August 5, 2009

Global Market Comments

August 5, 2009

Featured Trades: (SPX), (F)

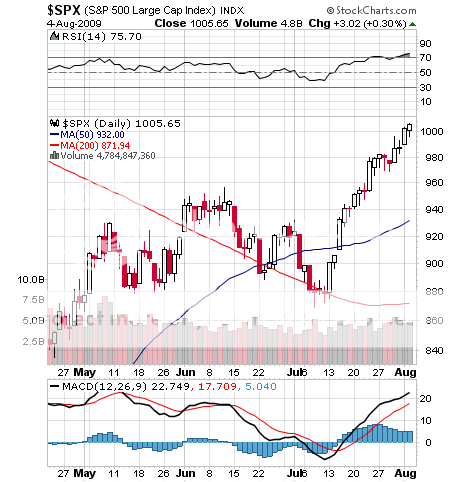

1)Welcome to the new bubble. In four months we have gone from 35% below the 200 day moving average to 15% above. It turns out that 1,000 in the S&P 500 is 38.2% recovery of the fall from the 2007 peak, a great Fibonacci number. DeMark indicators are showing that buying power is getting exhausted. Daily sentiment indicators are 88% bullish. RSI?s and oscillators are over extended. Every day the buyers show up, marching in lockstep with military precision, to give us our needed spike up at the close to keep the rally alive on the charts one more day. Worst of all, I am getting deluged with emails from subscribers who, having stayed out all year, are asking if they should start buying now, and buying everything. All of this, and we still have the second half of the ?W? to discount.?? If the American stock market was the only issue, I wouldn?t really care, since most of my longs are overseas. But if the US rolls over like the Bismarck, emerging markets, foreign currencies, commodities, the energies, and junk bonds will be dragged down with it, because everything is so interlinked these days. There will be no place to hide. I think the glass half full crowd is coming to the end of their run, so I would urge investors to pare down some risk. If your friends stay in, and they make a ton of money, that?s fine. Just let them buy the next round of drinks.

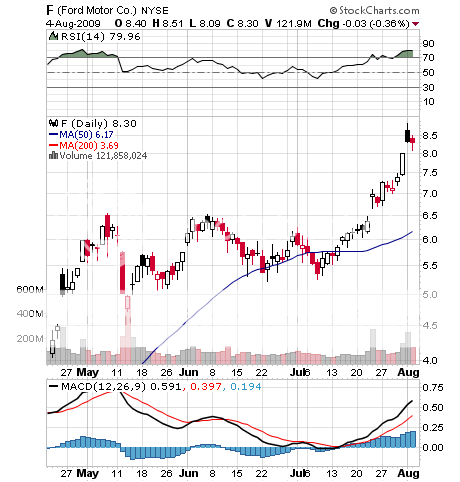

2) So now we have euthanasia for cars. The Wall Street Journal tells us that a government condition of the Cash for Clunkers program (see my last report ) is that clunker buyers total the engines by pouring sodium silicate into them. That way they can?t be resurrected like Frankenstein at the junkyard. What?s next? Free Viagra for the high mileage, new car buyers? There?s a certain poetic resonance there. Anything that works. In the meantime, the Republican Party is publicly slashing its wrists by trying to block an expansion of the most popular program since the end of the mandatory draft. Is Mc Cain trying to lose the election a second time? I think he is oblivious of the warm and fuzzy feelings the clunker clensing is generating, which is far more valuable than any direct economic impact. Don?t they have Ford dealers in Arizona? I never thought I?d run a car company chart again, but here is Ford in all its glory, up a mind boggling 65% since Cash for Clunkers started. Like virginity, confidence is very hard to recover, once it is lost.

3) I spent a sad and depressing evening with Dr. Stephen Greenspan, who had just lost the bulk of his personal fortune with Bernie Madoff. The University of Connecticut psychology professor had poured the bulk of his savings into Sandra Mansky?s Tremont feeder fund, receiving convincing trade confirms and rock solid custody statements from the Bank of New York. This is a particularly bitter pill for Dr. Greenspan, because he is an internationally known authority on Ponzi schemes, and just published a book entitled Annals of Gullibility- Why We Get Duped and How to Avoid It. It is a veritable history of scams, starting with Eve?s subterfuge to get Adam to eat the apple, to the Trojan Horse and the Pied Piper, up to more modern day cons in religion, politics, science, medicine, and yes, personal investments. Madoff?s genius was that the returns he fabricated were small, averaging only 11% a year, making them more believable. The original Ponzi promised his Boston area Italian immigrant customers a 50% return every 45 days. Madoff also feigned exclusivity, often turning potential investors down. For a deeper look into Greenspan?s fascinating observations and analysis, go to his website at www.stephen-greenspan.com.

4) The Bespoke Investment Group produces some top rate research, and believes they have hit on a leading economic indicator that is telling us that the recession is over. Since peaking in April, the four week moving average of initial jobless claims has dropped by 15%. Every time period examined following past peaks like this showed substantial improvements for both the economy and the stock market. Of course, whether we go into a double dip recession later is still an open question. To get the full gist of their argument, please click here.

QUOTE OF THE DAY

?I can calculate the motions of heavenly bodies, but never the madness of crowds,? said Sir Isaac Newton, the inventor of calculus and discoverer of Newton?s Laws, who lost his entire fortune in a 17th century investment scam called ?the south Sea Bubble.?