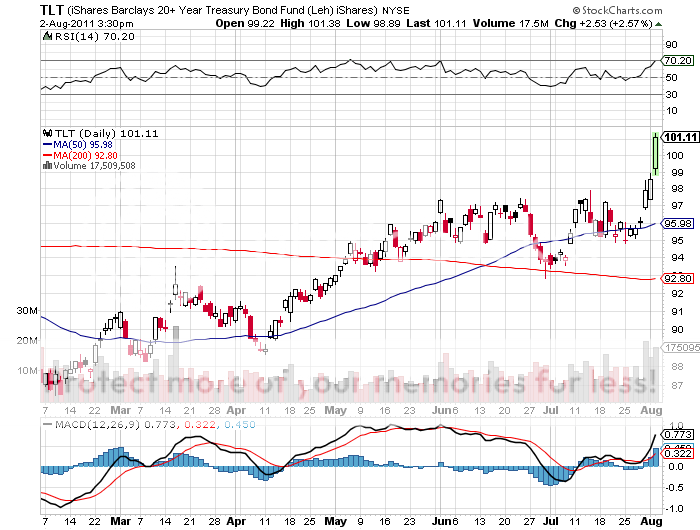

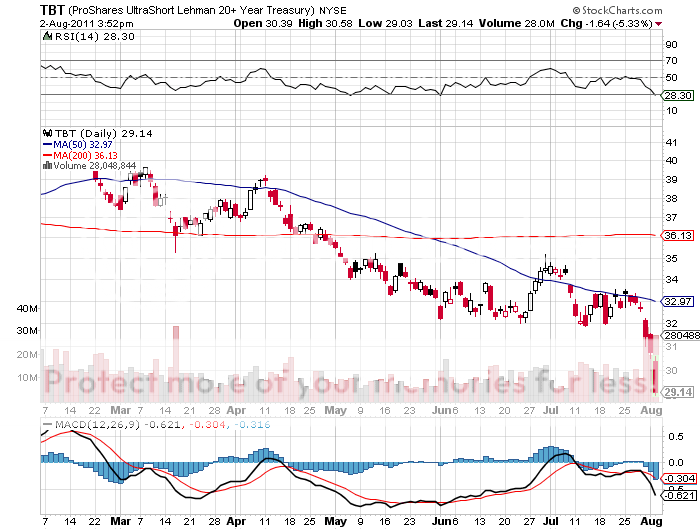

Instead of focusing on the postponement of a downgrade of US Treasury bonds, the markets instead are discounting the chopping of US growth by a third for the next decade that the congressional compromise assures. This is why bonds have soared by six points in a week. Good thing I covered my short call position on the (TLT) on July 22.

What the bond market is telling us is even more interesting. It is proof that the government is borrowing too little money, not too much. The Chinese are kicking themselves that they didn't buy 100% of our monthly bond issuance, instead of only the 50% they did, as prices are now rocketing to 30 year highs. This makes arguments that foreign investors will boycott American debt seem ridiculous. I challenge anyone to point to a market anywhere in the world that disagrees with this obvious conclusion.

The technical damage in the market is compelling, with the S&P 500 trading well below its 200 day moving average. US stocks are about to give up their year. What remains is to see whether the March low can hold here at 1249. If it doesn't, then look out below.

-

-

-

-

Too Many Traders Got Into the Same Canoe