August 4, 2023

(WHERE THE 10-YEAR TREASURY YIELD COULD BE HEADING AND WHY WE SHOULD CARE?)

August 4, 2023

Hello everyone,

Treasury yields rose on Thursday as investors digested fresh economic data and weighed Fitch’s U.S. downgrade from AAA to AA+ citing “fiscal deterioration” and concerns about growing general debt. The 10-year Treasury was up 11 basis points at 4.187%. The yield on the 2-year Treasury was flat at 4.887%.

What is a Treasury yield?

The Treasury yield is the annual interest rate that the U.S. government pays on one of its debt obligations, expressed as a percentage. In other words, Treasury yield is the annual return investors can expect from holding a U.S. government security with a given maturity.

Why is the 10-year Treasury yield important?

The 10-year Treasury yield indicates the overall state of the stock market and the general economy. Higher yields can indicate higher inflation expectations. It also influences many other interest rates, including mortgage interest rates, auto loans and business loans. Yields have a see-saw effect on these rates.

When the 10-year yield goes up, so do mortgage rates, and other borrowing rates. When the 10-year yield declines and mortgage rates fall, the housing market strengthens, which in turn has a positive impact on economic growth and the economy.

The 10-year Treasury yield also impacts the rate at which companies can borrow money. When the 10-year yield is high, companies will face more expensive borrowing costs that may reduce their ability to engage in the types of projects that lead to growth and innovation.

The 10-year Treasury yield can also impact the stock market, with movements in yield creating volatility. Rising yields may signal that investors are looking for higher-return investments but could also spook investors who fear that rising rates could draw capital away from the stock market.

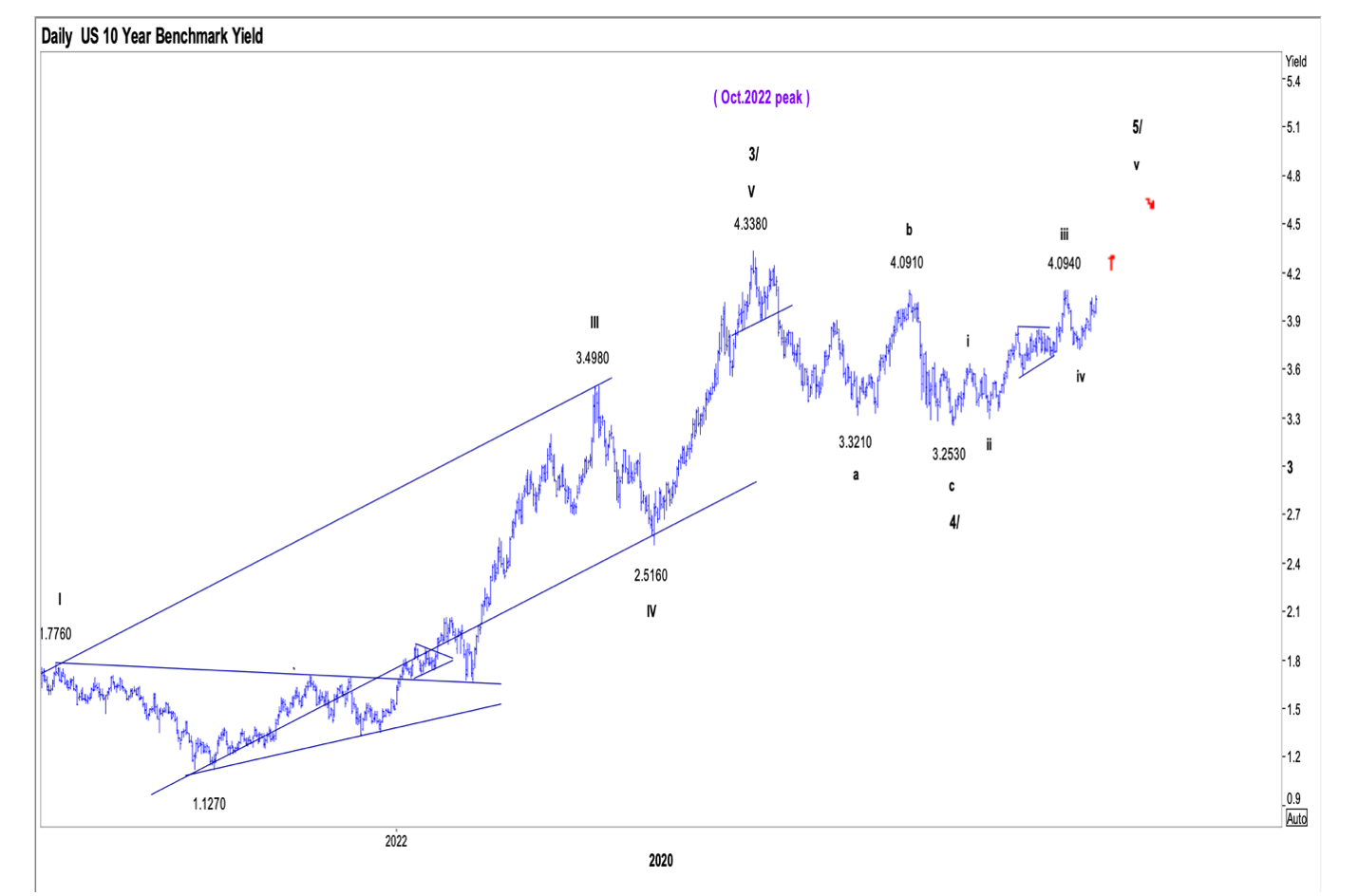

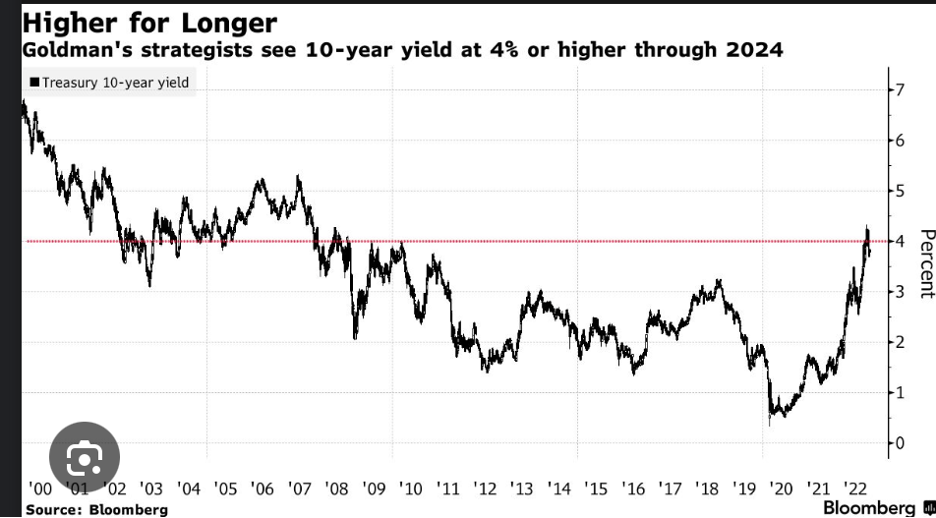

The chart below shows possible targets on the U.S. 10-year benchmark yield.

In the short term, the latest advance in yields commenced on their 3.7268% low of July 19th. We can see that support now lies at 4.00/3.92%, with an opportunity for rally toward potential targets around the 4.36% and 4.80% levels, before exhaustion. Then we may see a medium-term pullback before another possible rally in yields.

Wishing you all a wonderful weekend.

Cheers,

Jacquie